The shares of major producers of Ajinomoto Build-up Film (ABF) substrate underperformed compared with the broader market last week, as investors expected a dimmer outlook for the industry in the second half of this year.

The continued narrowing of the gap between supply and demand is likely to slow manufacturers’ earnings later this year and next year, analysts said, adding that investors are closely watching the effects of rising electronic product inventory on the ABF substrate sector’s supply-and-demand dynamics.

“We expect ABF substrate suppliers to see gradually weakening earnings growth in the second half of 2022 and in 2023, given weak sales for some electronic products, along with assemblers’ record-high inventories,” Yuanta Securities Investment Consulting Co (元大投顧) analysts led by Hope Liu (劉思良) said in a note on Thursday.

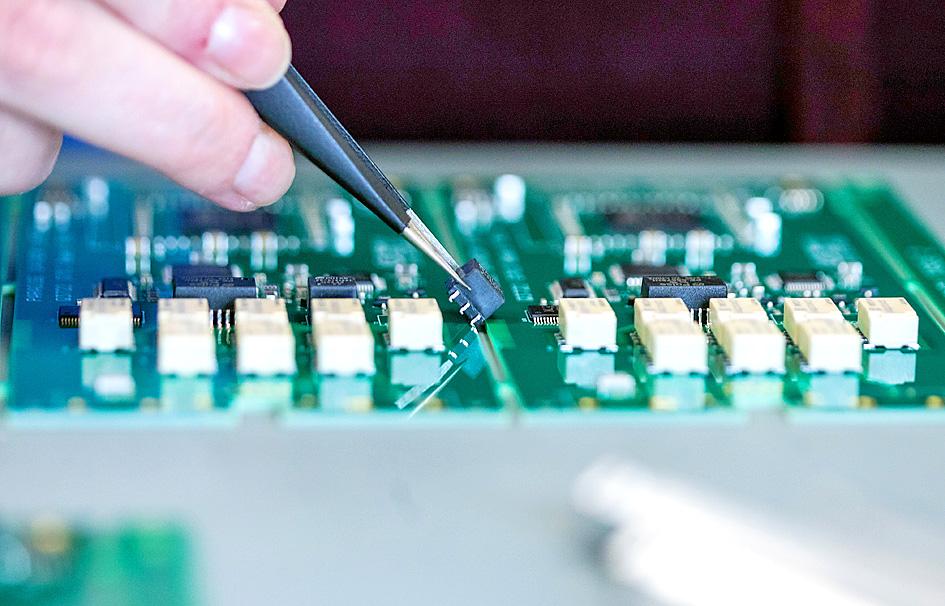

Photo: Bloomberg

Other negative factors also include “weakening consumption in various countries amid strong consumer price growth and [major Austrian supplier] AT&S’s 70 percent capacity expansion, scheduled for 2023,” they said.

Major ABF substrate makers in Taiwan include Unimicron Technology Corp (欣興電子), Nan Ya Printed Circuit Board Corp (南亞電路板) and Kinsus Interconnect Technology Corp (景碩科技).

Unimicron shares last week dropped 19.61 percent, while Kinsus fell 11.9 percent and Nan Ya PCB retreated by 13.42 percent, compared with the TAIEX’s 4.97 percent decline.

Yuanta analysts said that Unimicron began high-end substrate production at its Yangmei plant in Taoyuan this quarter, which is expected to increase its capacity by 20 to 30 percent from last year, while Kinsus began machine installation at its new plant in Yangmei, as it aims to expand its capacity by 40 to 50 percent this year.

Nan Ya PCB also expects capacity expansion of 20 to 30 percent this year, driven by mass production at its Jinxing plant in Taoyuan, in addition to the ramping up its Shulin plant in New Taipei City and its Kunshan plant in China, they said.

Increased output by global semiconductor companies against weak PC chip sales and the easing of networking chip shortages, as well as rising inventory at Taiwanese electronics assemblers, would pose concerns for ABF substrate producers in the second half of the year, the note said.

Yuanta estimates that PC chip applications account for 50 to 55 percent of ABF substrate demand, and an anticipated PC sales decline of 8 percent this year would be the key uncertainty in supply and demand for ABF substrate producers.

“We forecast ABF substrate demand growth to drop to 14 percent this year versus an annual growth of 20 percent in 2021, before recovering to 22 percent in 2023,” Yuanta analysts said.

“With AT&S dominating 14 percent of the market and its 70 percent capacity expansion scheduled for 2023, coupled with continued capacity expansion from various suppliers, we expect ABF substrate makers to see a narrowing supply-demand gap in the medium term,” they added.

Taiwan Semiconductor Manufacturing Co (TSMC, 台積電), the world’s biggest contract chipmaker, booked its first-ever profit from its Arizona subsidiary in the first half of this year, four years after operations began, a company financial statement showed. Wholly owned by TSMC, the Arizona unit contributed NT$4.52 billion (US$150.1 million) in net profit, compared with a loss of NT$4.34 billion a year earlier, the statement showed. The company attributed the turnaround to strong market demand and high factory utilization. The Arizona unit counts Apple Inc, Nvidia Corp and Advanced Micro Devices Inc among its major customers. The firm’s first fab in Arizona began high-volume production

VOTE OF CONFIDENCE: The Japanese company is adding Intel to an investment portfolio that includes artificial intelligence linchpins Nvidia Corp and TSMC Softbank Group Corp agreed to buy US$2 billion of Intel Corp stock, a surprise deal to shore up a struggling US name while boosting its own chip ambitions. The Japanese company, which is adding Intel to an investment portfolio that includes artificial intelligence (AI) linchpins Nvidia Corp and Taiwan Semiconductor Manufacturing Co (TSMC, 台積電), is to pay US$23 a share — a small discount to Intel’s last close. Shares of the US chipmaker, which would issue new stock to Softbank, surged more than 5 percent in after-hours trading. Softbank’s stock fell as much as 5.4 percent on Tuesday in Tokyo, its

COLLABORATION: Softbank would supply manufacturing gear to the factory, and a joint venture would make AI data center equipment, Young Liu said Hon Hai Precision Industry Co (鴻海精密) would operate a US factory owned by Softbank Group Corp, setting up what is in the running to be the first manufacturing site in the Japanese company’s US$500 billion Stargate venture with OpenAI and Oracle Corp. Softbank is acquiring Hon Hai’s electric-vehicle plant in Ohio, but the Taiwanese company would continue to run the complex after turning it into an artificial intelligence (AI) server production plant, Hon Hai chairman Young Liu (劉揚偉) said yesterday. Softbank would supply manufacturing gear to the factory, and a joint venture between the two companies would make AI data

The Taiwan Automation Intelligence and Robot Show, which is to be held from Wednesday to Saturday at the Taipei Nangang Exhibition Center, would showcase the latest in artificial intelligence (AI)-driven robotics and automation technologies, the organizer said yesterday. The event would highlight applications in smart manufacturing, as well as information and communications technology, the Taiwan Automation Intelligence and Robotics Association said. More than 1,000 companies are to display innovations in semiconductors, electromechanics, industrial automation and intelligent manufacturing, it said in a news release. Visitors can explore automated guided vehicles, 3D machine vision systems and AI-powered applications at the show, along