Hon Hai Precision Industry Co (鴻海精密) on Wednesday said it is deepening its partnerships with automotive chip supplier NXP Semiconductors NV to adopt more chips and technologies in its next generation of electric vehicle (EV) development.

Hon Hai said it has adopted NXP chips in its first electric sedan, dubbed Model C, and plans to use more chips in two new electric models to be unveiled in October.

Hon Hai said it would ramp up production of the Model C in Taiwan in the first half of next year.

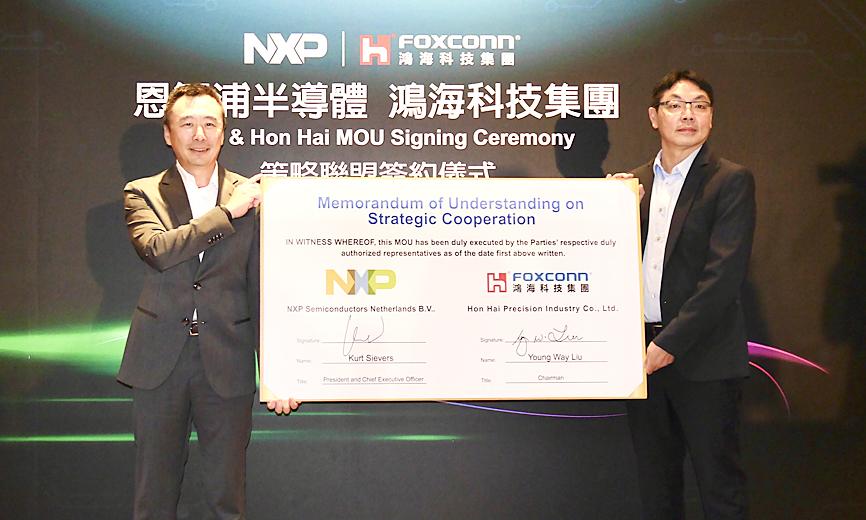

Photo: Fang Wei-jie, Taipei Times

Hon Hai’s EVs are developed by Foxtron Vehicles Technologies Co (鴻華先進), a joint venture between Hon Hai and Yulon Motor Co (裕隆汽車).

Hon Hai, the world’s largest iPhone maker, on Wednesday signed a memorandum of understanding with NXP Semiconductors to jointly develop platforms for a new generation of smart-connected vehicles.

The strategic partnership is to involve a broad suite of applications that includes more than 10 automotive products in its first stage, and is soon to begin development, the company said. That is different from NXP’s cooperation with Foxconn Industrial Internet Co Ltd (富士康工業互聯網) in developing smart cockpit solutions.

The collaboration between Hon Hai and NXP is also to include next-generation platforms such as cybersecurity, connectivity using the latest NXP S32 domain, and vehicle networking control, while also advancing secure car access with Bluetooth Low Energy and ultra-wideband, Hon Hai and NXP said in a joint statement.

NXP has also joined the MIH electric vehicle platform, an open platform initiated by Hon Hai.

Hon Hai aims to duplicate Taiwan’s success in the electronics sector in its efforts to build EVs, by swiftly integrating new technologies to introduce new hardware and other products, Hon Hai chief product officer Jerry Hsiao (蕭才祐) told reporters on the sidelines of a news conference in Taipei on Wednesday.

“The cooperation with NXP will allow us to engage in the development of new technologies and new solutions in the early stage of the collaboration, leading to shorter time-to-market,’ Hsiao said.

Such partnerships are crucial in developing next-generation vehicles, given that an open ecosystem significantly reduces manufacturing costs and shrinks time to market, he said.

That is different from conventional practice in the auto industry, where automakers operate their own closed supply chains, he added.

On Ireland’s blustery western seaboard, researchers are gleefully flying giant kites — not for fun, but in the hope of generating renewable electricity and sparking a “revolution” in wind energy. “We use a kite to capture the wind and a generator at the bottom of it that captures the power,” said Padraic Doherty of Kitepower, the Dutch firm behind the venture. At its test site in operation since September 2023 near the small town of Bangor Erris, the team transports the vast 60-square-meter kite from a hangar across the lunar-like bogland to a generator. The kite is then attached by a

Foxconn Technology Co (鴻準精密), a metal casing supplier owned by Hon Hai Precision Industry Co (鴻海精密), yesterday announced plans to invest US$1 billion in the US over the next decade as part of its business transformation strategy. The Apple Inc supplier said in a statement that its board approved the investment on Thursday, as part of a transformation strategy focused on precision mold development, smart manufacturing, robotics and advanced automation. The strategy would have a strong emphasis on artificial intelligence (AI), the company added. The company said it aims to build a flexible, intelligent production ecosystem to boost competitiveness and sustainability. Foxconn

Leading Taiwanese bicycle brands Giant Manufacturing Co (巨大機械) and Merida Industry Co (美利達工業) on Sunday said that they have adopted measures to mitigate the impact of the tariff policies of US President Donald Trump’s administration. The US announced at the beginning of this month that it would impose a 20 percent tariff on imported goods made in Taiwan, effective on Thursday last week. The tariff would be added to other pre-existing most-favored-nation duties and industry-specific trade remedy levy, which would bring the overall tariff on Taiwan-made bicycles to between 25.5 percent and 31 percent. However, Giant did not seem too perturbed by the

TARIFF CONCERNS: Semiconductor suppliers are tempering expectations for the traditionally strong third quarter, citing US tariff uncertainty and a stronger NT dollar Several Taiwanese semiconductor suppliers are taking a cautious view of the third quarter — typically a peak season for the industry — citing uncertainty over US tariffs and the stronger New Taiwan dollar. Smartphone chip designer MediaTek Inc (聯發科技) said that customers accelerated orders in the first half of the year to avoid potential tariffs threatened by US President Donald Trump’s administration. As a result, it anticipates weaker-than-usual peak-season demand in the third quarter. The US tariff plan, announced on April 2, initially proposed a 32 percent duty on Taiwanese goods. Its implementation was postponed by 90 days to July 9, then