MediaTek Inc (聯發科), the nation’s largest IC designer, became the world’s eighth-largest semiconductor supplier last year, a report from US-based market advisory firm IC Insights said.

MediaTek reported a more than 60 percent year-on-year increase in sales after posting US$17.7 billion in revenue last year, the report said.

IC Insights’ rankings excluded pure-play foundry operators such as Taiwan Semiconductor Manufacturing Co (TSMC, 台積電).

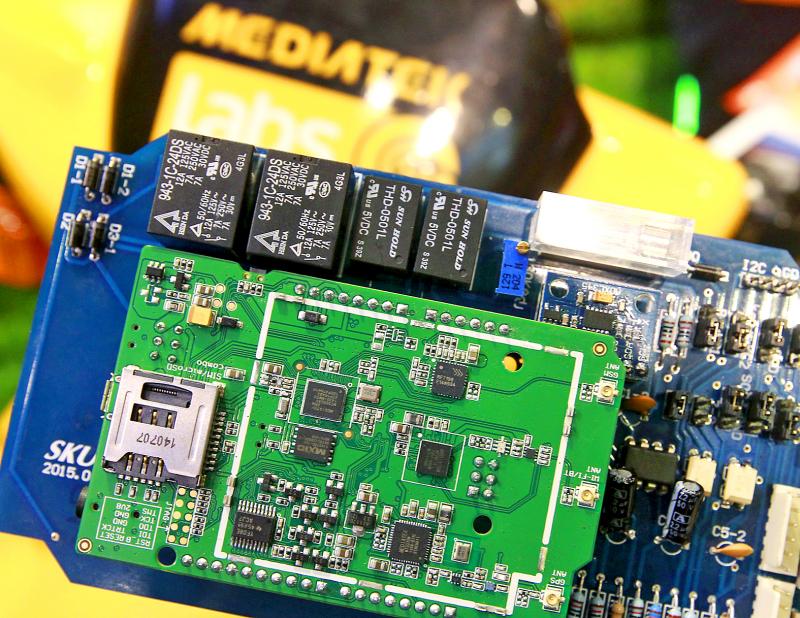

Photo: Pichi Chuang, Reuters

MediaTek and US-based Advanced Micro Devices Inc (AMD), which generated US$16.4 billion in sales and took the 10th spot, replaced Apple Inc and Germany’s Infineon Technologies AG among the top 10 semiconductor suppliers worldwide.

MediaTek and AMD held 2.9 percent and 2.7 percent market share respectively in the global semiconductor market, the report said.

South Korea’s Samsung Electronics Co held the top spot after generating US$82.0 billion of sales, ahead of US-based Intel Corp (US$76.7 billion), South Korea’s SK Hynix Inc (US$37.4 billion), Micron Technology Inc (US$30.0 billion), Qualcomm Inc (US$29.3 billion), Nvidia Corp (US$23.2 billion) and Broadcom Inc (US$21.0 billion).

Among the top 10 semiconductor suppliers, five were fabless IC companies — Qualcomm, Nvidia, Broadcom, MediaTek and AMD, the report said.

In MediaTek’s annual report, chairman Tsai Ming-kai (蔡明介) said that the company had worked with its pure wafer foundry partner to develop advanced processes, including 3D chipsets to support high-performance computing devices.

While Tsai did not name its partner, it is widely thought to be TSMC, as MediaTek is one of TSMC’s largest customers.

MediaTek last year posted revenue of NT$493.4 billion (US$16.74 billion) and earnings per share of NT$70.56.

Company data showed that MediaTek was the largest smartphone IC supplier in the world last year.

Tsai said he had faith that the firm’s strong cash flow and improving profitability would allow its shareholders to continue sharing the earnings of MediaTek.

MediaTek has proposed issuing a NT$73 cash dividend — NT$57 per share from its earnings and NT$16 per share from its surplus capital.

The NT$57 from its earnings represents about an 81 percent payout ratio and Tsai said that the company would continue to pay generous dividends to its shareholders.

Shareholders are to vote on the dividend proposal at MediaTek’s annual general meeting on May 31.

In Italy’s storied gold-making hubs, jewelers are reworking their designs to trim gold content as they race to blunt the effect of record prices and appeal to shoppers watching their budgets. Gold prices hit a record high on Thursday, surging near US$5,600 an ounce, more than double a year ago as geopolitical concerns and jitters over trade pushed investors toward the safe-haven asset. The rally is putting undue pressure on small artisans as they face mounting demands from customers, including international brands, to produce cheaper items, from signature pieces to wedding rings, according to interviews with four independent jewelers in Italy’s main

Japanese Prime Minister Sanae Takaichi has talked up the benefits of a weaker yen in a campaign speech, adopting a tone at odds with her finance ministry, which has refused to rule out any options to counter excessive foreign exchange volatility. Takaichi later softened her stance, saying she did not have a preference for the yen’s direction. “People say the weak yen is bad right now, but for export industries, it’s a major opportunity,” Takaichi said on Saturday at a rally for Liberal Democratic Party candidate Daishiro Yamagiwa in Kanagawa Prefecture ahead of a snap election on Sunday. “Whether it’s selling food or

CONCERNS: Tech companies investing in AI businesses that purchase their products have raised questions among investors that they are artificially propping up demand Nvidia Corp chief executive officer Jensen Huang (黃仁勳) on Saturday said that the company would be participating in OpenAI’s latest funding round, describing it as potentially “the largest investment we’ve ever made.” “We will invest a great deal of money,” Huang told reporters while visiting Taipei. “I believe in OpenAI. The work that they do is incredible. They’re one of the most consequential companies of our time.” Huang did not say exactly how much Nvidia might contribute, but described the investment as “huge.” “Let Sam announce how much he’s going to raise — it’s for him to decide,” Huang said, referring to OpenAI

Nvidia Corp’s negotiations to invest as much as US$100 billion in OpenAI have broken down, the Wall Street Journal (WSJ) reported, exposing a potential rift between two of the most powerful companies in the artificial intelligence (AI) industry. The discussions stalled after some inside Nvidia expressed concerns about the transaction, the WSJ reported, citing unidentified people familiar with the deliberations. OpenAI makes the popular chatbot ChatGPT, while Nvidia dominates the market for AI processors that help develop such software. The companies announced the agreement in September last year, saying at the time that they had signed a letter of intent for a strategic