US stocks closed higher in volatile trade on Friday to snap a four-session losing streak as investors wrestled with a mixed jobs report and comments from US Federal Reserve officials on the pace of interest rate hikes.

The S&P 500 and the NASDAQ each rose as much as 2 percent in the early stages of trading, while the Dow Jones Industrial Average climbed as much as 1.9 percent on the heels of the closely watched labor market report, before paring gains and briefly falling into negative territory.

The report showed an uptick in the unemployment rate last month, indicating that some signs of slack might finally be starting to emerge in the job market and give the Fed room to downsize its rate hikes beginning next month.

However, the data also showed that average hourly earnings rose slightly more than expected, as did job growth, pointing to a labor market that remains largely on firm footing.

Labor market data has been a primary focus for markets as the Fed has repeatedly stated that it is looking for some cooling before considering a pause in hikes.

Hawkish comments from Fed Chairman Jerome Powell on Wednesday increased worries that the central bank could keep boosting interest rates for longer than previously expected and put further pressure on stocks.

Photo: Reuters

“This was not a report that shows the rate hikes are starting to take hold,” said Shawn Cruz, head trading strategist at TD Ameritrade in Chicago. “You could maybe justify some of this move as this selling got a little overdone after what Powell said at the meeting, so maybe you already had the sellers flushed out.”

Fed officials on Friday echoed Powell’s comments about potentially decreasing the size of rate hikes, but needing to continue to raise rates for a longer period of time and potentially above the 4.6 percent level the central bank penciled in at its September meeting.

Equities got a boost late in the session after Chicago Fed President Charles Evans said it was possible for the Fed to be “thinking” about pausing even if it is a year from now.

The Dow Jones Industrial Average rose 401.97 points, or 1.26 percent, to 32,403.22, the S&P 500 gained 50.66 points, or 1.36 percent, to 3,770.55 and the NASDAQ Composite added 132.31 points, or 1.28 percent, to 10,475.25.

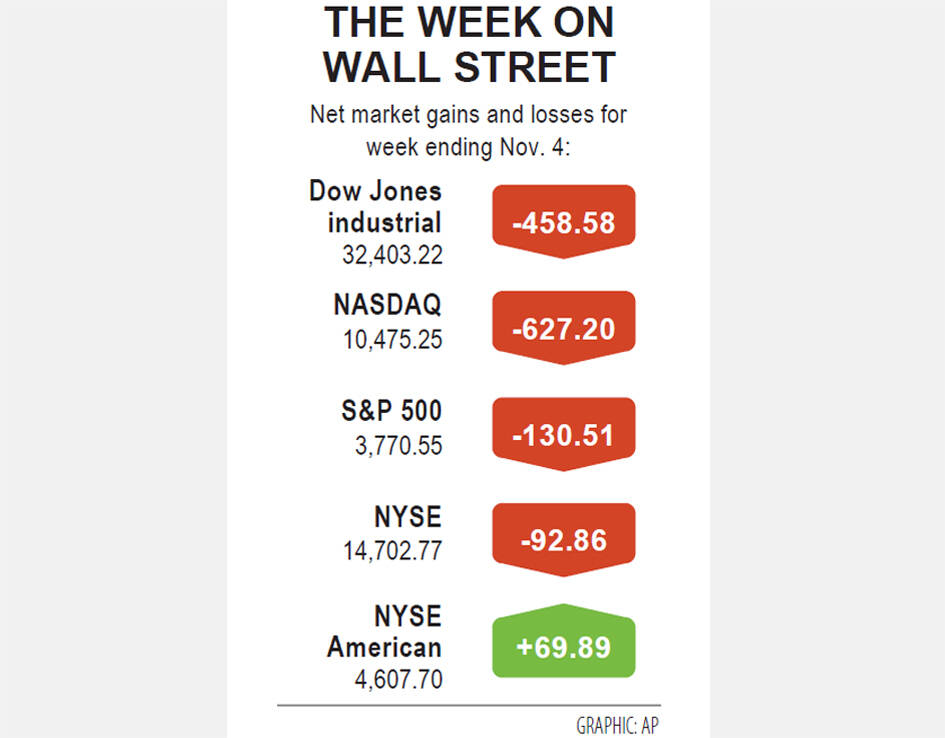

For the week, the Dow fell 1.4 percent, snapping a four-week winning streak, while the S&P dropped 3.35 percent and the NASDAQ slid 5.65 percent, posting its biggest weekly percentage decline since January.

The non-farm payrolls report comes after a conflicting set of data this week that pointed to a slowdown in certain parts of the economy, but also underscored the resilience of the US labor market despite aggressive rate hikes to tame inflation.

Traders’ expectations of a 75 basis-point rate hike next month had briefly jumped after the jobs report, but they are now pricing in about a 62 percent chance of a 50 basis-point hike, according to CME Group Inc’s FedWatch Tool.

Volume on US exchanges was 13.31 billion shares, compared with the 11.74 billion average for the full session over the past 20 trading days.

Advancing issues outnumbered declining ones on the NYSE by a 2.56-to-1 ratio; on the NASDAQ, a 1.41-to-1 ratio favored advancers.

The S&P 500 posted 18 new 52-week highs and 27 new lows, while the NASDAQ Composite recorded 81 new highs and 278 new lows.

The US dollar was trading at NT$29.7 at 10am today on the Taipei Foreign Exchange, as the New Taiwan dollar gained NT$1.364 from the previous close last week. The NT dollar continued to rise today, after surging 3.07 percent on Friday. After opening at NT$30.91, the NT dollar gained more than NT$1 in just 15 minutes, briefly passing the NT$30 mark. Before the US Department of the Treasury's semi-annual currency report came out, expectations that the NT dollar would keep rising were already building. The NT dollar on Friday closed at NT$31.064, up by NT$0.953 — a 3.07 percent single-day gain. Today,

‘SHORT TERM’: The local currency would likely remain strong in the near term, driven by anticipated US trade pressure, capital inflows and expectations of a US Fed rate cut The US dollar is expected to fall below NT$30 in the near term, as traders anticipate increased pressure from Washington for Taiwan to allow the New Taiwan dollar to appreciate, Cathay United Bank (國泰世華銀行) chief economist Lin Chi-chao (林啟超) said. Following a sharp drop in the greenback against the NT dollar on Friday, Lin told the Central News Agency that the local currency is likely to remain strong in the short term, driven in part by market psychology surrounding anticipated US policy pressure. On Friday, the US dollar fell NT$0.953, or 3.07 percent, closing at NT$31.064 — its lowest level since Jan.

The New Taiwan dollar and Taiwanese stocks surged on signs that trade tensions between the world’s top two economies might start easing and as US tech earnings boosted the outlook of the nation’s semiconductor exports. The NT dollar strengthened as much as 3.8 percent versus the US dollar to 30.815, the biggest intraday gain since January 2011, closing at NT$31.064. The benchmark TAIEX jumped 2.73 percent to outperform the region’s equity gauges. Outlook for global trade improved after China said it is assessing possible trade talks with the US, providing a boost for the nation’s currency and shares. As the NT dollar

The Financial Supervisory Commission (FSC) yesterday met with some of the nation’s largest insurance companies as a skyrocketing New Taiwan dollar piles pressure on their hundreds of billions of dollars in US bond investments. The commission has asked some life insurance firms, among the biggest Asian holders of US debt, to discuss how the rapidly strengthening NT dollar has impacted their operations, people familiar with the matter said. The meeting took place as the NT dollar jumped as much as 5 percent yesterday, its biggest intraday gain in more than three decades. The local currency surged as exporters rushed to