Dutch chipmaking equipment supplier ASML Holding NV is planning to offer NT$1.6 million (US$51,331) or more in starting annual pay to engineers with a master’s degree at its sites in Taiwan.

The major supplier to contract chipmaker Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) said it is keen to offer competitive compensation comprised of salaries, bonuses and other financial incentives as it seeks to expand its talent pool in Taiwan.

The company, which is planning to build a plant in New Taipei City, said engineers would in their first year be granted 10 days annual leave, compared with the minimum of three days per six months stipulated in the Labor Standards Act (勞動基準法).

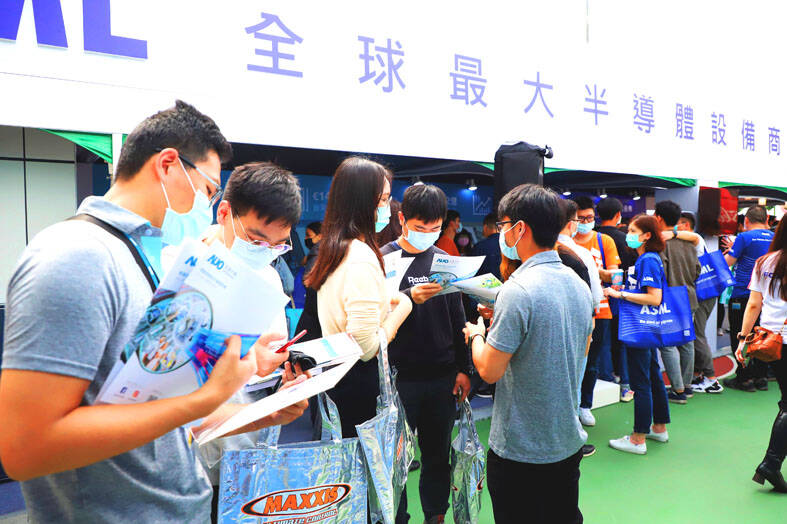

Photo courtesy of the New Taipei City Economic Development Department

Starting from next year, ASML’s female employees would also get 14 weeks of maternity leave and male employees 10 days of paternity leave, compared with a legal minimum of eight weeks and seven days respectively.

Amanda Ho (何思穎), chief financial officer of ASML’s Taiwanese and Southeast Asian operations, said that 35 percent of the firm’s local employees have no engineering, science, technology or mathematics-related degrees.

ASML is committed to helping those workers build their careers, she said.

Photo courtesy of National Taiwan University of Science and Technology

In-house training programs would run six to 18 months, the company said, adding that it spends more than NT$5 million on training each new engineer.

The recruitment campaign is in line with the company’s new investment project announced earlier last week to build a new production complex in New Taipei City’s Linkou District (林口) to better serve its clients in Taiwan.

The New Taipei City Government said that the first phase of ASML’s investment is expected to total NT$30 billion, the company’s largest investment plan in Taiwan to date, with a campaign to hire 2,000 workers for the Linkou campus, which is to include production lines, offices, a research and development center, and logistics and warehousing operations.

ASML is the world’s sole supplier of extreme ultraviolet lithography (EUV) machines used by semiconductor manufacturers to produce cutting-edge chips.

In addition to TSMC, the company’s other prominent clients include Taoyuan-headquartered DRAM maker Nanya Technology Corp (南亞科技) and US-based Micron Technology Inc, which are planning to install EUV photolithography machines.

The Veldhoven, Netherlands-headquartered company has 60 operation hubs in 16 countries, with Taiwan as its largest hub in Asia.

In Taiwan, ASML has four client support centers, two research-and-development centers and two training centers, with its workforce expected to expand to 4,500 by the end of this year.

NEW IDENTITY: Known for its software, India has expanded into hardware, with its semiconductor industry growing from US$38bn in 2023 to US$45bn to US$50bn India on Saturday inaugurated its first semiconductor assembly and test facility, a milestone in the government’s push to reduce dependence on foreign chipmakers and stake a claim in a sector dominated by China. Indian Prime Minister Narendra Modi opened US firm Micron Technology Inc’s semiconductor assembly, test and packaging unit in his home state of Gujarat, hailing the “dawn of a new era” for India’s technology ambitions. “When young Indians look back in the future, they will see this decade as the turning point in our tech future,” Modi told the event, which was broadcast on his YouTube channel. The plant would convert

Nanya Technology Corp (南亞科技) yesterday said the DRAM supply crunch could extend through 2028, as the artificial intelligence (AI) boom has led the world’s major memory makers to dramatically reduce production of standard DRAM and allocate a significant portion of their capacity for high-bandwidth memory (HBM) chips. The most severe supply constraints would stretch to the first half of next year due to “very limited” increases in new DRAM capacity worldwide, Nanya Technology president Lee Pei-ing (李培瑛) told a news briefing. The company plans to increase monthly 12-inch wafer capacity to 20,000 in the first half of 2028 after a

Property transactions in the nation’s six special municipalities plunged last month, as a lengthy Lunar New Year holiday combined with ongoing credit tightening dampened housing market activity, data compiled by local land administration offices released on Monday showed. The six cities recorded a total of 10,480 property transfers last month, down 42.5 percent from January and marking the second-lowest monthly level on record, the data showed. “The sharp drop largely reflected seasonal factors and tighter credit conditions,” Evertrust Rehouse Co (永慶房屋) deputy research manager Chen Chin-ping (陳金萍) said. The nine-day Lunar New Year holiday fell in February this year, reducing

Zimbabwe’s ban on raw lithium exports is forcing Chinese miners to rethink their strategy, speeding up plans to process the metal locally instead of shipping it to China’s vast rechargeable battery industry. The country is Africa’s largest lithium producer and has one of the world’s largest reserves, according to the US Geological Survey (USGS). Zimbabwe already banned the export of lithium ore in 2022 and last year announced it would halt exports of lithium concentrates from January next year. However, on Wednesday it imposed the ban with immediate effect, leaving unclear what the lithium mining sector would do in the