China is pausing massive investments aimed at building a chip industry to compete with the US, as a nationwide COVID-19 resurgence strains the world’s No. 2 economy and Beijing’s finances.

Top officials are discussing ways to move away from costly subsidies that have so far borne little fruit, and encouraged graft and US sanctions, people familiar with the matter said.

While some continue to push for incentives of as much as 1 trillion yuan (US$145 billion), other policymakers have lost their taste for an investment-led approach that has not yielded the results anticipated, the people said.

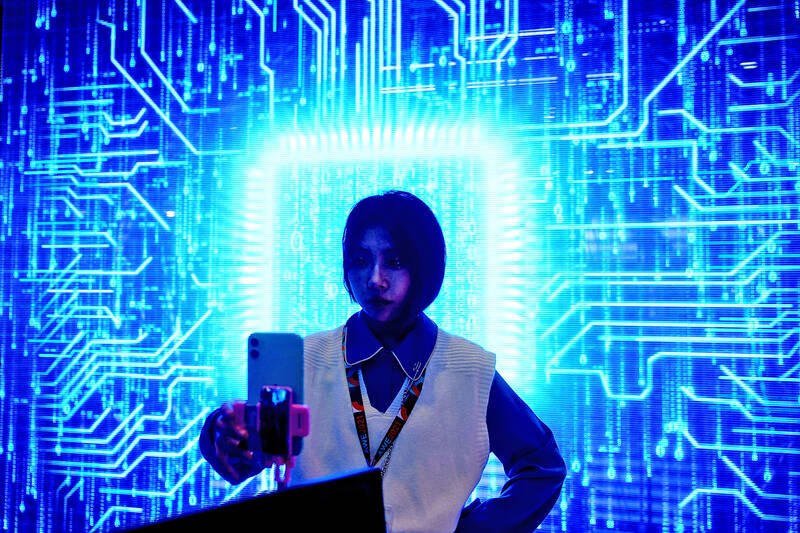

Photo: Reuters

Instead, they are seeking alternative ways to assist homegrown chipmakers, such as lowering the cost of semiconductor materials, the people said, asking not to be identified revealing sensitive negotiations.

That would mark a shift in Beijing’s approach toward an industry regarded as crucial to challenging US dominance, and safeguarding Chinese economic and military competitiveness.

It underscores how the country’s economic ructions are taxing Beijing’s resources and hobbling its chip ambitions — one of Chinese President Xi Jinping’s (習近平) top priorities.

That could have ramifications for spending in other critical areas, from the environment to defense.

It is unclear what other chip policies Beijing is considering, or whether it would ultimately decide to ditch the capital investment-heavy approach that has worked so well in propelling its manufacturing sector over the past decades.

The government could still decide to divert resources from other arenas to fund its chipmakers.

The discussions under way are in stark contrast to Beijing’s prior efforts of pouring colossal resources into the chip industry, including setting up the National Integrated Circuit Industry Investment Fund in 2014.

That vehicle lies at the heart of Xi’s unhappiness with Beijing’s prior philosophy. Known within the industry as the Big Fund, it drew about US$45 billion in capital and backed scores of companies, including China’s chipmaking champions Semiconductor Manufacturing International Corp (SMIC, 中芯國際) and Yangtze Memory Technologies Co (長江儲存).

Xi’s administration grew frustrated that tens of billions of dollars funneled into the industry over the past decade have not produced breakthroughs that allow China to compete with the US on a more equal footing. SMIC and Yangtze, arguably the two most advanced Chinese semiconductor players, were crippled by US sanctions.

Senior Beijing officials ordered a flurry of anti-graft probes into top industry figures last summer, blaming corruption for wasted and inefficient investment.

The Big Fund is likely to lose its stature as a result, the people said.

Chinese officials recently discussed whether to offer additional incentives for domestic semiconductor companies, the people said.

However, many reckoned it would be difficult to pool a substantial amount after Beijing had spent heavily to combat COVID-19 over past years, they said.

Instead, officials are now asking local semiconductor material suppliers to cut prices to provide support to their domestic customers, they added.

Weak tax revenue, declining land sales and the cost of stemming COVID-19 have squeezed the government’s finances, pushing the fiscal deficit to a record last year.

Meanwhile, the US is proving increasingly aggressive in going after China’s technological ambitions.

Last year, it accelerated a campaign to contain Beijing’s chip endeavors, wielding various tools, including export controls, to deter China’s progress in emerging technologies.

That was part of efforts to maintain what US National Security Adviser Jake Sullivan called “as large of a lead as possible.”

Its key allies, including the Netherlands and Japan, have also agreed in principle to tighten controls over the export of advanced chipmaking machinery to China, Bloomberg News has reported, in what might be another potentially debilitating blow to Beijing’s grand chip plans.

CHIP RACE: Three years of overbroad export controls drove foreign competitors to pursue their own AI chips, and ‘cost US taxpayers billions of dollars,’ Nvidia said China has figured out the US strategy for allowing it to buy Nvidia Corp’s H200s and is rejecting the artificial intelligence (AI) chip in favor of domestically developed semiconductors, White House AI adviser David Sacks said, citing news reports. US President Donald Trump on Monday said that he would allow shipments of Nvidia’s H200 chips to China, part of an administration effort backed by Sacks to challenge Chinese tech champions such as Huawei Technologies Co (華為) by bringing US competition to their home market. On Friday, Sacks signaled that he was uncertain about whether that approach would work. “They’re rejecting our chips,” Sacks

NATIONAL SECURITY: Intel’s testing of ACM tools despite US government control ‘highlights egregious gaps in US technology protection policies,’ a former official said Chipmaker Intel Corp has tested chipmaking tools this year from a toolmaker with deep roots in China and two overseas units that were targeted by US sanctions, according to two sources with direct knowledge of the matter. Intel, which fended off calls for its CEO’s resignation from US President Donald Trump in August over his alleged ties to China, got the tools from ACM Research Inc, a Fremont, California-based producer of chipmaking equipment. Two of ACM’s units, based in Shanghai and South Korea, were among a number of firms barred last year from receiving US technology over claims they have

BARRIERS: Gudeng’s chairman said it was unlikely that the US could replicate Taiwan’s science parks in Arizona, given its strict immigration policies and cultural differences Gudeng Precision Industrial Co (家登), which supplies wafer pods to the world’s major semiconductor firms, yesterday said it is in no rush to set up production in the US due to high costs. The company supplies its customers through a warehouse in Arizona jointly operated by TSS Holdings Ltd (德鑫控股), a joint holding of Gudeng and 17 Taiwanese firms in the semiconductor supply chain, including specialty plastic compounds producer Nytex Composites Co (耐特) and automated material handling system supplier Symtek Automation Asia Co (迅得). While the company has long been exploring the feasibility of setting up production in the US to address

OPTION: Uber said it could provide higher pay for batch trips, if incentives for batching is not removed entirely, as the latter would force it to pass on the costs to consumers Uber Technologies Inc yesterday warned that proposed restrictions on batching orders and minimum wages could prompt a NT$20 delivery fee increase in Taiwan, as lower efficiency would drive up costs. Uber CEO Dara Khosrowshahi made the remarks yesterday during his visit to Taiwan. He is on a multileg trip to the region, which includes stops in South Korea and Japan. His visit coincided the release last month of the Ministry of Labor’s draft bill on the delivery sector, which aims to safeguard delivery workers’ rights and improve their welfare. The ministry set the minimum pay for local food delivery drivers at