Apple Inc added three Taiwanese manufacturers to its supplier list in the past fiscal year, while many others, such as iPhone assembler Hon Hai Precision Industry Co (鴻海精密), IC packaging and testing services provider ASE Technology Holding Co (日月光投控) and contract chipmaker Taiwan Semiconductor Manufacturing Co (TSMC, 台積電), remained on the list.

On the list released for the year ending September last year, metal powder injection molding device maker Taiwan Powder Technologies Co (台耀科技), membrane touch switch supplier Ko Ja (Cayman) Co (科嘉) and LCD surface-mount technology production solutions provider Taiwan Surface Mounting Technology Corp (台灣表面黏著科技) were added.

As for Hon Hai, about 40 percent of its sales come from Apple. The manufacturer has production sites in China’s Guangdong, Henan, Hubei, Jiangsu, Shaanxi, Sichuan and Zhejiang provinces, Brazil’s Amasonas state and Sao Paulo, India’s Tamil Nadu state, the US states of California and Texas, and Vietnam’s Bac Giang Province on the Apple supplier list.

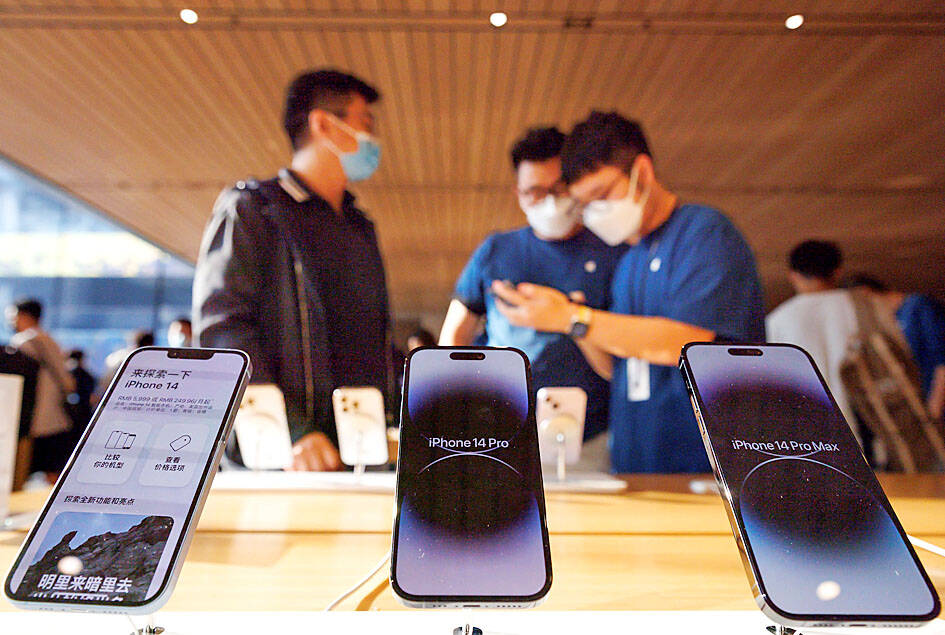

Photo: Reuters

Hon Hai, also known as Foxconn Technology Group (富士康科技集團), produces iPhones at its Zhengzhou complex in Henan, while its production compound in Shenzhen is involved in development and new product introduction for iPhones, analysts said.

ASE’s production sites in Kaohsiung, Taoyuan and Nantou County, China’s Jiangsu and Shanghai, Japan’s Yamagata Prefecture, South Korea’s Gyeonggi Province, Singapore and Vietnam’s Haiphong are on the Apple supplier list. ASE is the world’s largest IC packaging and testing provider.

TSMC, the world’s largest contract chipmaker, is believed to serve as the sole supplier of chips for iPhone production, as Apple is one of its largest clients.

Other Taiwanese manufacturers on the list included smartphone camera lens suppliers Largan Precision Co (大立光) and Genius Electronic Optical Co (玉晶光), power management solution provider Delta Electronics Inc (台達電子), metal casing supplier Catcher Technology Co (可成科技), Hon Hai’s resistor subsidiary Cheng Uei Precision Industry Co (正崴精密), and contract notebook computer makers Compal Electronics Inc (仁寶電腦) and Inventec Corp (英業達).

Smaller Taiwanese iPhone assemblers Pegatron Corp (和碩) and Wistron Corp (緯創), the world’s third-largest multilayer ceramic capacitor maker, Yageo Corp (國巨), DRAM chip supplier Nanya Technology Corp (南亞科技), printed circuit board supplier Compeq Manufacturing Co (華通電腦) and Unimicron Technology Corp (欣興電子), one of Taiwan’s major suppliers of Ajinomoto build-up film, are also on the list.

Separately, iPhone exports from India exceeded US$1 billion in the five months since April, people familiar with the matter said, signaling that the South Asian nation is making progress with its bid to become a force in electronics manufacturing.

At the current rate, outbound shipments of India-made iPhones, mainly to Europe and the Middle East, are set to reach US$2.5 billion in the 12 months through March next year, the people said, asking not to be named as the data are not public.

That is almost double the US$1.3 billion worth of iPhones India exported in the year through March this year, the people said.

Apple’s key Taiwanese contract manufacturers Hon Hai, Wistron and Pegatron make iPhones at plants in Southern India. All three won manufacturing incentives under a federal government plan.

However, India is still far behind China. About 3 million iPhones were made in India last year, compared with 230 million in China, Bloomberg Intelligence estimates showed.

The devices exported from India from April to August comprise iPhone 11, 12 and 13 models, and exports of the new iPhone 14 line are to begin soon, the people said.

Beyond smartphones, India is drawing up plans to boost financial incentives for tablet and laptop makers, hoping to woo Apple to make MacBooks and iPads locally, and attract other brands.

Sweeping policy changes under US Secretary of Health and Human Services Robert F. Kennedy Jr are having a chilling effect on vaccine makers as anti-vaccine rhetoric has turned into concrete changes in inoculation schedules and recommendations, investors and executives said. The administration of US President Donald Trump has in the past year upended vaccine recommendations, with the country last month ending its longstanding guidance that all children receive inoculations against flu, hepatitis A and other diseases. The unprecedented changes have led to diminished vaccine usage, hurt the investment case for some biotechs, and created a drag that would likely dent revenues and

Macronix International Co (旺宏), the world’s biggest NOR flash memory supplier, yesterday said it would spend NT$22 billion (US$699.1 million) on capacity expansion this year to increase its production of mid-to-low-density memory chips as the world’s major memorychip suppliers are phasing out the market. The company said its planned capital expenditures are about 11 times higher than the NT$1.8 billion it spent on new facilities and equipment last year. A majority of this year’s outlay would be allocated to step up capacity of multi-level cell (MLC) NAND flash memory chips, which are used in embedded multimedia cards (eMMC), a managed

CULPRITS: Factors that affected the slip included falling global crude oil prices, wait-and-see consumer attitudes due to US tariffs and a different Lunar New Year holiday schedule Taiwan’s retail sales ended a nine-year growth streak last year, slipping 0.2 percent from a year earlier as uncertainty over US tariff policies affected demand for durable goods, data released on Friday by the Ministry of Economic Affairs showed. Last year’s retail sales totaled NT$4.84 trillion (US$153.27 billion), down about NT$9.5 billion, or 0.2 percent, from 2024. Despite the decline, the figure was still the second-highest annual sales total on record. Ministry statistics department deputy head Chen Yu-fang (陳玉芳) said sales of cars, motorcycles and related products, which accounted for 17.4 percent of total retail rales last year, fell NT$68.1 billion, or

In the wake of strong global demand for AI applications, Taiwan’s export-oriented economy accelerated with the composite index of economic indicators flashing the first “red” light in December for one year, indicating the economy is in booming mode, the National Development Council (NDC) said yesterday. Moreover, the index of leading indicators, which gauges the potential state of the economy over the next six months, also moved higher in December amid growing optimism over the outlook, the NDC said. In December, the index of economic indicators rose one point from a month earlier to 38, at the lower end of the “red” light.