The Reserve Bank of India (RBI) yesterday signaled a shift in policy focus, as it ramped up efforts to mop up excess liquidity in the banking system and raised its inflation forecasts, sending bond yields higher.

While the Indian central bank’s rate-setting panel decided to hold rates and keep its accommodative stance, it also voted unanimously to focus on “withdrawal of accommodation to ensure that inflation remains within the target going forward, while supporting growth.”

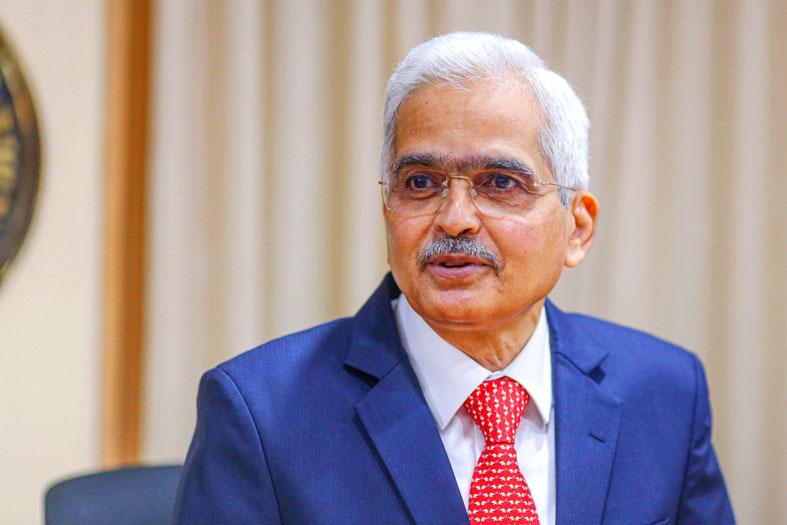

RBI Governor Shaktikanta Das also announced a new tool to enable the monetary authority to soak up excess cash in the banking system by narrowing the so-called interest rate corridor.

Photo: Bloomberg

The statement dropped a pledge to keep policy loose “as long as necessary” for the first time since late 2019. Combined with increased efforts to tighten liquidity, economists said it marked a hawkish shift in the policy outlook.

“The RBI has undertaken a normalization of the corridor effectively, and is preparing the ground for further normalization in coming months,” Barclays PLC economist Rahul Bajoria said.

India’s 10-year bond yield rose to 7 percent, the highest since 2019, as the RBI also raised its inflation and lowered its economic growth forecast.

“The Reserve Bank of India held its policy rate steady, but indicated it is now focused on withdrawing accommodation. Changes to its forward guidance dialed back its dovish tone,” Indian economist Abhishek Gupta said. It is “an incremental step toward tightening that we expect [until] early next year.”

A recovery in Asia’s third-

largest economy is facing fresh challenges from the war in Ukraine and COVID-19 lockdowns in China, which risk exacerbating a global supply squeeze and price pressures.

Das said the global economy is seeing “tectonic shifts” from the war, and extreme volatility in commodity and financial markets.

“Caught in the cross current of multiple headwinds, our approach needs to be cautious but proactive in mitigating the adverse impact on India’s growth, inflation and financial conditions,” Das said.

The decision comes as many central bank peers pivot toward tightening, led by the US Federal Reserve, which is expected to continue raising rates when it meets next month.

Policymakers globally have begun shifting their focus toward fighting inflation, as recoveries from the COVID-19 pandemic begin to take hold.

A key announcement in the policy statement was the introduction of a new tool to soak up excess liquidity. The so-called Standing Deposit Facility will absorb cash from banks at 3.75 percent, with the central bank not having to provide any collateral in exchange.

The new mechanism, which was first proposed in 2014, now forms the floor of the interest rate corridor, pushing up overnight rates without any direct tightening of policy. Earlier, the floor was the reverse repo rate, at 3.35 percent.

The RBI raised its inflation forecast to 5.7 percent for the fiscal year that started on Friday last week, up from 4.5 percent in February.

It also predicted GDP growth of 7.2 percent for this fiscal year, compared with its previous forecast of 7.8 percent.

The US dollar was trading at NT$29.7 at 10am today on the Taipei Foreign Exchange, as the New Taiwan dollar gained NT$1.364 from the previous close last week. The NT dollar continued to rise today, after surging 3.07 percent on Friday. After opening at NT$30.91, the NT dollar gained more than NT$1 in just 15 minutes, briefly passing the NT$30 mark. Before the US Department of the Treasury's semi-annual currency report came out, expectations that the NT dollar would keep rising were already building. The NT dollar on Friday closed at NT$31.064, up by NT$0.953 — a 3.07 percent single-day gain. Today,

‘SHORT TERM’: The local currency would likely remain strong in the near term, driven by anticipated US trade pressure, capital inflows and expectations of a US Fed rate cut The US dollar is expected to fall below NT$30 in the near term, as traders anticipate increased pressure from Washington for Taiwan to allow the New Taiwan dollar to appreciate, Cathay United Bank (國泰世華銀行) chief economist Lin Chi-chao (林啟超) said. Following a sharp drop in the greenback against the NT dollar on Friday, Lin told the Central News Agency that the local currency is likely to remain strong in the short term, driven in part by market psychology surrounding anticipated US policy pressure. On Friday, the US dollar fell NT$0.953, or 3.07 percent, closing at NT$31.064 — its lowest level since Jan.

Hong Kong authorities ramped up sales of the local dollar as the greenback’s slide threatened the foreign-exchange peg. The Hong Kong Monetary Authority (HKMA) sold a record HK$60.5 billion (US$7.8 billion) of the city’s currency, according to an alert sent on its Bloomberg page yesterday in Asia, after it tested the upper end of its trading band. That added to the HK$56.1 billion of sales versus the greenback since Friday. The rapid intervention signals efforts from the city’s authorities to limit the local currency’s moves within its HK$7.75 to HK$7.85 per US dollar trading band. Heavy sales of the local dollar by

The Financial Supervisory Commission (FSC) yesterday met with some of the nation’s largest insurance companies as a skyrocketing New Taiwan dollar piles pressure on their hundreds of billions of dollars in US bond investments. The commission has asked some life insurance firms, among the biggest Asian holders of US debt, to discuss how the rapidly strengthening NT dollar has impacted their operations, people familiar with the matter said. The meeting took place as the NT dollar jumped as much as 5 percent yesterday, its biggest intraday gain in more than three decades. The local currency surged as exporters rushed to