The industrial production index last month expanded 1.12 percent year-on-year to 135.9, mainly driven by strong chips demand from the world’s major smartphone vendors and rising adoption of emerging technologies, the Ministry of Economic Affairs said yesterday.

Last month's increase represented the 30th consecutive month of annual rise, the ministry said. On a monthly basis, the index edged up 0.08 percent, it said.

The manufacturing production index, a major contributor to industrial production, expanded 1.03 percent from a year earlier to 136.88, but the index contracted 0.49 percent month-on-month due to depressed demand for petrochemicals, base metals and machine tools, offsetting growth in chips and high-end computers, the ministry said.

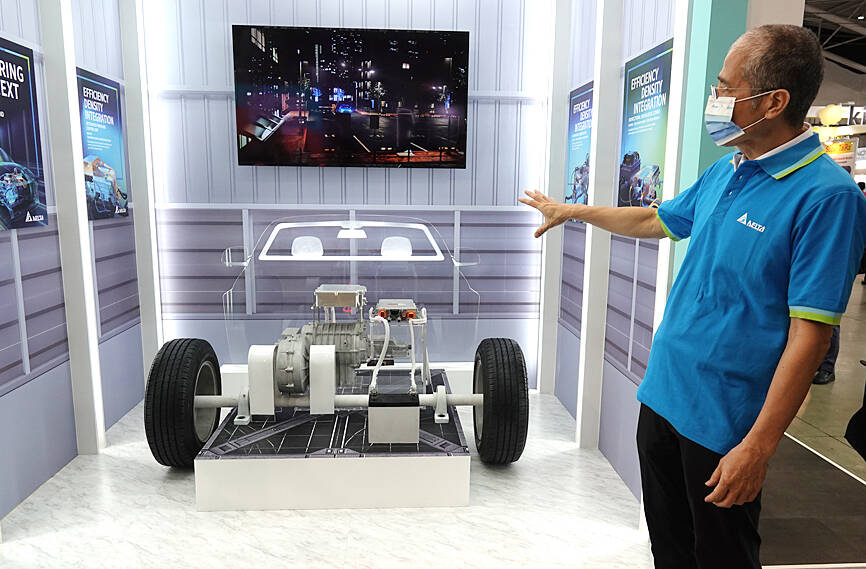

Photo: CNA

The ministry is cautious about the prospects of the manufacturing industry in the remainder of this year, if the macroeconomic environment does not improve and soaring inflation continues harming demand.

As a result, the manufacturing production index might dip 0.5 percent year-on-year to 137.4 this month in the worst-case scenario, dragged by persistent weakness in traditional industries, or rise 2.4 percent at best, the ministry said.

“We are still looking at positive growth in August,” Department of Statistics Deputy Director-General Huang Wei-jie (黃偉傑) said by telephone. “Traditional industries are expected to report further declines this month as rising inflation continues putting pressure on demand.”

On the positive side, inventory buildup demand for semiconductors and electronics is rising ahead of new launches by global brands, the ministry said.

For the third quarter, the manufacturing production index is expected to be flat or to grow by a single-digit percentage, Huang said.

The downside risk is higher next quarter, due to a higher comparison base in the fourth quarter last year when demand for local goods jumped after the US, China and European countries reopened their economies after the COVID-19 pandemic stabilized, he said.

Production of electronic components last month rose 0.64 percent month-on-month, or 9.26 percent year-on-year, supported by the semiconductor sub-index, which increased 1.35 percent month-on-month and 21.89 percent year-on-year.

The growth was fueled by robust demand for chips for automobiles and high-performance computing devices, such as servers and networking applications.

Displays and related products slumped 7.92 percent month-on-month and 41.92 percent year-on-year due to weak TV and tablet sales.

The production of computers and optical products slid 0.54 percent month-on-month, but rose 12.2 percent year-on-year.

The growth was driven by higher demand for data centers and high-end notebook computers, the ministry said, adding that local manufacturers are expanding capacity in response to rising demand.

Production in the petrochemicals sector last month shrank 6.53 percent month-on-month and 18.36 percent year-on-year, as customers became conservative about placing orders after entering an inventory digestion cycle.

To cope with falling demand, local manufacturers shut down some facilities for annual maintenance.

The production of basic metals dropped 8.23 percent month-on-month and 19.55 percent year-on-year due to sluggish demand for steel as customers had excessive inventories.

Production in the machinery sector fell 3.86 percent month-on-month and 6.71 percent year-on-year as customers were cautious about investing in new manufacturing equipment due to the slowing global economy, but increased demand from semiconductor companies helped cushion the negative effects.

The production of vehicles and auto components increased 7.23 percent month-on-month and 7.16 percent year-on-year due to annual promotions during Ghost Month and easing component shortages.

SEMICONDUCTORS: The German laser and plasma generator company will expand its local services as its specialized offerings support Taiwan’s semiconductor industries Trumpf SE + Co KG, a global leader in supplying laser technology and plasma generators used in chip production, is expanding its investments in Taiwan in an effort to deeply integrate into the global semiconductor supply chain in the pursuit of growth. The company, headquartered in Ditzingen, Germany, has invested significantly in a newly inaugurated regional technical center for plasma generators in Taoyuan, its latest expansion in Taiwan after being engaged in various industries for more than 25 years. The center, the first of its kind Trumpf built outside Germany, aims to serve customers from Taiwan, Japan, Southeast Asia and South Korea,

Gasoline and diesel prices at domestic fuel stations are to fall NT$0.2 per liter this week, down for a second consecutive week, CPC Corp, Taiwan (台灣中油) and Formosa Petrochemical Corp (台塑石化) announced yesterday. Effective today, gasoline prices at CPC and Formosa stations are to drop to NT$26.4, NT$27.9 and NT$29.9 per liter for 92, 95 and 98-octane unleaded gasoline respectively, the companies said in separate statements. The price of premium diesel is to fall to NT$24.8 per liter at CPC stations and NT$24.6 at Formosa pumps, they said. The price adjustments came even as international crude oil prices rose last week, as traders

SIZE MATTERS: TSMC started phasing out 8-inch wafer production last year, while Samsung is more aggressively retiring 8-inch capacity, TrendForce said Chipmakers are expected to raise prices of 8-inch wafers by up to 20 percent this year on concern over supply constraints as major contract chipmakers Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) and Samsung Electronics Co gradually retire less advanced wafer capacity, TrendForce Corp (集邦科技) said yesterday. It is the first significant across-the-board price hike since a global semiconductor correction in 2023, the Taipei-based market researcher said in a report. Global 8-inch wafer capacity slid 0.3 percent year-on-year last year, although 8-inch wafer prices still hovered at relatively stable levels throughout the year, TrendForce said. The downward trend is expected to continue this year,

Taiwan Semiconductor Manufacturing Co (TSMC, 台積電), which supplies advanced chips to Nvidia Corp and Apple Inc, yesterday reported NT$1.046 trillion (US$33.1 billion) in revenue for last quarter, driven by constantly strong demand for artificial intelligence (AI) chips, falling in the upper end of its forecast. Based on TSMC’s financial guidance, revenue would expand about 22 percent sequentially to the range from US$32.2 billion to US$33.4 billion during the final quarter of 2024, it told investors in October last year. Last year in total, revenue jumped 31.61 percent to NT$3.81 trillion, compared with NT$2.89 trillion generated in the year before, according to