Europe’s STOXX 600 index closed higher on Friday in a broad-based rally led by retailers and automakers, while investors awaited minutes from the European Central Bank’s last policy meeting and kept an eye out for a slew of data due next week.

The pan-European benchmark index jumped 1.16 percent to 433.33 to log its best one-day performance in more than a week.

The index rose 0.25 from a week earlier, and has gained 5.1 percent so far this month, putting it on track for its second straight month of gains, driven by several factors including better-than-expected earnings, despite lingering worries of a recession in the eurozone.

Data this week showed that inflation hovered at a record high last month.

S&P Global’s eurozone flash composite Purchasing Managers’ Index survey scheduled to be released on Wednesday is expected to show activity falling further from last month.

“The underlying momentum seems quite better than the macro might suggest it should be, which is quite encouraging,” Peel Hunt economist and strategist Ian Williams said.

The STOXX 600 index is down more than 11 percent this year as investors feared aggressive interest rate hikes by the European Central Bank (ECB) could deepen a recession in the eurozone already reeling with an energy crisis triggered by Russia’s invasion of Ukraine.

Three top policymakers on Friday said that the ECB must raise interest rates high enough to dampen growth as it fights sky-high inflation, and that it could soon start running down its 5 trillion euro (US$5.2 trillion) debt pile, even as some hint at slower rate hikes.

“It’s a very difficult balancing act, because inflation has surprised consistently to the upside and they have all got it wrong,” Williams said.

Minutes of the ECB’s policy meeting last month are due on Thursday

Automakers and retailers were the top gainers, up more than 2.1 percent each.

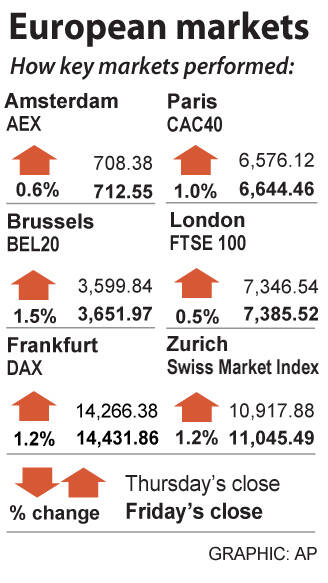

The UK’s blue-chip index FTSE 100 closed the session 0.53 percent higher at 7,385.52, while marking a weekly gain of nearly 0.92 percent, as gains in insurer Legal & General and broad optimism in European markets outweighed declines in energy stocks.

The US dollar was trading at NT$29.7 at 10am today on the Taipei Foreign Exchange, as the New Taiwan dollar gained NT$1.364 from the previous close last week. The NT dollar continued to rise today, after surging 3.07 percent on Friday. After opening at NT$30.91, the NT dollar gained more than NT$1 in just 15 minutes, briefly passing the NT$30 mark. Before the US Department of the Treasury's semi-annual currency report came out, expectations that the NT dollar would keep rising were already building. The NT dollar on Friday closed at NT$31.064, up by NT$0.953 — a 3.07 percent single-day gain. Today,

‘SHORT TERM’: The local currency would likely remain strong in the near term, driven by anticipated US trade pressure, capital inflows and expectations of a US Fed rate cut The US dollar is expected to fall below NT$30 in the near term, as traders anticipate increased pressure from Washington for Taiwan to allow the New Taiwan dollar to appreciate, Cathay United Bank (國泰世華銀行) chief economist Lin Chi-chao (林啟超) said. Following a sharp drop in the greenback against the NT dollar on Friday, Lin told the Central News Agency that the local currency is likely to remain strong in the short term, driven in part by market psychology surrounding anticipated US policy pressure. On Friday, the US dollar fell NT$0.953, or 3.07 percent, closing at NT$31.064 — its lowest level since Jan.

The New Taiwan dollar and Taiwanese stocks surged on signs that trade tensions between the world’s top two economies might start easing and as US tech earnings boosted the outlook of the nation’s semiconductor exports. The NT dollar strengthened as much as 3.8 percent versus the US dollar to 30.815, the biggest intraday gain since January 2011, closing at NT$31.064. The benchmark TAIEX jumped 2.73 percent to outperform the region’s equity gauges. Outlook for global trade improved after China said it is assessing possible trade talks with the US, providing a boost for the nation’s currency and shares. As the NT dollar

PRESSURE EXPECTED: The appreciation of the NT dollar reflected expectations that Washington would press Taiwan to boost its currency against the US dollar, dealers said Taiwan’s export-oriented semiconductor and auto part manufacturers are expecting their margins to be affected by large foreign exchange losses as the New Taiwan dollar continued to appreciate sharply against the US dollar yesterday. Among major semiconductor manufacturers, ASE Technology Holding Co (日月光), the world’s largest integrated circuit (IC) packaging and testing services provider, said that whenever the NT dollar rises NT$1 against the greenback, its gross margin is cut by about 1.5 percent. The NT dollar traded as strong as NT$29.59 per US dollar before trimming gains to close NT$0.919, or 2.96 percent, higher at NT$30.145 yesterday in Taipei trading