The local semiconductor industry is expected to face earnings challenges in 2025 as profit growth is likely to peak this year, the Taipei-based China Credit Information Service Ltd (CCIS, 中華徵信所) said in a report on Tuesday last week.

Industry profit declines are to become more apparent in 2025 as the US, Europe, South Korea and Japan, which compete with Taiwan in the semiconductor industry, are scheduled to fulfill their expansion plans by that year as they strive for a higher share of the global semiconductor market, the report said.

Additionally, China is expected to reduce its dependence on Taiwan’s semiconductor exports, which would further affect local export earnings, it said.

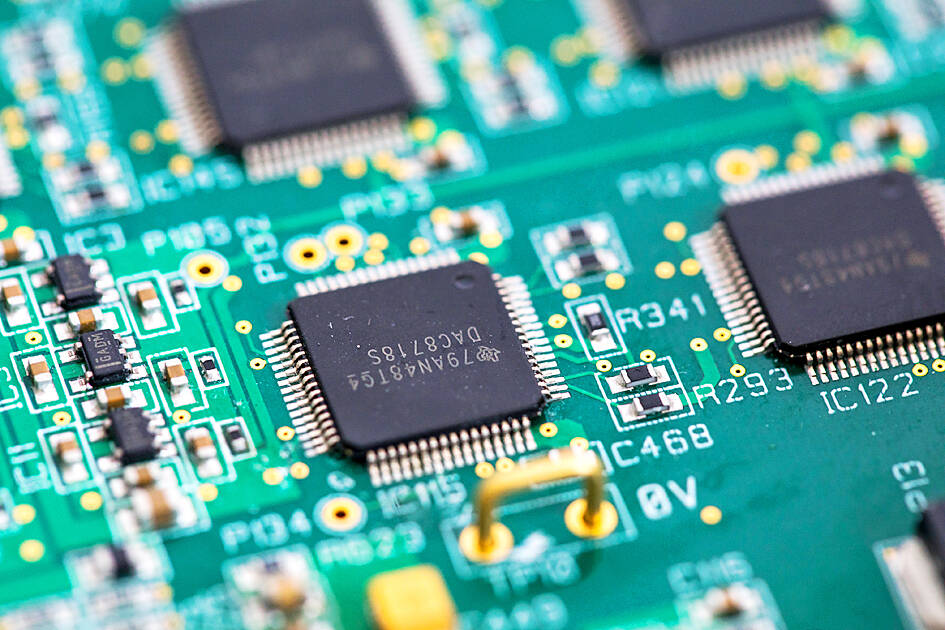

Photo: Bloomberg

As Taiwanese semiconductor firms incur higher investment costs in their overseas expansion, the industry is expected to see slowing profit growth, it added.

However, CCIS said that old economy industries — such as textile firms, electric equipment suppliers and machinery makers — performed better in the first half of this year, compared with the same period last year.

Taiwan’s technology sector is expected to benefit from the launch of the iPhone 14 and a booming global electric vehicle market in the second half of this year, it said.

The CCIS report showed that the local manufacturing sector posted its highest profit margins in 10 years last year, and the uptrend is expected to continue this year despite several uncertainties, including skyrocketing global inflation, a rate hike cycle launched by the US Federal Reserve, the war in Ukraine and an economic slowdown in China.

The local manufacturing sector’s gross margin rose to 12.4 percent last year from 10.2 percent in 2020, while its operating margin increased to 7.8 percent from 5.1 percent, the report said.

Net margin also rose to 11.3 percent from 8.0 percent in 2020, it added.

The optoelectronics and precision equipment industry last year had the highest gross margin at 30.9 percent, marking the fourth consecutive year it has finished on top, CCIS said.

The rubber and plastics, non-metal mineral, agriculture and food, and machinery industries took second to fifth place at 26.4 percent, 20.57 percent, 20.24 percent and 19.8 percent respectively, it said.

Sweeping policy changes under US Secretary of Health and Human Services Robert F. Kennedy Jr are having a chilling effect on vaccine makers as anti-vaccine rhetoric has turned into concrete changes in inoculation schedules and recommendations, investors and executives said. The administration of US President Donald Trump has in the past year upended vaccine recommendations, with the country last month ending its longstanding guidance that all children receive inoculations against flu, hepatitis A and other diseases. The unprecedented changes have led to diminished vaccine usage, hurt the investment case for some biotechs, and created a drag that would likely dent revenues and

Global semiconductor stocks advanced yesterday, as comments by Nvidia Corp chief executive officer Jensen Huang (黃仁勳) at Davos, Switzerland, helped reinforce investor enthusiasm for artificial intelligence (AI). Samsung Electronics Co gained as much as 5 percent to an all-time high, helping drive South Korea’s benchmark KOSPI above 5,000 for the first time. That came after the Philadelphia Semiconductor Index rose more than 3 percent to a fresh record on Wednesday, with a boost from Nvidia. The gains came amid broad risk-on trade after US President Donald Trump withdrew his threat of tariffs on some European nations over backing for Greenland. Huang further

CULPRITS: Factors that affected the slip included falling global crude oil prices, wait-and-see consumer attitudes due to US tariffs and a different Lunar New Year holiday schedule Taiwan’s retail sales ended a nine-year growth streak last year, slipping 0.2 percent from a year earlier as uncertainty over US tariff policies affected demand for durable goods, data released on Friday by the Ministry of Economic Affairs showed. Last year’s retail sales totaled NT$4.84 trillion (US$153.27 billion), down about NT$9.5 billion, or 0.2 percent, from 2024. Despite the decline, the figure was still the second-highest annual sales total on record. Ministry statistics department deputy head Chen Yu-fang (陳玉芳) said sales of cars, motorcycles and related products, which accounted for 17.4 percent of total retail rales last year, fell NT$68.1 billion, or

MediaTek Inc (聯發科) shares yesterday notched their best two-day rally on record, as investors flock to the Taiwanese chip designer on excitement over its tie-up with Google. The Taipei-listed stock jumped 8.59 percent, capping a two-session surge of 19 percent and closing at a fresh all-time high of NT$1,770. That extended a two-month rally on growing awareness of MediaTek’s work on Google’s tensor processing units (TPUs), which are chips used in artificial intelligence (AI) applications. It also highlights how fund managers faced with single-stock limits on their holding of market titan Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) are diversifying into other AI-related firms.