At a nuclear waste site in Normandy, robotic arms guided by technicians behind a protective shield maneuver a pipe that will turn radioactive chemicals into glass, as France seeks to make safe the byproducts of its growing reliance on atomic power.

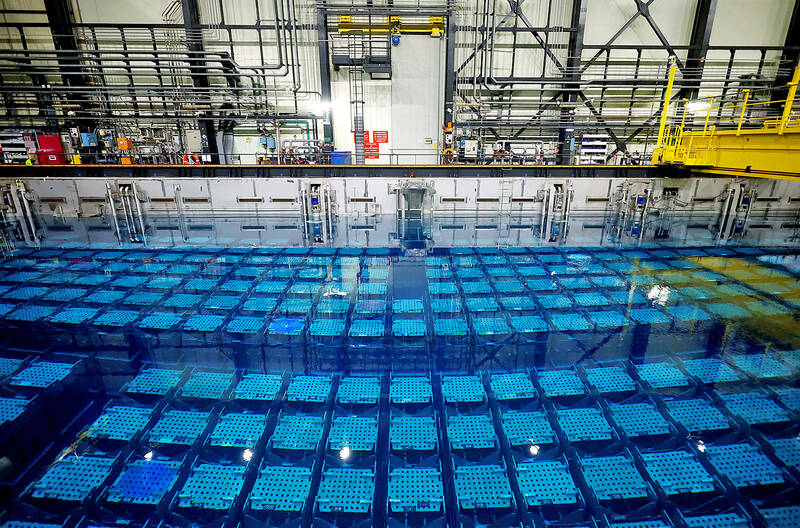

The fuel-cooling pools in La Hague, on the country’s northwestern tip, could be full by the end of the decade and state-owned Orano, which runs them, says the government needs to outline a long-term strategy to modernize its aging facilities no later than 2025.

While more nuclear energy can help France and other countries to reduce planet-warming emissions, environmental campaigners say it replaces one problem with another.

Photo: Reuters

POLICY MEETINGS

To seek solutions, French President Emmanuel Macron, who has announced plans to build at least six new reactors by 2050, yesterday chaired the first of a series of meetings on nuclear policy to discuss investments and waste recycling.

“We can’t have a responsible nuclear policy without taking into account the handling of used fuel and waste. It’s a subject we can’t sweep under the rug,” a government adviser told Reuters, speaking on condition of anonymity.

“We have real skills and a real technological advantage, especially over the United States. Russia is the only other country that is able to do what France does in terms of treatment and recycling,” the adviser said.

La Hague is the country’s sole site able to process and partially recycle used nuclear fuel.

France historically has relied on nuclear power for about 70 percent of its energy, although the share is likely to have fallen last year as the nuclear fleet suffered repeated outages.

Since the launch of the site at La Hague in 1976, it has treated nearly 40,000 tonnes of radioactive material and recycled some into nuclear fuel that can be reused. The waste that cannot be recycled is mixed with hardening slices of glass and buried for short-term storage underground.

However, its four existing cooling pools for spent fuel rods and recycled fuel that has been reused risk saturation by 2030, said French power giant EDF, which runs France’s 56-strong fleet of reactors, the world’s second-biggest after the US.

Should saturation happen, France’s reactors would have nowhere to place their spent fuel and would have to shut down — a worst-case scenario that led France’s Court of Audit to designate La Hague as “an important vulnerability point” in 2019.

COOL POOLS

EDF is hurrying to build an extra refrigerated pool at La Hague, at a cost of 1.25 billion euros (US$1.36 billion), to store spent nuclear fuel — a first step before the waste can be treated — but that will not be ready until 2034 at the earliest.

Meanwhile, France’s national agency for managing nuclear waste last month requested approval for a project to store permanently high-level radioactive waste.

The plan, called Cigeo, would involve placing the waste 500m below ground in a clay formation in eastern France.

Construction is expected in 2027 if it is approved. Among those opposed to it are residents of the nearby village of Bure and anti-nuclear campaigners.

Jean-Christophe Varin, deputy director of the La Hague site, said that Orano could be flexible to ensure more recycling is done at the facility and there were “several possible scenarios.”

However, he said they could not be worked on in detail in the absence of a strategic vision.

The US dollar was trading at NT$29.7 at 10am today on the Taipei Foreign Exchange, as the New Taiwan dollar gained NT$1.364 from the previous close last week. The NT dollar continued to rise today, after surging 3.07 percent on Friday. After opening at NT$30.91, the NT dollar gained more than NT$1 in just 15 minutes, briefly passing the NT$30 mark. Before the US Department of the Treasury's semi-annual currency report came out, expectations that the NT dollar would keep rising were already building. The NT dollar on Friday closed at NT$31.064, up by NT$0.953 — a 3.07 percent single-day gain. Today,

‘SHORT TERM’: The local currency would likely remain strong in the near term, driven by anticipated US trade pressure, capital inflows and expectations of a US Fed rate cut The US dollar is expected to fall below NT$30 in the near term, as traders anticipate increased pressure from Washington for Taiwan to allow the New Taiwan dollar to appreciate, Cathay United Bank (國泰世華銀行) chief economist Lin Chi-chao (林啟超) said. Following a sharp drop in the greenback against the NT dollar on Friday, Lin told the Central News Agency that the local currency is likely to remain strong in the short term, driven in part by market psychology surrounding anticipated US policy pressure. On Friday, the US dollar fell NT$0.953, or 3.07 percent, closing at NT$31.064 — its lowest level since Jan.

The New Taiwan dollar and Taiwanese stocks surged on signs that trade tensions between the world’s top two economies might start easing and as US tech earnings boosted the outlook of the nation’s semiconductor exports. The NT dollar strengthened as much as 3.8 percent versus the US dollar to 30.815, the biggest intraday gain since January 2011, closing at NT$31.064. The benchmark TAIEX jumped 2.73 percent to outperform the region’s equity gauges. Outlook for global trade improved after China said it is assessing possible trade talks with the US, providing a boost for the nation’s currency and shares. As the NT dollar

PRESSURE EXPECTED: The appreciation of the NT dollar reflected expectations that Washington would press Taiwan to boost its currency against the US dollar, dealers said Taiwan’s export-oriented semiconductor and auto part manufacturers are expecting their margins to be affected by large foreign exchange losses as the New Taiwan dollar continued to appreciate sharply against the US dollar yesterday. Among major semiconductor manufacturers, ASE Technology Holding Co (日月光), the world’s largest integrated circuit (IC) packaging and testing services provider, said that whenever the NT dollar rises NT$1 against the greenback, its gross margin is cut by about 1.5 percent. The NT dollar traded as strong as NT$29.59 per US dollar before trimming gains to close NT$0.919, or 2.96 percent, higher at NT$30.145 yesterday in Taipei trading