A visit to the US by a Taiwanese delegation has opened the door to dialogue on cooperation between biotechnology companies, the Ministry of Economic Affairs said yesterday.

During the trip from Sept. 11 to Saturday, the delegation led by Deputy Minister of Economic Affairs Chen Chern-chyi (陳正祺) visited five prominent US companies to solicit investments in Taiwan, the ministry said in a statement.

Those visits created an opportunity for the potential start of discussions between biotechnology companies in the US and Taiwan on investments, under the contract development and manufacturing organization (CDMO) model, the ministry said.

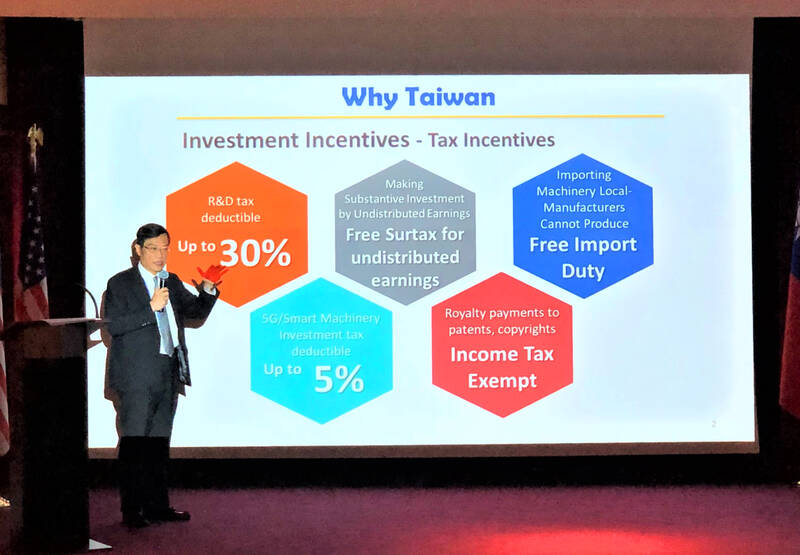

Photo courtesy of the Ministry of Economic Affairs’ Department of Investment Services

Under that model, pharmaceutical companies partner with others in the industry that are categorized as CDMOs to outsource drug development and manufacturing.

Potential cooperation between Taiwanese and US pharmaceutical companies could include the development and production of medical consumables and minimally invasive surgical instruments.

However, the ministry did not say when the discussions were expected to start or which US companies would be involved.

One of the Taiwanese delegates told the Central News Agency that two biotechnology firms in the US had expressed interest in starting discussions with Taiwanese companies, but the delegate did not name the firms.

In the push for US investments in Taiwan, Chen’s delegation also hosted a conference in New York which was attended by more than 50 representatives from prominent think tanks, investment advisory companies, private equity firms, industrial associations and other enterprises, the ministry said.

At the conference, Peter Chow (周鉅原), a Taiwanese professor at City University of New York, called on Washington to sign a bilateral trade agreement with Taipei, while some of the US participants said Washington should forge closer trade and investment ties with Taipei, the ministry said.

Chen and his delegation also visited SkySkopes, a geospatial data solutions company that specializes in aerial data acquisition through the use of advanced crewed and uncrewed aircraft equipped with cutting edge sensor solutions, it said.

At that company, the delegation met with its founder and partner Matt Dunlevy, who said he hoped to visit Taiwan to hold discussions with potential business partners, it added.

Vincent Wei led fellow Singaporean farmers around an empty Malaysian plot, laying out plans for a greenhouse and rows of leafy vegetables. What he pitched was not just space for crops, but a lifeline for growers struggling to make ends meet in a city-state with high prices and little vacant land. The future agriculture hub is part of a joint special economic zone launched last year by the two neighbors, expected to cost US$123 million and produce 10,000 tonnes of fresh produce annually. It is attracting Singaporean farmers with promises of cheaper land, labor and energy just over the border.

US actor Matthew McConaughey has filed recordings of his image and voice with US patent authorities to protect them from unauthorized usage by artificial intelligence (AI) platforms, a representative said earlier this week. Several video clips and audio recordings were registered by the commercial arm of the Just Keep Livin’ Foundation, a non-profit created by the Oscar-winning actor and his wife, Camila, according to the US Patent and Trademark Office database. Many artists are increasingly concerned about the uncontrolled use of their image via generative AI since the rollout of ChatGPT and other AI-powered tools. Several US states have adopted

KEEPING UP: The acquisition of a cleanroom in Taiwan would enable Micron to increase production in a market where demand continues to outpace supply, a Micron official said Micron Technology Inc has signed a letter of intent to buy a fabrication site in Taiwan from Powerchip Semiconductor Manufacturing Corp (力積電) for US$1.8 billion to expand its production of memory chips. Micron would take control of the P5 site in Miaoli County’s Tongluo Township (銅鑼) and plans to ramp up DRAM production in phases after the transaction closes in the second quarter, the company said in a statement on Saturday. The acquisition includes an existing 12 inch fab cleanroom of 27,871m2 and would further position Micron to address growing global demand for memory solutions, the company said. Micron expects the transaction to

A proposed billionaires’ tax in California has ignited a political uproar in Silicon Valley, with tech titans threatening to leave the state while California Governor Gavin Newsom of the Democratic Party maneuvers to defeat a levy that he fears would lead to an exodus of wealth. A technology mecca, California has more billionaires than any other US state — a few hundred, by some estimates. About half its personal income tax revenue, a financial backbone in the nearly US$350 billion budget, comes from the top 1 percent of earners. A large healthcare union is attempting to place a proposal before