The latest leaps in artificial intelligence (AI) in everything from cars, robots to appliances are to be on full display at the annual Consumer Electronics Show (CES) opening on Thursday in Las Vegas, Nevada.

Forced by the COVID-19 pandemic to go virtual in 2021 and hybrid last year, tens of thousands of show-goers are hoping for a return to packed halls and rapid-fire dealmaking that were long the hallmark of the annual gadget extravaganza.

“In 2022, it was a shadow of itself — empty halls, no meetings in hotel rooms,” Techspotential analyst Avi Greengart told reporters. “Now, [we expect] crowds, trouble getting around and meetings behind closed doors — which is what a trade show is all about.”

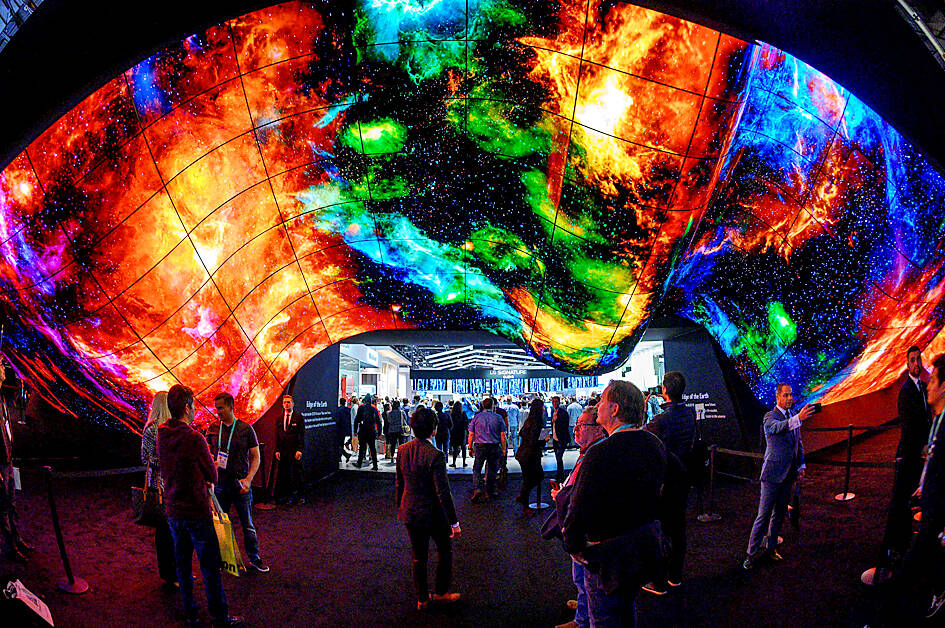

Photo: AFP

The CES show officially opens on Thursday, but companies would begin to vie for the spotlight with the latest tech wizardry as early as today.

CES is to be spread over more than 7 hectares, from the sprawling Las Vegas Convention Center to pavilions set up in parking lots. Ballrooms and banquet rooms across the city are to be used to hustle up business.

With transportation computing’s new frontier, next-generation autos, trucks, boats, farm equipment and even flying machines are expected to grab attention, analysts have said.

“It’s going to feel almost like you’re at an auto show,” Accenture Ltd head of platform strategy Kevan Yalowitz said.

More than ever, cars now come with operating systems so much like a smartphone or laptop computer, Accenture expects that by 2040 about 40 percent of vehicles on the road would need software updated remotely.

With connected vehicles come apps and online entertainment as developers battle to grab passenger attention with streaming or shopping services on board.

Electric vehicles enhanced with artificial intelligence would also be on display “in a big way,” Greengart said.

“What has really been the buzz is personalized flying machines,” independent tech analyst Rob Enderle said. “Basically, they are human-carrying drones.”

Led by Mark Zuckerberg’s Meta Platforms Inc, immersive virtual worlds referred to as the metaverse are seen by some as the future of the ever-evolving Internet, despite widespread criticism that the billionaire CEO is over-investing in an unproven sector.

After being a major theme at CES last year, virtual reality headgear aimed at transporting people to the metaverse are expected to again to figure prominently.

Formerly known as Facebook, Meta would be allowing selected guests to try its latest Oculus Quest virtual-reality headset, trying to persuade doubters that the company’s pivot to the metaverse was the right one.

Gadgets or services pitched as being part of the next generation of the Internet — or “Web 3” — are also expected to include mixed-reality gear as well as blockchain technology and non-fungible tokens.

Web 3 promises a more decentralized Internet where tech giants, big business or governments no longer hold all the keys to life online.

“The idea of how we are going to connect is going to be part of the big trend at CES,” Creative Strategies analyst Carolina Milanesi said.

Analysts had expected cryptocurrencies to be touted among Web 3 innovations at the show, but there “could be pullback” because of the implosion of cryptocurrency platform FTX and arrest of its boss, Sam Bankman-Fried, Milanesi said.

CES offerings would likely show effects of the pandemic, as products designed during a time of lockdowns and remote work would be heading for market even if lifestyles are returning to pre-pandemic habits, Greengart said.

Tech designed to better assess health and connect remotely with care providers would also be strong at CES.

Although the show is unabashedly devoted to consumerism, the environment would also be a theme from gadgets designed to scoop trash from waterways to apps that help people cut down on energy use.

A lot of companies are eliminating plastic from packaging and shifting to biodegradable materials, while also trying to reduce carbon emissions, analysts have said.

“If you are the kind of person who is off the grid growing vegetables, then CES is not for you,” Greengart said. “But, I do commend companies that find ways to make their products and the supply chain more sustainable.”

Vincent Wei led fellow Singaporean farmers around an empty Malaysian plot, laying out plans for a greenhouse and rows of leafy vegetables. What he pitched was not just space for crops, but a lifeline for growers struggling to make ends meet in a city-state with high prices and little vacant land. The future agriculture hub is part of a joint special economic zone launched last year by the two neighbors, expected to cost US$123 million and produce 10,000 tonnes of fresh produce annually. It is attracting Singaporean farmers with promises of cheaper land, labor and energy just over the border.

US actor Matthew McConaughey has filed recordings of his image and voice with US patent authorities to protect them from unauthorized usage by artificial intelligence (AI) platforms, a representative said earlier this week. Several video clips and audio recordings were registered by the commercial arm of the Just Keep Livin’ Foundation, a non-profit created by the Oscar-winning actor and his wife, Camila, according to the US Patent and Trademark Office database. Many artists are increasingly concerned about the uncontrolled use of their image via generative AI since the rollout of ChatGPT and other AI-powered tools. Several US states have adopted

A proposed billionaires’ tax in California has ignited a political uproar in Silicon Valley, with tech titans threatening to leave the state while California Governor Gavin Newsom of the Democratic Party maneuvers to defeat a levy that he fears would lead to an exodus of wealth. A technology mecca, California has more billionaires than any other US state — a few hundred, by some estimates. About half its personal income tax revenue, a financial backbone in the nearly US$350 billion budget, comes from the top 1 percent of earners. A large healthcare union is attempting to place a proposal before

KEEPING UP: The acquisition of a cleanroom in Taiwan would enable Micron to increase production in a market where demand continues to outpace supply, a Micron official said Micron Technology Inc has signed a letter of intent to buy a fabrication site in Taiwan from Powerchip Semiconductor Manufacturing Corp (力積電) for US$1.8 billion to expand its production of memory chips. Micron would take control of the P5 site in Miaoli County’s Tongluo Township (銅鑼) and plans to ramp up DRAM production in phases after the transaction closes in the second quarter, the company said in a statement on Saturday. The acquisition includes an existing 12 inch fab cleanroom of 27,871m2 and would further position Micron to address growing global demand for memory solutions, the company said. Micron expects the transaction to