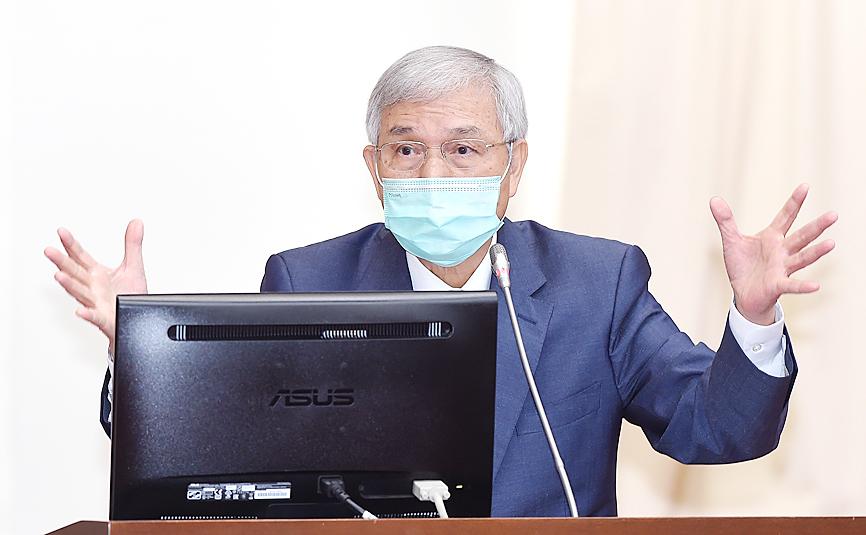

Raising interest rates before other economies would cause a surge in incoming funds and create chaos in the nation’s foreign-exchange market, central bank Governor Yang Chin-long (楊金龍) said yesterday.

Overseas funds could also invest in Taiwan’s overheated real-estate market and raise home prices further, Yang said at a meeting of the legislature’s Finance Committee when asked by Chinese Nationalist Party (KMT) Legislator William Tseng (曾銘宗) about a possible rate hike and its likely effects.

Yang said the central bank is closely monitoring how other central banks adjust their monetary policies, because acting alone could pose problems.

Photo: Liao Cheng-hui, Taipei Times

“Taiwan’s stock market remains sound, so if the central bank raises key interest rates by 25 basis points, it would not put much pressure on stocks,” Yang said.

The TAIEX closed down 14.77 points, or 0.08 percent, at 17,803.54 yesterday, after moving in a narrow range throughout the session. The benchmark index has risen 20.95 since the beginning of this year, Taiwan Stock Exchange data showed.

“But a rate hike in Taiwan before other countries act could send the New Taiwan dollar higher against the greenback due to large fund inflows,” he said.

Yang also raised concerns that the heavy influx of funds after a rate increase would boost liquidity in the domestic real-estate market, as soaring home prices have sparked outcries from younger Taiwanese who say they cannot afford to buy a home.

To rein in residential property prices, Yang said the central bank could consider introducing more select credit control measures in the next policymaking meeting.

Three separate rounds of credit control measures targeting institutional and retail home buyers have taken effect since the end of last year, mostly to lower the home loan-to-value ratio to prevent speculation, with mixed results.

Yang said the average home loan-to-value ratio for corporate buyers was lowered to 39 percent, from 64 percent before the measures were put in place, and the same ratio targeting buyers with at least three homes was also lowered.

The central bank has also increased inspections of loans extended by banks operating in Taiwan, including foreign banks, to the property market, urging banks to abide by the regulations to extend mortgages.

The central bank has carried out 51 rounds of inspections of the local banking industry so far this year, Yang said.

The central bank is to hold its next quarterly policymaking meeting on Dec. 16.

NEW IDENTITY: Known for its software, India has expanded into hardware, with its semiconductor industry growing from US$38bn in 2023 to US$45bn to US$50bn India on Saturday inaugurated its first semiconductor assembly and test facility, a milestone in the government’s push to reduce dependence on foreign chipmakers and stake a claim in a sector dominated by China. Indian Prime Minister Narendra Modi opened US firm Micron Technology Inc’s semiconductor assembly, test and packaging unit in his home state of Gujarat, hailing the “dawn of a new era” for India’s technology ambitions. “When young Indians look back in the future, they will see this decade as the turning point in our tech future,” Modi told the event, which was broadcast on his YouTube channel. The plant would convert

‘SEISMIC SHIFT’: The researcher forecast there would be about 1.1 billion mobile shipments this year, down from 1.26 billion the prior year and erasing years of gains The global smartphone market is expected to contract 12.9 percent this year due to the unprecedented memorychip shortage, marking “a crisis like no other,” researcher International Data Corp (IDC) said. The new forecast, a dramatic revision down from earlier estimates, gives the latest accounting of the ongoing memory crunch that is affecting every corner of the electronics industry. The demand for advanced memory to power artificial intelligence (AI) tasks has drained global supply until well into next year and jeopardizes the business model of many smartphone makers. IDC forecast about 1.1 billion mobile shipments this year, down from 1.26 billion the prior

People stand in a Pokemon store in Tokyo on Thursday. One of the world highest-grossing franchises is celebrated its 30th anniversary yesterday.

Zimbabwe’s ban on raw lithium exports is forcing Chinese miners to rethink their strategy, speeding up plans to process the metal locally instead of shipping it to China’s vast rechargeable battery industry. The country is Africa’s largest lithium producer and has one of the world’s largest reserves, according to the US Geological Survey (USGS). Zimbabwe already banned the export of lithium ore in 2022 and last year announced it would halt exports of lithium concentrates from January next year. However, on Wednesday it imposed the ban with immediate effect, leaving unclear what the lithium mining sector would do in the