CTBC Financial Holding Co (中信金控) on Wednesday was given a National Sustainable Development Award for its efforts in promoting sustainable business practices.

The awards, organized by the National Council for Sustainable Development, were presented by Premier Su Tseng-chang (蘇貞昌), chairman of the council, at a ceremony in Taipei.

CTBC Bank (中國信託銀行) vice chairman Austin Chan (詹庭禎) was in attendance to receive the award.

CTBC Financial won in the corporate category for its active adoption of sustainable development goals (SDGs) and climate governance as guiding management principles, as well as connecting with other stakeholders to fulfill its corporate social responsibility.

The company uses a complete implementation structure to produce diverse, specific and data-driven results, the judges said.

The firm incorporates priority SDG projects into its operating strategy, and comprehensively improves corporate environmental, social and governance (ESG) management and risk resilience, they said.

The council recognized CTBC Financial’s five major SDG-linked public welfare initiatives.

They include the “Light Up a Life” national fundraising campaign; establishment of the CTBC Charity Foundation; the “Taiwan Dream Project” creating local community centers for disadvantaged children; the microloan “CTBC Poverty Alleviation Program”; and more to help improve the lives of disadvantaged people.

The judges also commended the CTBC Anti-drug Educational Foundation’s touring educational exhibition “Breaking the Habit: Unlocking the Distance between You and Addiction” for its implementation of Taiwan’s third SDG — to “promote healthy lives and well-being for all at all ages.”

Its environmental and climate initiatives were also viewed highly by the judges.

In 2020, CTBC Financial was Taiwan’s first financial institution to join the Partnership for Carbon Accounting Financials. It was also the first in the industry to use scenarios provided by the Network for Greening the Financial System in its climate risk assessment report.

After last year becoming Taiwan’s first firm to join the Taskforce on Nature-related Financial Disclosures (TNFD), CTBC Financial was invited to participate in the TNFD Forum.

In October, the firm joined Business for Nature in calling on countries to adopt stringent policies, attach importance to biodiversity and reverse the biodiversity loss crisis at the UN Biodiversity Conference.

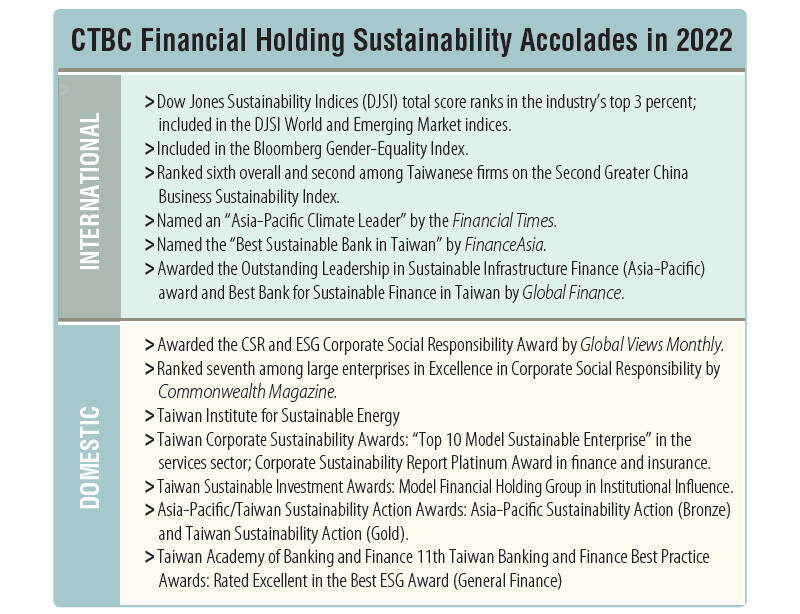

CTBC Financial — which was selected to the Dow Jones Sustainability Indices (DJSI) World Index for the fourth time this year and has been a constituent of the DJSI Emerging Market Index for seven consecutive years — has also achieved excellent results in domestic and foreign sustainability-related evaluations, showing that its strength in sustainable governance has garnered global recognition.

NEW IDENTITY: Known for its software, India has expanded into hardware, with its semiconductor industry growing from US$38bn in 2023 to US$45bn to US$50bn India on Saturday inaugurated its first semiconductor assembly and test facility, a milestone in the government’s push to reduce dependence on foreign chipmakers and stake a claim in a sector dominated by China. Indian Prime Minister Narendra Modi opened US firm Micron Technology Inc’s semiconductor assembly, test and packaging unit in his home state of Gujarat, hailing the “dawn of a new era” for India’s technology ambitions. “When young Indians look back in the future, they will see this decade as the turning point in our tech future,” Modi told the event, which was broadcast on his YouTube channel. The plant would convert

‘SEISMIC SHIFT’: The researcher forecast there would be about 1.1 billion mobile shipments this year, down from 1.26 billion the prior year and erasing years of gains The global smartphone market is expected to contract 12.9 percent this year due to the unprecedented memorychip shortage, marking “a crisis like no other,” researcher International Data Corp (IDC) said. The new forecast, a dramatic revision down from earlier estimates, gives the latest accounting of the ongoing memory crunch that is affecting every corner of the electronics industry. The demand for advanced memory to power artificial intelligence (AI) tasks has drained global supply until well into next year and jeopardizes the business model of many smartphone makers. IDC forecast about 1.1 billion mobile shipments this year, down from 1.26 billion the prior

People stand in a Pokemon store in Tokyo on Thursday. One of the world highest-grossing franchises is celebrated its 30th anniversary yesterday.

Zimbabwe’s ban on raw lithium exports is forcing Chinese miners to rethink their strategy, speeding up plans to process the metal locally instead of shipping it to China’s vast rechargeable battery industry. The country is Africa’s largest lithium producer and has one of the world’s largest reserves, according to the US Geological Survey (USGS). Zimbabwe already banned the export of lithium ore in 2022 and last year announced it would halt exports of lithium concentrates from January next year. However, on Wednesday it imposed the ban with immediate effect, leaving unclear what the lithium mining sector would do in the