Shares of Gold Circuit Electronics Ltd (金像電子), a supplier of printed circuit boards (PCBs) for notebook computers, rose 14.55 percent last week, closing at their highest level in 22 years on Friday, buoyed by investors’ optimism about the company’s revenue and earnings outlook for this year.

The company, which also produces PCBs for high-density interconnect, networking and server-related products, reported that consolidated revenue last month increased 20.1 percent month-on-month and 37.5 percent year-on-year to NT$3.06 billion (US$103.43 million), a record high for the company, Gold Circuit said in a regulatory filing on Wednesday.

Fubon Securities Investment Services Co (富邦投顧) attributed last month’s revenue growth to some deferred shipments from March and April, strong demand for servers, continued pull-in orders from customers, the New Taiwan dollar’s depreciation against the US dollar and an increase in average selling prices, it said in a research note on Thursday.

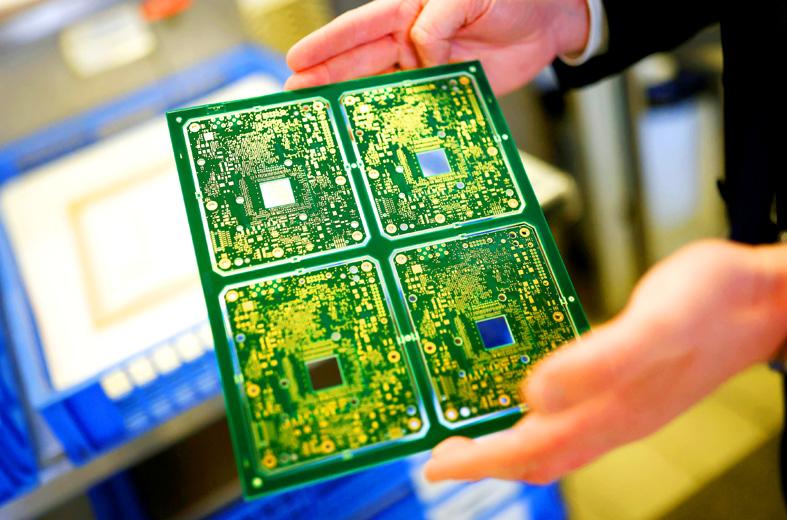

Photo: Reuters

Combined revenue in the first five months of the year rose 26.47 percent from a year earlier to NT$12.82 billion, company data showed.

“Given better-than-expected sales in May, the continued demand from customers and the value of the NT dollar at about NT$29.5 versus the US dollar, the company’s June revenue is expected to stay at a high level,” Fubon said.

“We have raised the second-quarter revenue forecast to NT$8.496 billion, a 17.3 percent increase quarter-on-quarter, which is better than our previous estimate of a quarterly increase of 7.3 percent,” it said.

Gold Circuit shares rose 9.94 percent on Friday to close at NT$92.9, the highest since June 1999, Taiwan Stock Exchange data showed. So far this year, they have advanced 22.24 percent, outperforming the TAIEX, which dropped 9.65 percent over the same period, exchange data showed.

Thanks to robust order momentum, the company has expanded capacity by 10 to 15 percent in the first half of this year, compared with its previous estimate of a 5 to 10 percent expansion for this year as a whole.

Given its order visibility extending through the fourth quarter of this year, the company is expected to perform better in the second half of the year, with revenue increasing sequentially, Fubon said.

Gold Circuit is also forecast to expand substantial gross margin this quarter from 23.02 percent in the first quarter, and the margin improvement is expected to continue through the second half of the year, helped by capacity enlargement via debottlenecking, a better product mix and the depreciation of the NT dollar and Chinese yuan against the US dollar, Fubon said.

The company posted net profit of NT$810.84 million in the first quarter, up 36.27 percent from NT$595.02 million a year earlier, with earnings per share (EPS) of NT$1.5.

The company’s EPS for last year stood at NT$5.41, the highest since 1997, when it generated NT$6.09 in EPS, and the figure could grow to NT$8.14 this year and NT$9.84 next year, Fubon’s forecast showed.

The US dollar was trading at NT$29.7 at 10am today on the Taipei Foreign Exchange, as the New Taiwan dollar gained NT$1.364 from the previous close last week. The NT dollar continued to rise today, after surging 3.07 percent on Friday. After opening at NT$30.91, the NT dollar gained more than NT$1 in just 15 minutes, briefly passing the NT$30 mark. Before the US Department of the Treasury's semi-annual currency report came out, expectations that the NT dollar would keep rising were already building. The NT dollar on Friday closed at NT$31.064, up by NT$0.953 — a 3.07 percent single-day gain. Today,

‘SHORT TERM’: The local currency would likely remain strong in the near term, driven by anticipated US trade pressure, capital inflows and expectations of a US Fed rate cut The US dollar is expected to fall below NT$30 in the near term, as traders anticipate increased pressure from Washington for Taiwan to allow the New Taiwan dollar to appreciate, Cathay United Bank (國泰世華銀行) chief economist Lin Chi-chao (林啟超) said. Following a sharp drop in the greenback against the NT dollar on Friday, Lin told the Central News Agency that the local currency is likely to remain strong in the short term, driven in part by market psychology surrounding anticipated US policy pressure. On Friday, the US dollar fell NT$0.953, or 3.07 percent, closing at NT$31.064 — its lowest level since Jan.

Hong Kong authorities ramped up sales of the local dollar as the greenback’s slide threatened the foreign-exchange peg. The Hong Kong Monetary Authority (HKMA) sold a record HK$60.5 billion (US$7.8 billion) of the city’s currency, according to an alert sent on its Bloomberg page yesterday in Asia, after it tested the upper end of its trading band. That added to the HK$56.1 billion of sales versus the greenback since Friday. The rapid intervention signals efforts from the city’s authorities to limit the local currency’s moves within its HK$7.75 to HK$7.85 per US dollar trading band. Heavy sales of the local dollar by

The Financial Supervisory Commission (FSC) yesterday met with some of the nation’s largest insurance companies as a skyrocketing New Taiwan dollar piles pressure on their hundreds of billions of dollars in US bond investments. The commission has asked some life insurance firms, among the biggest Asian holders of US debt, to discuss how the rapidly strengthening NT dollar has impacted their operations, people familiar with the matter said. The meeting took place as the NT dollar jumped as much as 5 percent yesterday, its biggest intraday gain in more than three decades. The local currency surged as exporters rushed to