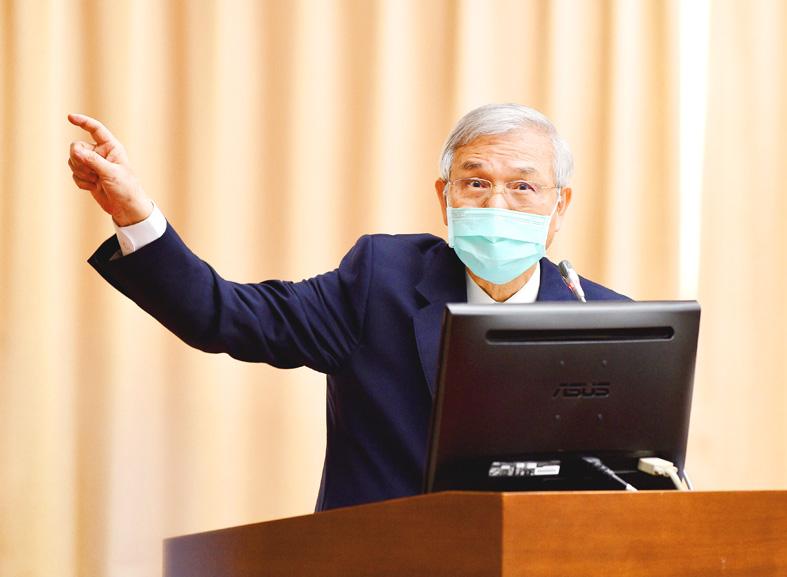

Central bank Governor Yang Chin-long (楊金龍) yesterday said there is still room for credit tightening to cool metropolitan Taipei’s property market, adding that mortgage restrictions for those buying a second property are potential options.

Yang’s statements came at a question-and-answer session at the legislature in Taipei focused on potential economic repercussions from the US Federal Reserve’s expected interest rate increases and inflation pressure caused by Russia’s invasion of Ukraine.

“There is still room for the central bank to improve its policy measures to cool down the property fever,” Yang told lawmakers on the Finance Committee, after some of them had called existing credit controls ineffective.

Photo: Peter Lo, Taipei Times

Lawmakers said that Taiwan should learn a lesson from South Korea, where real estate becoming increasingly unaffordable led to the opposition candidate winning Wednesday’s presidential election.

Yang said that second-home mortgage restrictions imposed in 2010 proved successful to curb housing price increases in metropolitan Taipei.

Reimposing the measure would be discussed at the central bank’s quarterly policy meeting on Thursday next week, he added.

Housing prices surged due in part to Taiwan’s strong economy, Yang said, denying that fund inflows and property speculation are the main factors.

The central bank is seeking to induce a soft landing for housing prices, Yang said.

Measures to rein in the housing market should not be used to fight inflation, as they would prove costly after interest rates have been raised, he said.

Yang said he doubted that Russia would soon be bankrupt due to economic sanctions, including oil embargos and its credit ratings being downgraded.

Russia has foreign exchange reserves of more than US$600 billion and about US$400 billion in privately owned foreign currency-denominated assets, Yang said.

Russia has cut its US dollar reserves from more than 40 percent of overall foreign currency reserves in 2014 to about 10 percent, Yang said.

Moscow has raised its Chinese yuan, cryptocurrency and gold reserves, which could give it a buffer, as China is not participating in international sanctions, he added.

Yang said Taiwanese companies have limited exposure in Russia, as trade between the countries is mainly handled by foreign banks, such as HSBC Holdings PLC and Citibank Inc.

Nickel prices have surged to more than US$100,000 per tonne, but as Taiwan’s current nickel reserves would last more than one year, minting costs would remain stable, Yang said, adding that recycled coins could also be used for minting new ones.

Global monetary policymakers could moderate the pace of rate increases to ease the economic effects of Russia invasion of Ukraine, Yang said.

GROWING OWINGS: While Luxembourg and China swapped the top three spots, the US continued to be the largest exposure for Taiwan for the 41st consecutive quarter The US remained the largest debtor nation to Taiwan’s banking sector for the 41st consecutive quarter at the end of September, after local banks’ exposure to the US market rose more than 2 percent from three months earlier, the central bank said. Exposure to the US increased to US$198.896 billion, up US$4.026 billion, or 2.07 percent, from US$194.87 billion in the previous quarter, data released by the central bank showed on Friday. Of the increase, about US$1.4 billion came from banks’ investments in securitized products and interbank loans in the US, while another US$2.6 billion stemmed from trust assets, including mutual funds,

AI TALENT: No financial details were released about the deal, in which top Groq executives, including its CEO, would join Nvidia to help advance the technology Nvidia Corp has agreed to a licensing deal with artificial intelligence (AI) start-up Groq, furthering its investments in companies connected to the AI boom and gaining the right to add a new type of technology to its products. The world’s largest publicly traded company has paid for the right to use Groq’s technology and is to integrate its chip design into future products. Some of the start-up’s executives are leaving to join Nvidia to help with that effort, the companies said. Groq would continue as an independent company with a new chief executive, it said on Wednesday in a post on its Web

JOINT EFFORTS: MediaTek would partner with Denso to develop custom chips to support the car-part specialist company’s driver-assist systems in an expanding market MediaTek Inc (聯發科), the world’s largest mobile phone chip designer, yesterday said it is working closely with Japan’s Denso Corp to build a custom automotive system-on-chip (SoC) solution tailored for advanced driver-assistance systems and cockpit systems, adding another customer to its new application-specific IC (ASIC) business. This effort merges Denso’s automotive-grade safety expertise and deep vehicle integration with MediaTek’s technologies cultivated through the development of Media- Tek’s Dimensity AX, leveraging efficient, high-performance SoCs and artificial intelligence (AI) capabilities to offer a scalable, production-ready platform for next-generation driver assistance, the company said in a statement yesterday. “Through this collaboration, we are bringing two

Even as the US is embarked on a bitter rivalry with China over the deployment of artificial intelligence (AI), Chinese technology is quietly making inroads into the US market. Despite considerable geopolitical tensions, Chinese open-source AI models are winning over a growing number of programmers and companies in the US. These are different from the closed generative AI models that have become household names — ChatGPT-maker OpenAI or Google’s Gemini — whose inner workings are fiercely protected. In contrast, “open” models offered by many Chinese rivals, from Alibaba (阿里巴巴) to DeepSeek (深度求索), allow programmers to customize parts of the software to suit their