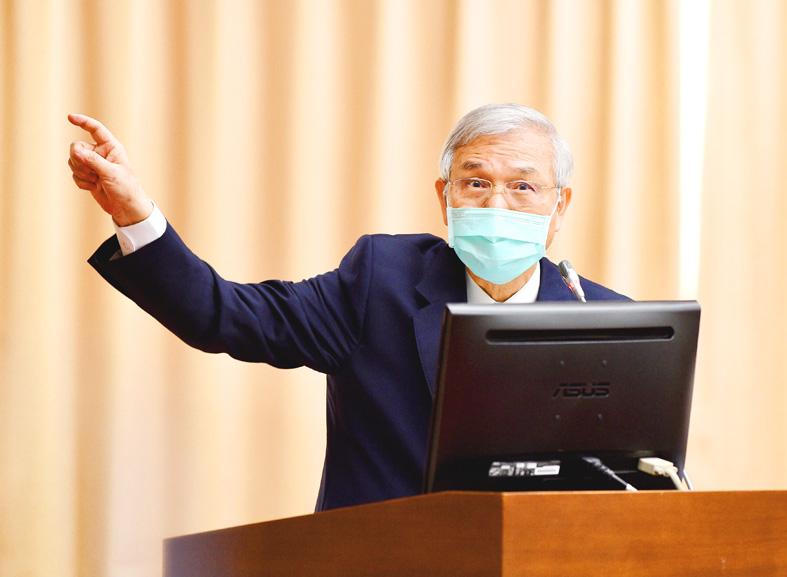

Central bank Governor Yang Chin-long (楊金龍) yesterday said there is still room for credit tightening to cool metropolitan Taipei’s property market, adding that mortgage restrictions for those buying a second property are potential options.

Yang’s statements came at a question-and-answer session at the legislature in Taipei focused on potential economic repercussions from the US Federal Reserve’s expected interest rate increases and inflation pressure caused by Russia’s invasion of Ukraine.

“There is still room for the central bank to improve its policy measures to cool down the property fever,” Yang told lawmakers on the Finance Committee, after some of them had called existing credit controls ineffective.

Photo: Peter Lo, Taipei Times

Lawmakers said that Taiwan should learn a lesson from South Korea, where real estate becoming increasingly unaffordable led to the opposition candidate winning Wednesday’s presidential election.

Yang said that second-home mortgage restrictions imposed in 2010 proved successful to curb housing price increases in metropolitan Taipei.

Reimposing the measure would be discussed at the central bank’s quarterly policy meeting on Thursday next week, he added.

Housing prices surged due in part to Taiwan’s strong economy, Yang said, denying that fund inflows and property speculation are the main factors.

The central bank is seeking to induce a soft landing for housing prices, Yang said.

Measures to rein in the housing market should not be used to fight inflation, as they would prove costly after interest rates have been raised, he said.

Yang said he doubted that Russia would soon be bankrupt due to economic sanctions, including oil embargos and its credit ratings being downgraded.

Russia has foreign exchange reserves of more than US$600 billion and about US$400 billion in privately owned foreign currency-denominated assets, Yang said.

Russia has cut its US dollar reserves from more than 40 percent of overall foreign currency reserves in 2014 to about 10 percent, Yang said.

Moscow has raised its Chinese yuan, cryptocurrency and gold reserves, which could give it a buffer, as China is not participating in international sanctions, he added.

Yang said Taiwanese companies have limited exposure in Russia, as trade between the countries is mainly handled by foreign banks, such as HSBC Holdings PLC and Citibank Inc.

Nickel prices have surged to more than US$100,000 per tonne, but as Taiwan’s current nickel reserves would last more than one year, minting costs would remain stable, Yang said, adding that recycled coins could also be used for minting new ones.

Global monetary policymakers could moderate the pace of rate increases to ease the economic effects of Russia invasion of Ukraine, Yang said.

Meta Platforms Inc offered US$100 million bonuses to OpenAI employees in an unsuccessful bid to poach the ChatGPT maker’s talent and strengthen its own generative artificial intelligence (AI) teams, OpenAI CEO Sam Altman has said. Facebook’s parent company — a competitor of OpenAI — also offered “giant” annual salaries exceeding US$100 million to OpenAI staffers, Altman said in an interview on the Uncapped with Jack Altman podcast released on Tuesday. “It is crazy,” Sam Altman told his brother Jack in the interview. “I’m really happy that at least so far none of our best people have decided to take them

PLANS: MSI is also planning to upgrade its service center in the Netherlands Micro-Star International Co (MSI, 微星) yesterday said it plans to set up a server assembly line at its Poland service center this year at the earliest. The computer and peripherals manufacturer expects that the new server assembly line would shorten transportation times in shipments to European countries, a company spokesperson told the Taipei Times by telephone. MSI manufactures motherboards, graphics cards, notebook computers, servers, optical storage devices and communication devices. The company operates plants in Taiwan and China, and runs a global network of service centers. The company is also considering upgrading its service center in the Netherlands into a

DIVIDED VIEWS: Although the Fed agreed on holding rates steady, some officials see no rate cuts for this year, while 10 policymakers foresee two or more cuts There are a lot of unknowns about the outlook for the economy and interest rates, but US Federal Reserve Chair Jerome Powell signaled at least one thing seems certain: Higher prices are coming. Fed policymakers voted unanimously to hold interest rates steady at a range of 4.25 percent to 4.50 percent for a fourth straight meeting on Wednesday, as they await clarity on whether tariffs would leave a one-time or more lasting mark on inflation. Powell said it is still unclear how much of the bill would fall on the shoulders of consumers, but he expects to learn more about tariffs

Taiwan’s property market is entering a freeze, with mortgage activity across the nation’s six largest cities plummeting in the first quarter, H&B Realty Co (住商不動產) said yesterday, citing mounting pressure on housing demand amid tighter lending rules and regulatory curbs. Mortgage applications in Taipei, New Taipei City, Taoyuan, Taichung, Tainan and Kaohsiung totaled 28,078 from January to March, a sharp 36.3 percent decline from 44,082 in the same period last year, the nation’s largest real-estate brokerage by franchise said, citing data from the Joint Credit Information Center (JCIC, 聯徵中心). “The simultaneous decline across all six cities reflects just how drastically the market