Hong Kong is set to end the year in the midst of a full-blown recession, its finance chief said yesterday, as spiraling interest rates join strict COVID-19 controls in hammering the economy.

“There is a very high chance for Hong Kong to record a negative GDP growth for this year,” Hong Kong Financial Secretary Paul Chan (陳茂波) told reporters, adding that interest rates were being raised “at a pace that was never seen in the past three decades.”

Hong Kong’s monetary policy moves with the US Federal Reserve because its currency, one of the cornerstones of its business hub reputation, is pegged to the US dollar.

Photo: AFP

The Fed’s hawkish rate hikes, aimed at curbing soaring inflation, come at an especially difficult time for Hong Kong, dampening sentiment when the economy is struggling.

Hong Kong is currently in a technical recession — recording two consecutive quarters of negative growth this year.

The government has adhered to a version of China’s “zero COVID” policy for more than two-and-a-half years, enforcing strict controls and mandatory quarantine for international arrivals.

Chan signaled his support for making travel and business easier.

“The aspects related to the pandemic need to continue to improve in order for us to see larger investments, because people are more cautious in a high-interest-rates environment,” he said.

Business leaders have long been warning that the COVID-19 controls, combined with Beijing’s ongoing crackdown on dissent, have made it harder to attract talent and cut off Hong Kong internationally, especially as rivals reopen.

Hong Kong has seen a net outflow of more than 200,000 people in the past two years, a record population drop.

“Hong Kong should be ahead of other Asian cities, but now there’s a feeling that we’re falling behind and being left isolated,” Eden Woon (翁以登), the new head of the Hong Kong American Chamber of Commerce told the South China Morning Post in an article published yesterday.

“There are people leaving and the problems of retaining talent — all these things add up together and need to be addressed,” he added.

While the Hong Kong Monetary Authority has no choice but to follow the Fed, major banks such as Standard Chartered PLC and HSBC Holdings PLC had resisted that pressure.

However, HSBC yesterday raised its prime lending rate in Hong Kong by 12.5 basis points to 5.125 percent, the bank’s first rise in four years.

Others are likely to follow suit. That could affect the territory’s once hot property sector, with Goldman Sachs Group Inc estimating that prices could slide by about 20 percent over the next four years.

Hong Kong also experienced a recession in 2019 when months of huge and sometimes violent democracy protests rocked the business district.

On Ireland’s blustery western seaboard, researchers are gleefully flying giant kites — not for fun, but in the hope of generating renewable electricity and sparking a “revolution” in wind energy. “We use a kite to capture the wind and a generator at the bottom of it that captures the power,” said Padraic Doherty of Kitepower, the Dutch firm behind the venture. At its test site in operation since September 2023 near the small town of Bangor Erris, the team transports the vast 60-square-meter kite from a hangar across the lunar-like bogland to a generator. The kite is then attached by a

Foxconn Technology Co (鴻準精密), a metal casing supplier owned by Hon Hai Precision Industry Co (鴻海精密), yesterday announced plans to invest US$1 billion in the US over the next decade as part of its business transformation strategy. The Apple Inc supplier said in a statement that its board approved the investment on Thursday, as part of a transformation strategy focused on precision mold development, smart manufacturing, robotics and advanced automation. The strategy would have a strong emphasis on artificial intelligence (AI), the company added. The company said it aims to build a flexible, intelligent production ecosystem to boost competitiveness and sustainability. Foxconn

Leading Taiwanese bicycle brands Giant Manufacturing Co (巨大機械) and Merida Industry Co (美利達工業) on Sunday said that they have adopted measures to mitigate the impact of the tariff policies of US President Donald Trump’s administration. The US announced at the beginning of this month that it would impose a 20 percent tariff on imported goods made in Taiwan, effective on Thursday last week. The tariff would be added to other pre-existing most-favored-nation duties and industry-specific trade remedy levy, which would bring the overall tariff on Taiwan-made bicycles to between 25.5 percent and 31 percent. However, Giant did not seem too perturbed by the

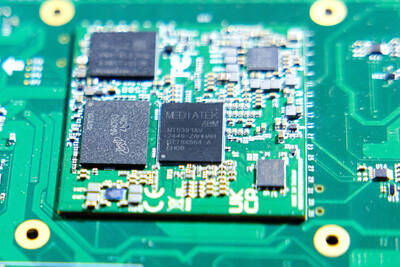

TARIFF CONCERNS: Semiconductor suppliers are tempering expectations for the traditionally strong third quarter, citing US tariff uncertainty and a stronger NT dollar Several Taiwanese semiconductor suppliers are taking a cautious view of the third quarter — typically a peak season for the industry — citing uncertainty over US tariffs and the stronger New Taiwan dollar. Smartphone chip designer MediaTek Inc (聯發科技) said that customers accelerated orders in the first half of the year to avoid potential tariffs threatened by US President Donald Trump’s administration. As a result, it anticipates weaker-than-usual peak-season demand in the third quarter. The US tariff plan, announced on April 2, initially proposed a 32 percent duty on Taiwanese goods. Its implementation was postponed by 90 days to July 9, then