MediaTek Inc (聯發科) yesterday lowered its annual revenue outlook, forecasting growth in the high teens amid rising macroeconomic uncertainties that it said would dampen handset demand and lead to swelling inventories, after it previously predicted 20 percent annual expansion.

The world’s biggest mobile phone chip supplier said it would review its previous forecast of 15 percent of compound annual growth over the next three years.

However, the Hsinchu-based company said gross margin would remain between 48 percent and 50 percent over that period, as estimated in April.

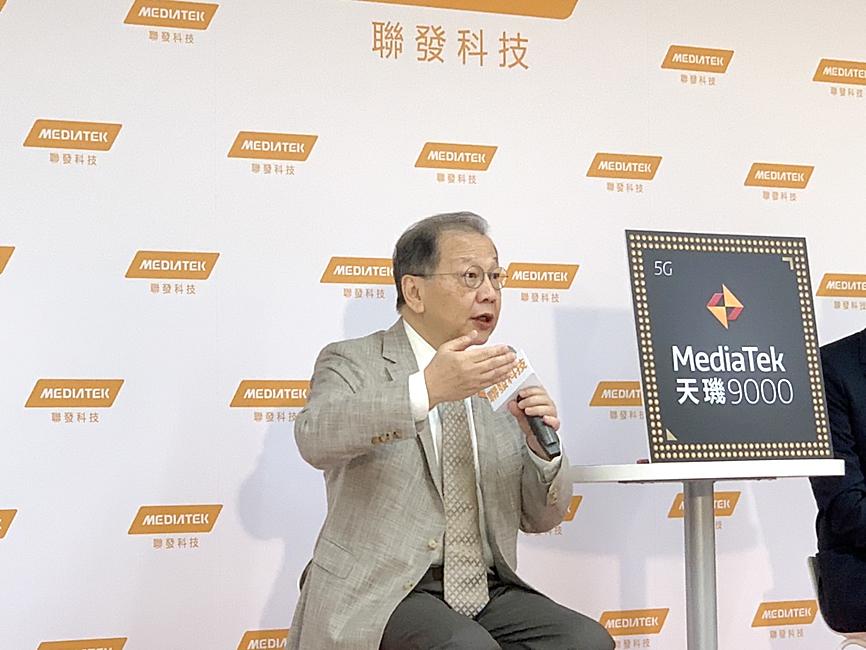

Photo: Vanessa Cho, Taipei Times

“We already observed that our customers and their distribution channels have started to adjust inventory aggressively, and we expect the inventory management to continue for two to three quarters,” MediaTek CEO Rick Tsai (蔡力行) told an investors’ teleconference.

The Chinese market, where MediaTek has substaintial exposures, is recovering gradually, while uncertainty about the US market remains high, Tsai said.

Even though customers’ demand is shrinking, the company would not cut prices to stimulate demand, he said.

MediaTek also slashed its forecast for global 5G smartphone chip shipments to 600 million units this year. It was the second downward revision of the year, after it earlier forecast that 600 million to 680 million units would be shipped.

The firm’s latest estimate would result in 20 percent year-on-year growth of 5G smartphone chip shipments, rather than a 30 percent growth estimated before.

To cope with the macroeconomic and industrial headwinds, MediaTek is slowing new hiring as one of its broader efforts to prudently manage its operating expenses, cost and inventory, it said.

The chipmaker expects revenue this quarter to decline between 1 and 9 percent, coming in at NT$141.7 billion to NT$154.2 billion (US$4.73 billion to US$5.15 billion).

On an annual basis, revenue would grow between 8 and 18 percent, it said.

Gross margin would be 47.5 to 50.5 percent this quarter, the firm said, after it last quarter saw gross margin drop to 49.3 percent from 50.3 percent in the first quarter.

In response to an investor’s question about the newly formed foundry cooperation with Intel Corp, MediaTek said the deal mainly aims to secure sufficient mature 22-nanometer process node capacity, given the persistent supply constraint of the technology worldwide.

MediaTek said it would also maintain its close foundry partnership with Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) in advanced technologies.

However, MediaTek said it is planning to adopt Intel’s technology to make digital TV chips and less advanced WiFi chips.

The deal matches MediaTek’s long-standing policy of keeping multiple foundry sources, it said.

MediaTek reported a record-high quarterly net profit last quarter of NT$35.61 billion, surging 29 percent from a year earlier, and increasing 6.6 percent quarterly, or up from NT$27.59 billion in the second quarter of last year and NT$33.41 billion in the first quarter of this year.

Revenue jumped about 24 percent year-on-year and 9 percent quarterly, to NT$155.73 billion.

Mobile phone chips outpaced the rest of the chip businesses last quarter, attributable to robust demand for its flag-ship and high-end chips, it said.

Mobile phone chips accounted for 54 percent of the company’s overall revenue last quarter, it added.

NEW IDENTITY: Known for its software, India has expanded into hardware, with its semiconductor industry growing from US$38bn in 2023 to US$45bn to US$50bn India on Saturday inaugurated its first semiconductor assembly and test facility, a milestone in the government’s push to reduce dependence on foreign chipmakers and stake a claim in a sector dominated by China. Indian Prime Minister Narendra Modi opened US firm Micron Technology Inc’s semiconductor assembly, test and packaging unit in his home state of Gujarat, hailing the “dawn of a new era” for India’s technology ambitions. “When young Indians look back in the future, they will see this decade as the turning point in our tech future,” Modi told the event, which was broadcast on his YouTube channel. The plant would convert

‘SEISMIC SHIFT’: The researcher forecast there would be about 1.1 billion mobile shipments this year, down from 1.26 billion the prior year and erasing years of gains The global smartphone market is expected to contract 12.9 percent this year due to the unprecedented memorychip shortage, marking “a crisis like no other,” researcher International Data Corp (IDC) said. The new forecast, a dramatic revision down from earlier estimates, gives the latest accounting of the ongoing memory crunch that is affecting every corner of the electronics industry. The demand for advanced memory to power artificial intelligence (AI) tasks has drained global supply until well into next year and jeopardizes the business model of many smartphone makers. IDC forecast about 1.1 billion mobile shipments this year, down from 1.26 billion the prior

People stand in a Pokemon store in Tokyo on Thursday. One of the world highest-grossing franchises is celebrated its 30th anniversary yesterday.

Zimbabwe’s ban on raw lithium exports is forcing Chinese miners to rethink their strategy, speeding up plans to process the metal locally instead of shipping it to China’s vast rechargeable battery industry. The country is Africa’s largest lithium producer and has one of the world’s largest reserves, according to the US Geological Survey (USGS). Zimbabwe already banned the export of lithium ore in 2022 and last year announced it would halt exports of lithium concentrates from January next year. However, on Wednesday it imposed the ban with immediate effect, leaving unclear what the lithium mining sector would do in the