Large chip companies so far predict limited supply chain disruption from the Russia-Ukraine crisis, thanks to raw material stockpiling and diversified procurement, but some industry sources worry about the longer-term effects.

The crisis has hit stocks of tech companies that source or sell globally on fears of further disruptions on the back of a year-long shortage of semiconductor chips.

Ukraine supplies more than 90 percent of US semiconductor-grade neon, critical for lasers used in chipmaking.

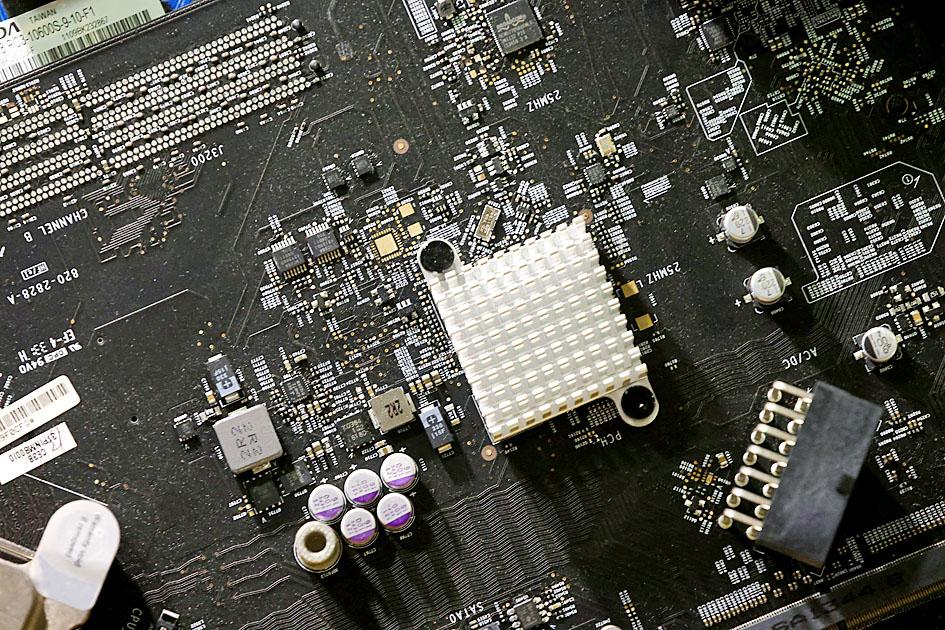

Photo: Reuters

The gas, a byproduct of Russian steel manufacturing, is purified in Ukraine, market research firm Techcet said.

Thirty-five percent of US palladium, used in sensors and memory, among other applications, is sourced from Russia.

“The chipmakers are not feeling any direct impact, but the companies that supply them with materials for semiconductor fabrication buy gases, including neon and palladium, from Russia and Ukraine,” said a Japanese chip industry source who spoke on condition of anonymity. “The availability of those materials is already tight, so any further pressure on supplies could push up prices. That in turn could knock on to higher chip prices.”

Companies are better prepared than in the past few years, due to other disruptions and conflicts, reducing some of the pain.

The White House has warned the chip industry to diversify its supply chain in case Russia retaliates against threatened US export curbs by blocking access to key materials, Reuters reported earlier this month, citing people familiar with the matter.

Ahead of the invasion, the West sanctioned Russia’s Nord Stream 2 pipeline and some Russian banks, and imposed curbs on a number of senior Russian officials.

More sanctions could come in the form of Cold War-like curbs on technology, followed by Russian retaliation on exports.

ASML Holding NV, a key Dutch supplier to chipmakers including Taiwan Semiconductor Manufacturing Co (TSMC, 台積電), Samsung Electronics Co and Intel Corp on Wednesday said it is examining alternative sources for neon.

Most chipmakers are in wait-and-watch mode and in communication before yesterday’s escalation projected confidence about their supply chains, which they have diversified in the wake of US-China trade tensions, the COVID-19 pandemic and Japan’s diplomatic spat with South Korea.

Some companies started diversifying away from Russia and Ukraine after Moscow annexed Crimea in 2014, which triggered a huge increase in neon prices.

South Korean memorychip maker SK Hynix Inc CEO Lee Seok-hee told reporters last week that the company had “secured a lot” of chip materials, and that “there’s no need to worry.”

Intel said it does not anticipate any impact, while GlobalFoundries Inc said it does not anticipate a direct risk and has flexibility to seek sources outside Russia or Ukraine, as did Taiwanese chipmaker United Microelectronics Corp (聯電).

TSMC, the world’s largest contract chipmaker declined to comment “at the moment.”

Taiwanese chip testing and packaging firm ASE Technology Holding Co (日月光投控) said that its material supply remains stable “at this point.”

The Ministry of Economic Affairs said in a statement that it had checked the nation’s semiconductor supply chain and found no direct impact on materials or production activities.

“Russia is not, at the moment, one of the Taiwanese foundry industry’s major markets,” TrendForce Corp (集邦科技) senior analyst Joanne Chiao (喬安) said.

Amid rumors that the government is considering restricting the export of strategic goods to Russia, Taiwan Institute of Economic Research (台灣經濟研究院) researcher Arisa Liu (劉佩真) said that there is unlikely to be substantial effects on local semiconductor firms, given that most of their orders come from the US, Europe, Japan and South Korea.

Liu added that Russia was only the 35th largest exporter of Taiwanese semiconductor products, according to export data from January to November last year.

Taiwan mainly receives orders for mixed-signal ICs, optical amplifiers, DRAM, transistors and CPUs from Russia, she added.

Malaysian chipmaker Unisem Bhd, whose customers include Apple Inc, said it expects no impact on chip production from a raw materials perspective, as the materials it needs are not sourced from Russia, and its machines are mainly from domestic suppliers or from the US, Japan, South Korea and Singapore.

Malaysia has emerged as an important link in the chip production chain, and accounts for 13 percent of global chip assembly testing and packaging.

Japan’s Ibiden Co, which makes packaging substrates for chips, said that it had enough materials, but the situation could change with sanctions, when asked about supplies of neon and other gases from Russia.

“We are a little concerned,” a spokesperson said.

The company would buy material elsewhere and keep in close contact with suppliers to tackle any disruptions, she added.

Additional reporting by CNA

NEW IDENTITY: Known for its software, India has expanded into hardware, with its semiconductor industry growing from US$38bn in 2023 to US$45bn to US$50bn India on Saturday inaugurated its first semiconductor assembly and test facility, a milestone in the government’s push to reduce dependence on foreign chipmakers and stake a claim in a sector dominated by China. Indian Prime Minister Narendra Modi opened US firm Micron Technology Inc’s semiconductor assembly, test and packaging unit in his home state of Gujarat, hailing the “dawn of a new era” for India’s technology ambitions. “When young Indians look back in the future, they will see this decade as the turning point in our tech future,” Modi told the event, which was broadcast on his YouTube channel. The plant would convert

‘SEISMIC SHIFT’: The researcher forecast there would be about 1.1 billion mobile shipments this year, down from 1.26 billion the prior year and erasing years of gains The global smartphone market is expected to contract 12.9 percent this year due to the unprecedented memorychip shortage, marking “a crisis like no other,” researcher International Data Corp (IDC) said. The new forecast, a dramatic revision down from earlier estimates, gives the latest accounting of the ongoing memory crunch that is affecting every corner of the electronics industry. The demand for advanced memory to power artificial intelligence (AI) tasks has drained global supply until well into next year and jeopardizes the business model of many smartphone makers. IDC forecast about 1.1 billion mobile shipments this year, down from 1.26 billion the prior

People stand in a Pokemon store in Tokyo on Thursday. One of the world highest-grossing franchises is celebrated its 30th anniversary yesterday.

Zimbabwe’s ban on raw lithium exports is forcing Chinese miners to rethink their strategy, speeding up plans to process the metal locally instead of shipping it to China’s vast rechargeable battery industry. The country is Africa’s largest lithium producer and has one of the world’s largest reserves, according to the US Geological Survey (USGS). Zimbabwe already banned the export of lithium ore in 2022 and last year announced it would halt exports of lithium concentrates from January next year. However, on Wednesday it imposed the ban with immediate effect, leaving unclear what the lithium mining sector would do in the