Permits for new office space construction totaled 612,000 ping (2 million square meters) in the first half of this year, up 91 percent from a year earlier, as demand for upscale offices remained strong, Shining Building Business Co (鄉林建設) said yesterday.

The growth, which occurred despite new policies unfavorable to building projects, could be attributed to companies that relocated operations from abroad, and to a lack of upscale office spaces in popular locations, the Taichung-based developer said.

In Taipei, permits for new office space construction reached 314,000 ping in the first six months, which not only expanded by 7.6 times from a year earlier, but outperformed new residential spaces whose combined areas total 251,000 ping, Shining Building said, citing government data.

It is the first time in 10 years that the areas of planned office spaces exceeded those of residential spaces, the company said, adding that developers had shifted their focus to commercial properties.

Strong demand for Grade A offices are behind the rise in Taipei’s prime districts, despite COVID-19 infections and economic uncertainty, it said.

Monthly rents in the Taipei 101 skyscraper climbed to more than NT$5,000 per ping and rose to more than NT$4,200 at the nearby Taipei Nan Shan Plaza office tower.

Vacancies hit record lows in the city’s Xinyi (信義), Daan (大安), Neihu (內湖) and Nangan (南港) districts, prompting potential tenants to look elsewhere in the city, it said.

Shining, which owns unsold mixed-use complexes in Shihlin District (士林) near the National Palace Museum, said that inquiries increased 30 percent recently.

The areas of residential spaces nationwide with building permits stagnated at 3.64 million ping, while that of warehousing and logistics facilities grew to 1.35 million ping, Shining said.

Unfavorable lending and tax terms intended to curb property speculation should not affect urban renewal or industrial development projects, Shining Building said.

Taipei and Kaohsiung had seen permits for commercial and industrial projects nearly double, it added.

Taiwan’s exports soared 56 percent year-on-year to an all-time high of US$64.05 billion last month, propelled by surging global demand for artificial intelligence (AI), high-performance computing and cloud service infrastructure, the Ministry of Finance said yesterday. Department of Statistics Director-General Beatrice Tsai (蔡美娜) called the figure an unexpected upside surprise, citing a wave of technology orders from overseas customers alongside the usual year-end shopping season for technology products. Growth is likely to remain strong this month, she said, projecting a 40 percent to 45 percent expansion on an annual basis. The outperformance could prompt the Directorate-General of Budget, Accounting and

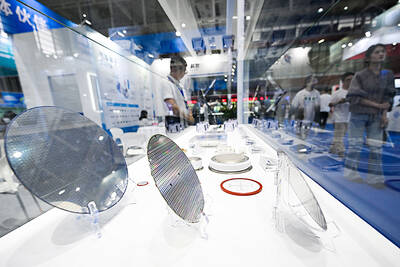

Two Chinese chipmakers are attracting strong retail investor demand, buoyed by industry peer Moore Threads Technology Co’s (摩爾線程) stellar debut. The retail portion of MetaX Integrated Circuits (Shanghai) Co’s (上海沐曦) upcoming initial public offering (IPO) was 2,986 times oversubscribed on Friday, according to a filing. Meanwhile, Beijing Onmicro Electronics Co (北京昂瑞微), which makes radio frequency chips, was 2,899 times oversubscribed on Friday, its filing showed. The bids coincided with Moore Threads’ trading debut, which surged 425 percent on Friday after raising 8 billion yuan (US$1.13 billion) on bets that the company could emerge as a viable local competitor to Nvidia

BARRIERS: Gudeng’s chairman said it was unlikely that the US could replicate Taiwan’s science parks in Arizona, given its strict immigration policies and cultural differences Gudeng Precision Industrial Co (家登), which supplies wafer pods to the world’s major semiconductor firms, yesterday said it is in no rush to set up production in the US due to high costs. The company supplies its customers through a warehouse in Arizona jointly operated by TSS Holdings Ltd (德鑫控股), a joint holding of Gudeng and 17 Taiwanese firms in the semiconductor supply chain, including specialty plastic compounds producer Nytex Composites Co (耐特) and automated material handling system supplier Symtek Automation Asia Co (迅得). While the company has long been exploring the feasibility of setting up production in the US to address

OPTION: Uber said it could provide higher pay for batch trips, if incentives for batching is not removed entirely, as the latter would force it to pass on the costs to consumers Uber Technologies Inc yesterday warned that proposed restrictions on batching orders and minimum wages could prompt a NT$20 delivery fee increase in Taiwan, as lower efficiency would drive up costs. Uber CEO Dara Khosrowshahi made the remarks yesterday during his visit to Taiwan. He is on a multileg trip to the region, which includes stops in South Korea and Japan. His visit coincided the release last month of the Ministry of Labor’s draft bill on the delivery sector, which aims to safeguard delivery workers’ rights and improve their welfare. The ministry set the minimum pay for local food delivery drivers at