Chip sales are set to cool more than previously expected as the global economy struggles under the weight of rapid interest rate increases and rising geopolitical risks, fueling fears of a recession.

World Semiconductor Trade Statistics (WSTS), a non-profit body that tracks shipments, lowered its market outlook to 13.9 percent growth this year from 16.3 percent. For next year, it sees chip sales rising just 4.6 percent, the weakest pace since 2019.

The market is still expected to surpass US$600 billion this year, WSTS forecast. Next year’s forecast growth would be the weakest since a 12 percent drop in sales at the height of the US-China trade dispute.

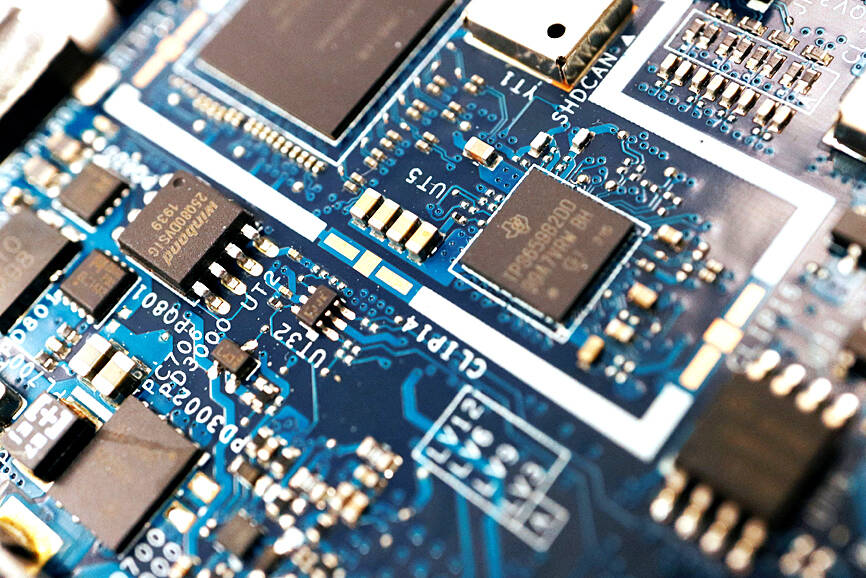

Photo: Reuters

Chip sales are an important indicator of global economic activity as households and firms increasingly rely on digital devices and online services to consume and expand.

US President Joe Biden this month signed the so-called CHIPS and Science Act aimed at strengthening the US semiconductor industry as China races to expand its own chipmaking capacity.

Japan is likely to see the strongest sales growth at 5 percent next year, followed by the Americas at 4.8 percent and the Asia-Pacific region at 4.7 percent, WSTS said. Europe, where Russia’s invasion of Ukraine is reverberating across the continent’s economy, is likely to post an expansion of just 3.2 percent.

Based in Morgan Hill, California, WSTS includes among its members Texas Instruments Inc, Samsung Electronics Co, Sony Semiconductor Solutions Corp and Yangzhou Yangjie Electronic Technology Co (揚州揚傑電子科技), according to its Web site.

Separately, US-based market information advisory firm IC Insights yesterday said it has adjusted its global semiconductor capital expenditure forecast this year to grow 21 percent year-on-year to US$185.5 billion, compared with the previous estimate of a 24 percent increase to US$190.4 billion it made at the beginning of the year.

The downward adjustment came as the semiconductor industry faces soaring inflation and a rapidly decelerating worldwide economy, causing many semiconductor manufacturers to re-evaluate their aggressive expansion plans, IC Insights said in a press release.

“Several (but not all) suppliers — particularly many leading DRAM and flash memory manufacturers — have already announced reductions in their capex [capital expenditure] budgets for this year,” it said. “Many more suppliers have noted that capital spending cuts are expected in 2023 as the industry digests three years of robust spending and evaluates capacity needs in the face of slowing economic growth.”

Despite the downward adjustment, the revised capital expenditure forecast for this year still represents a new record high and would mark the first three-year period of double-digit gains in the semiconductor industry since 1993 to 1995, IC Insights said.

Additional reporting by Chen Cheng-hui

NEW IDENTITY: Known for its software, India has expanded into hardware, with its semiconductor industry growing from US$38bn in 2023 to US$45bn to US$50bn India on Saturday inaugurated its first semiconductor assembly and test facility, a milestone in the government’s push to reduce dependence on foreign chipmakers and stake a claim in a sector dominated by China. Indian Prime Minister Narendra Modi opened US firm Micron Technology Inc’s semiconductor assembly, test and packaging unit in his home state of Gujarat, hailing the “dawn of a new era” for India’s technology ambitions. “When young Indians look back in the future, they will see this decade as the turning point in our tech future,” Modi told the event, which was broadcast on his YouTube channel. The plant would convert

Nanya Technology Corp (南亞科技) yesterday said the DRAM supply crunch could extend through 2028, as the artificial intelligence (AI) boom has led the world’s major memory makers to dramatically reduce production of standard DRAM and allocate a significant portion of their capacity for high-bandwidth memory (HBM) chips. The most severe supply constraints would stretch to the first half of next year due to “very limited” increases in new DRAM capacity worldwide, Nanya Technology president Lee Pei-ing (李培瑛) told a news briefing. The company plans to increase monthly 12-inch wafer capacity to 20,000 in the first half of 2028 after a

Property transactions in the nation’s six special municipalities plunged last month, as a lengthy Lunar New Year holiday combined with ongoing credit tightening dampened housing market activity, data compiled by local land administration offices released on Monday showed. The six cities recorded a total of 10,480 property transfers last month, down 42.5 percent from January and marking the second-lowest monthly level on record, the data showed. “The sharp drop largely reflected seasonal factors and tighter credit conditions,” Evertrust Rehouse Co (永慶房屋) deputy research manager Chen Chin-ping (陳金萍) said. The nine-day Lunar New Year holiday fell in February this year, reducing

New vehicle sales in Taiwan plunged about 37 percent sequentially last month as the long Lunar New Year holiday and 228 Peace Memorial Day holiday cut short the number of working days, along with the lingering uncertainty over import tax cuts on US vehicles, market researcher U-Car said in a report yesterday. New car sales last month totaled 22,043, slumping from 35,073 units in January and down 19.89 percent from 37,515 in February last year, U-Car data showed. Sales of imported luxury cars, led by Mercedes-Benz, plummeted about 45 percent to 3,109 units last month from 5,663 units in the previous month,