Shares advanced in most Asian markets on Friday after Wall Street extended a rally into a third day and oil prices pushed past US$105 per barrel.

Ukrainian President Volodymyr Zelenskiy called for more help for his country after days of bombardment of civilian sites in multiple cities over the past few days.

The war is among the uncertainties overhanging markets.

The TAIEX on Friday edged up 0.048 percent to close at 17,456.52 points, posting a weekly gain of 1.11 percent.

Wrapping up a two-day meeting, the Bank of Japan opted to keep its monetary policy unchanged, with its benchmark interest rate at minus-0.1 percent. Japan’s central bank has been keeping interest rates ultra-low and pumping tens of billions of US dollars into the world’s third-largest economy for years, trying to spur faster growth.

Tokyo’s benchmark Nikkei 225 on Friday gained 0.65 percent, or 174.54 points, to 26,827.43, advancing 6.6 percent on the week, while the broader TOPIX added 0.54 percent, or 10.26 points, to 1,909.27, surging 6.1 percent weekly.

Among major shares, Sony Group Corp rose 1.26 percent to 12,425 yen and Softbank Group Corp jumped 3.68 percent.

Uniqlo-operator Fast Retailing Co rose 0.5 percent.

Mitsubishi UFJ Financial Group emerged above water and ended 0.26 percent higher, while Nintendo Co gave up earlier gains and ended 0.02 percent lower.

Air carrier ANA Holdings Inc dropped 0.67 percent and Toyota Motor Corp fell 0.79 percent after the automaker announced a further reduction of production activities because of a COVID-19 pandemic-linked parts shortage.

In Sydney, the S&P/ASX 200 in Sydney rose 0.6 percent to 7,294.40, bringing its weekly gain to 3.3 percent.

Hong Kong’s Hang Seng Index retreated 0.4 percent to 21,412.40 points, paring its weekly gain to 4.2 percent.

The Shanghai Composite Index on Friday added 1 percent to 3,251.07, falling 1.8 percent weekly.

Big swings in markets have become the norm as investors struggle to handicap what will happen to the economy and the world’s already high inflation because of Russia’s invasion of Ukraine, higher interest rates from central banks around the world and renewed COVID-19 worries in various hotspots.

Additional reporting by staff writer

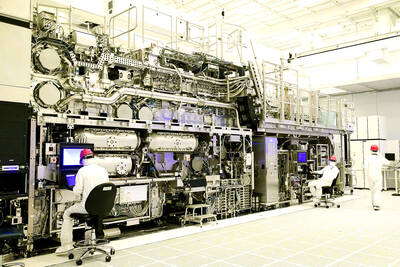

ASML Holding NV’s new advanced chip machines have a daunting price tag, said Taiwan Semiconductor Manufacturing Co (TSMC, 台積電), one of the Dutch company’s biggest clients. “The cost is very high,” TSMC senior vice president Kevin Zhang (張曉強) said at a technology symposium in Amsterdam on Tuesday, referring to ASML’s latest system known as high-NA extreme ultraviolet (EUV). “I like the high-NA EUV’s capability, but I don’t like the sticker price,” Zhang said. ASML’s new chip machine can imprint semiconductors with lines that are just 8 nanometers thick — 1.7 times smaller than the previous generation. The machines cost 350 million euros (US$378 million)

EXPLOSION: A driver who was transporting waste material from the site was hit by a blunt object after an uncontrolled pressure release and thrown 6m from the truck Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) said yesterday there was no damage to its facilities after an incident at its Arizona factory construction site where a waste disposal truck driver was transported to hospital. Firefighters responded to an explosion on Wednesday afternoon at the TSMC plant in Phoenix, the Arizona Republic reported, citing the local fire department. Cesar Anguiano-Guitron, 41, was transporting waste material from the project site and stopped to inspect the tank when he was made aware of a potential problem, a police report seen by Bloomberg News showed. Following an “uncontrolled pressure release,” he was hit by a blunt

Quanta Computer Inc (廣達), which makes servers and laptop computers on a contract basis, yesterday said it expects artificial intelligence (AI) devices to bring explosive growth to Taiwan’s electronics industry, as AI applications are starting to run on edge devices such as AI PCs. Taiwanese electronics manufacturers such as chipmakers, component suppliers and hardware assemblers are likely to benefit from a rapid uptake of AI applications, Mike Yang (楊麒令), president of Quanta Cloud Technology Inc (雲達科技), a server manufacturing arm of Quanta, told reporters on the sidelines of a technology forum in Taipei yesterday. “I believe the growth potential is promising once

‘WORST OVER’: A large portion of Hon Hai’s non-operating loss came from Sharp’s large flat-screen business, but Young Liu said the situation is expected to improve Hon Hai Precision Industry Co (鴻海精密), a major iPhone assembler, yesterday reported annual growth of 72 percent in net profit last quarter, due to a dramatic decrease in losses from Sharp Corp’s display business. Net profit surged to NT$22 billion (US$678.7 million) last quarter, from NT$12.83 billion a year earlier, as Hon Hai booked a non-operating loss of NT$4.24 billion, an improvement from NT$20.12 billion in the first quarter of last year. A major portion of its non-operating loss came from Sharp’s large flat-screen business Sakai Display Products Corp. On a quarterly basis, Hon Hai’s net profit sank 59 percent from NT$53.15