The US is tightening restrictions on China’s access to chipmaking gear, two major equipment suppliers have said, underscoring Washington’s accelerating efforts to curb Beijing’s economic ambitions.

Washington had banned the sale of most gear that can fabricate chips of 10 nanometers or better to Chinese firm Semiconductor Manufacturing International Corp (SMIC, 中芯國際) without a license.

Now it has expanded that barrier to equipment that can make anything more advanced than 14 nanometers, Lam Research Corp chief executive officer Tim Archer told analysts.

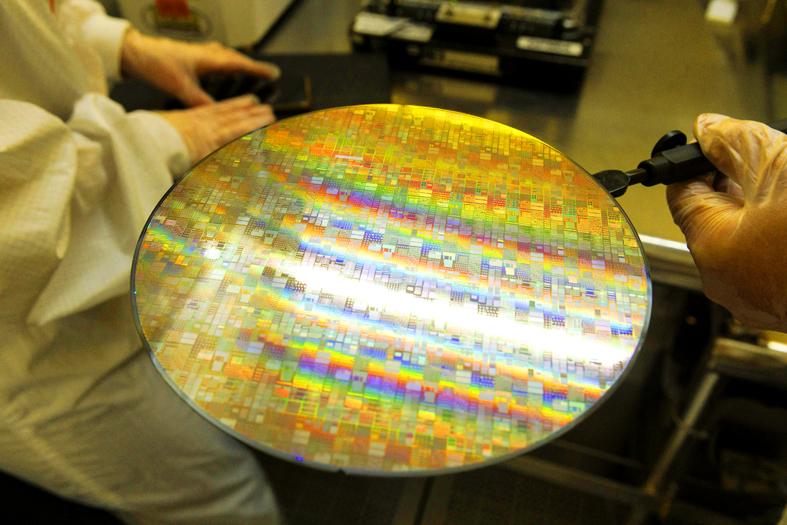

Photo: Bloomberg

The moratorium likely extends beyond SMIC and includes other fabrication plants run by contract chipmakers operating in China, including those by Taiwan Semiconductor Manufacturing Co (TSMC, 台積電).

“We were recently notified that there was to be a broadening of the restrictions of technology shipments to China for fabs that are operating below 14 nanometers,” Archer said during a conference call on Wednesday. “That’s the change, I think, people have been thinking might be coming and we’re prepared to fully comply. We’re working with the US government.”

In chip manufacturing, production identified by lower numbers of nanometers is more advanced. That means raising the restriction level to 14 nanometers would cover a broader range of semiconductor equipment.

The US Department of Commerce said in a statement that the administration of US President Joe Biden is tightening policies aimed at the People’s Republic of China (PRC), without specifying the precise chip geometry.

“The Biden administration is focused on impairing PRC efforts to manufacture advanced semiconductors to address significant national security risks to the United States,” the agency said.

All US equipment makers have in the past few weeks received letters from the commerce department telling them not to supply gear to Chinese firms for manufacturing at 14 nanometers or below, people familiar with the matter said.

The letters are at least partly an effort by the Biden administration to look tough on China, but the department had already declined many licenses at 14 nanometers so the change would have little financial effects, they said.

The new requirements are targeted at foundries — facilities making logic chips for others — and exclude memory chips “to the best of our understanding,” Archer said.

Lam Research executives said they had incorporated the expected effects of the US requirements into their outlook for the third quarter of this year, without elaborating.

KLA Corp CEO Rick Wallace on Thursday confirmed that his company had been notified by the US government of the change in export licensing requirements on China-bound gear for chips more advanced than 14 nanometers.

Wallace said there was no material impact on KLA’s business.

The comments from the two California-based companies mark the first detailed confirmation that the Biden administration is ramping up attempts to contain China. The US is pushing partner countries such as the Netherlands and Japan to ban ASML Holding NV and Nikon Corp from selling mainstream technology essential in making a large chunk of the world’s chips to China.

The new rules cover a wider swath of semiconductors across a plethora of industries and possibly affect far more companies than standing restrictions targeted at SMIC. While the new curbs specifically cover equipment capable of making chips more advanced than 14 nanometers, mature chips could still be affected, as about 90 percent of gear is compatible from one generation to the next. Semiconductor manufacturers can reuse equipment as they migrate to more sophisticated nodes, meaning a ban on one generation could have longer-term ripple effects.

SMIC’s most sophisticated technology is 14 nanometers, while the best TSMC uses in China is 16 nanometers. Those are three generations behind the most cutting-edge technology TSMC uses in Taiwan.

The new rules are likely to affect SMIC, TSMC and any others with the ambition to build capacity for relatively advanced chips in China, as well as gear makers such as Applied Materials Inc, ASML and Tokyo Electron Ltd, which sell to the world’s largest chip market.

NEW IDENTITY: Known for its software, India has expanded into hardware, with its semiconductor industry growing from US$38bn in 2023 to US$45bn to US$50bn India on Saturday inaugurated its first semiconductor assembly and test facility, a milestone in the government’s push to reduce dependence on foreign chipmakers and stake a claim in a sector dominated by China. Indian Prime Minister Narendra Modi opened US firm Micron Technology Inc’s semiconductor assembly, test and packaging unit in his home state of Gujarat, hailing the “dawn of a new era” for India’s technology ambitions. “When young Indians look back in the future, they will see this decade as the turning point in our tech future,” Modi told the event, which was broadcast on his YouTube channel. The plant would convert

‘SEISMIC SHIFT’: The researcher forecast there would be about 1.1 billion mobile shipments this year, down from 1.26 billion the prior year and erasing years of gains The global smartphone market is expected to contract 12.9 percent this year due to the unprecedented memorychip shortage, marking “a crisis like no other,” researcher International Data Corp (IDC) said. The new forecast, a dramatic revision down from earlier estimates, gives the latest accounting of the ongoing memory crunch that is affecting every corner of the electronics industry. The demand for advanced memory to power artificial intelligence (AI) tasks has drained global supply until well into next year and jeopardizes the business model of many smartphone makers. IDC forecast about 1.1 billion mobile shipments this year, down from 1.26 billion the prior

People stand in a Pokemon store in Tokyo on Thursday. One of the world highest-grossing franchises is celebrated its 30th anniversary yesterday.

Zimbabwe’s ban on raw lithium exports is forcing Chinese miners to rethink their strategy, speeding up plans to process the metal locally instead of shipping it to China’s vast rechargeable battery industry. The country is Africa’s largest lithium producer and has one of the world’s largest reserves, according to the US Geological Survey (USGS). Zimbabwe already banned the export of lithium ore in 2022 and last year announced it would halt exports of lithium concentrates from January next year. However, on Wednesday it imposed the ban with immediate effect, leaving unclear what the lithium mining sector would do in the