Wall Street’s main indices on Friday all gained more than 2 percent after last month’s payrolls expanded more than expected, even as wage increases slowed and services activity contracted, easing worries about the US Federal Reserve’s interest rate hiking path.

US nonfarm payrolls rose by 223,000 jobs last month, US Department of Labor data showed, while a 0.3 percent rise in average earnings was smaller than expected and less than the previous month’s 0.4 percent.

In another set of data, US services activity declined for the first time in more than two-and-a-half years last month, as demand weakened, with more signs of inflation easing.

Photo: AFP

“We got good news on the inflation front with wage gains that are slowing. We got participation rates pick up again and yet we’re still creating jobs. It’s a kind of a win-win for the economy. And on the other side the ISM [Institute for Supply Management] services report was really weak and broadly weak,” said Megan Horneman, chief investment officer at Verdence Capital Management in Hunt Valley, Maryland.

“That’s basically making people think the Fed is nearing the end of what’s been one of the most aggressive tightening cycles we’ve seen in decades,” she added. “That’s why the markets are taking off.”

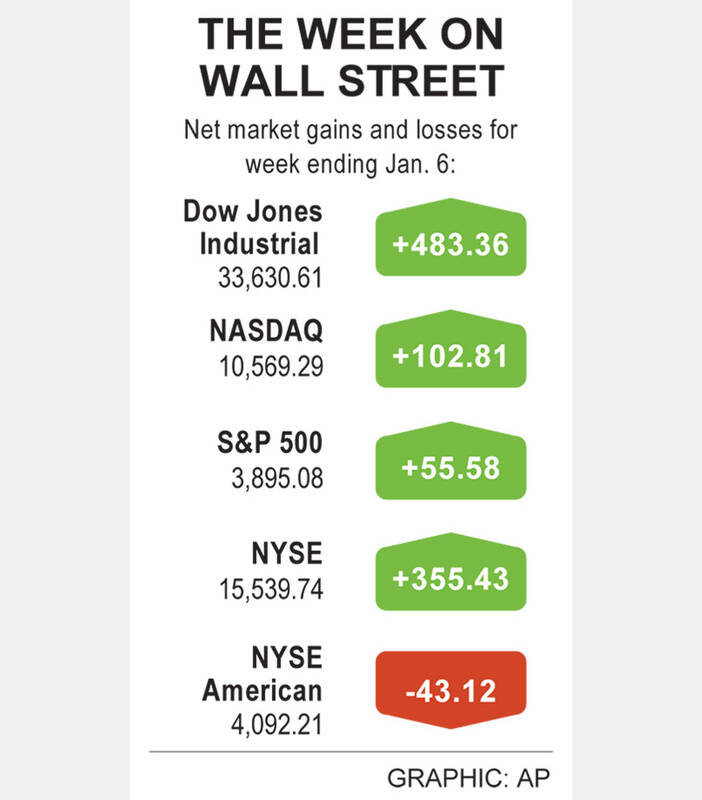

The Dow Jones Industrial Average rose 700.53 points, or 2.13 percent, to 33,630.61. The S&P 500 gained 86.98 points, or 2.28 percent, to close at 3,895.08, while the NASDAQ Composite Index added 264.05 points, or 2.56 percent, to close at 10,569.29.

Friday’s rally boosted the benchmark S&P and the NASDAQ enough to snap four weeks of declines. For the holiday-shortened week, the S&P rose 1.45 percent, while the NASDAQ added 0.98 percent and the Dow advanced by 1.46 percent.

John Augustine, chief investment officer at Huntington National Bank in Columbus, Ohio, said the gains were due to a calming of anxiety that the Fed would raise rates so much that it causes a recession.

“Today’s reports may alleviate that pressure to force a recession. They may already have slowed down the economy enough. They just need validation from inflation reports,” he said.

Still the Fed last month projected an a interest rate target peak of about 5 percent, and said it would keep rates high until inflation is where it wants it to be.

Fed officials on Friday acknowledged cooling wage growth and other signs of a gradually slowing economy, with US Federal Reserve Bank of Atlanta President Raphael Bostic hinting at the chance of a one-quarter percentage point hike at the next policy meeting.

However, Augustine said that the central bank needs to see further slowing of price increases in the inflation report for last month, due out on Thursday, before deciding whether to slow its next rate hike. It raised rates 50 basis points last month.

Also this week, several of the biggest US banks including JPMorgan and Bank of America are to start fourth-quarter earnings season on Friday.

“That’s the part of the puzzle people haven’t been able to figure out. How much should earnings estimates be cut for the calendar year or have they been cut enough?” Horneman said.

The US dollar was trading at NT$29.7 at 10am today on the Taipei Foreign Exchange, as the New Taiwan dollar gained NT$1.364 from the previous close last week. The NT dollar continued to rise today, after surging 3.07 percent on Friday. After opening at NT$30.91, the NT dollar gained more than NT$1 in just 15 minutes, briefly passing the NT$30 mark. Before the US Department of the Treasury's semi-annual currency report came out, expectations that the NT dollar would keep rising were already building. The NT dollar on Friday closed at NT$31.064, up by NT$0.953 — a 3.07 percent single-day gain. Today,

‘SHORT TERM’: The local currency would likely remain strong in the near term, driven by anticipated US trade pressure, capital inflows and expectations of a US Fed rate cut The US dollar is expected to fall below NT$30 in the near term, as traders anticipate increased pressure from Washington for Taiwan to allow the New Taiwan dollar to appreciate, Cathay United Bank (國泰世華銀行) chief economist Lin Chi-chao (林啟超) said. Following a sharp drop in the greenback against the NT dollar on Friday, Lin told the Central News Agency that the local currency is likely to remain strong in the short term, driven in part by market psychology surrounding anticipated US policy pressure. On Friday, the US dollar fell NT$0.953, or 3.07 percent, closing at NT$31.064 — its lowest level since Jan.

The New Taiwan dollar and Taiwanese stocks surged on signs that trade tensions between the world’s top two economies might start easing and as US tech earnings boosted the outlook of the nation’s semiconductor exports. The NT dollar strengthened as much as 3.8 percent versus the US dollar to 30.815, the biggest intraday gain since January 2011, closing at NT$31.064. The benchmark TAIEX jumped 2.73 percent to outperform the region’s equity gauges. Outlook for global trade improved after China said it is assessing possible trade talks with the US, providing a boost for the nation’s currency and shares. As the NT dollar

The Financial Supervisory Commission (FSC) yesterday met with some of the nation’s largest insurance companies as a skyrocketing New Taiwan dollar piles pressure on their hundreds of billions of dollars in US bond investments. The commission has asked some life insurance firms, among the biggest Asian holders of US debt, to discuss how the rapidly strengthening NT dollar has impacted their operations, people familiar with the matter said. The meeting took place as the NT dollar jumped as much as 5 percent yesterday, its biggest intraday gain in more than three decades. The local currency surged as exporters rushed to