Tencent Holdings Ltd (騰訊) faces a record fine after China’s central bank discovered its WeChat Pay (微信支付) had contravened money laundering rules, the Wall Street Journal reported, citing people familiar with the matter.

The People’s Bank of China found Tencent’s payments platform had allowed the transfer of funds for illicit purposes such as gambling, the newspaper reported.

WeChat Pay was also judged non-compliant with other rules that required Tencent to identify users and merchants transacting on the platform, the Journal said.

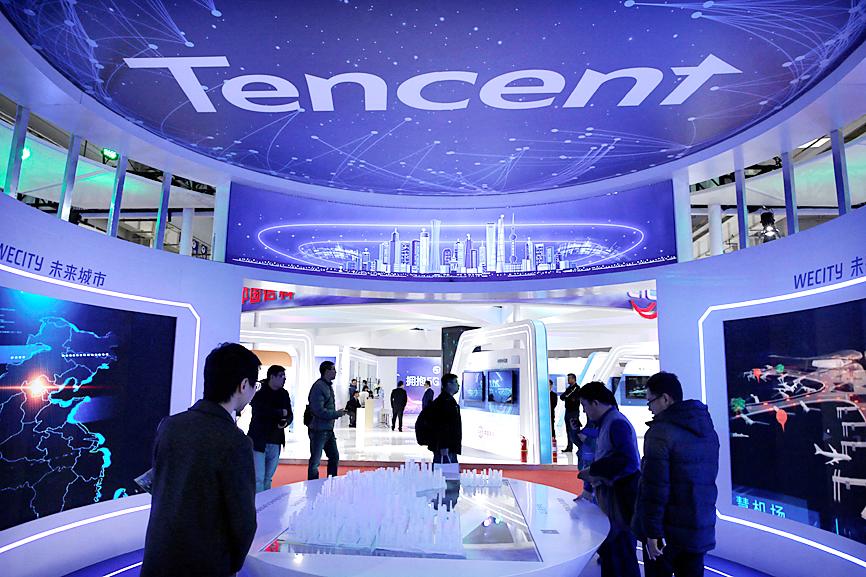

Photo: Reuters

A probe into potential money laundering would open a new front in Beijing’s sweeping crackdown on the Internet industry, an effort that has already wiped out hundreds of billions of dollars in arenas from ride-hailing and e-commerce to online education.

Tencent itself has thus far mostly escaped formal regulatory action. Unlike rivals Alibaba Group Holding Ltd (阿里巴巴) and Meituan (美團), the WeChat operator has not yet been the direct target of any government probe.

A Tencent spokesperson did not immediately respond to a request for comment.

Tencent’s investment arm could be affected as Chinese President Xi Jinping’s (習近平) administration grows wary of what it deems a “disorderly expansion of capital,” while WeChat has drawn scrutiny from regulators for building an enclosed Internet ecosystem that spans everything from e-commerce to short videos and online payments.

Last year, the country’s technology overseer told Internet firms to stop blocking rival services, prompting WeChat to start allowing external links to apps run by companies such as Alibaba and ByteDance Ltd (字節跳動).

Under recently established regulations, Tencent is required to restructure its fintech business under a financial holdings company much like Alibaba founder Jack Ma’s (馬雲) Ant Group Co (螞蟻集團).

However, the connection between WeChat Pay and the rest of Tencent’s finance division could make the separation — which executives have said would have a minimal effect on operations — more complicated.

Separately, Hong Kong stocks yesterday fell more than 5 percent, as technology firms were hit by concerns over China’s crackdown on the sector and as the country’s tech hub Shenzhen was put into lockdown.

The Hang Seng Index sank 4.97 percent, or 1,022.13 points, to 19,531.66, dropping below 20,000 points for the first time since mid-2016.

The Hang Seng Tech Index shed 11.03 percent, with market heavyweight Alibaba down 10.9 percent and Tencent 9.79 percent.

Additional reporting by AFP and staff writer

SEEKING CLARITY: Washington should not adopt measures that create uncertainties for ‘existing semiconductor investments,’ TSMC said referring to its US$165 billion in the US Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) told the US that any future tariffs on Taiwanese semiconductors could reduce demand for chips and derail its pledge to increase its investment in Arizona. “New import restrictions could jeopardize current US leadership in the competitive technology industry and create uncertainties for many committed semiconductor capital projects in the US, including TSMC Arizona’s significant investment plan in Phoenix,” the chipmaker wrote in a letter to the US Department of Commerce. TSMC issued the warning in response to a solicitation for comments by the department on a possible tariff on semiconductor imports by US President Donald Trump’s

‘FAILED EXPORT CONTROLS’: Jensen Huang said that Washington should maximize the speed of AI diffusion, because not doing so would give competitors an advantage Nvidia Corp cofounder and chief executive officer Jensen Huang (黃仁勳) yesterday criticized the US government’s restrictions on exports of artificial intelligence (AI) chips to China, saying that the policy was a failure and would only spur China to accelerate AI development. The export controls gave China the spirit, motivation and government support to accelerate AI development, Huang told reporters at the Computex trade show in Taipei. The competition in China is already intense, given its strong software capabilities, extensive technology ecosystems and work efficiency, he said. “All in all, the export controls were a failure. The facts would suggest it,” he said. “The US

The government has launched a three-pronged strategy to attract local and international talent, aiming to position Taiwan as a new global hub following Nvidia Corp’s announcement that it has chosen Taipei as the site of its Taiwan headquarters. Nvidia cofounder and CEO Jensen Huang (黃仁勳) on Monday last week announced during his keynote speech at the Computex trade show in Taipei that the Nvidia Constellation, the company’s planned Taiwan headquarters, would be located in the Beitou-Shilin Technology Park (北投士林科技園區) in Taipei. Huang’s decision to establish a base in Taiwan is “primarily due to Taiwan’s talent pool and its strength in the semiconductor

French President Emmanuel Macron has expressed gratitude to Hon Hai Precision Industry Co (鴻海精密) for its plan to invest approximately 250 million euros (US$278 million) in a joint venture in France focused on the semiconductor and space industries. On his official X account on Tuesday, Macron thanked Hon Hai, also known globally as Foxconn Technology Group (富士康科技集團), for its investment projects announced at Choose France, a flagship economic summit held on Monday to attract foreign investment. In the post, Macron included a GIF displaying the national flag of the Republic of China (Taiwan), as he did for other foreign investors, including China-based