The NASDAQ Composite Index on Friday closed above 16,000 points for the first time, in its second-straight record finish powered by technology stocks, while COVID-19 pandemic jitters sent the Dow to its fourth losing session in the last five.

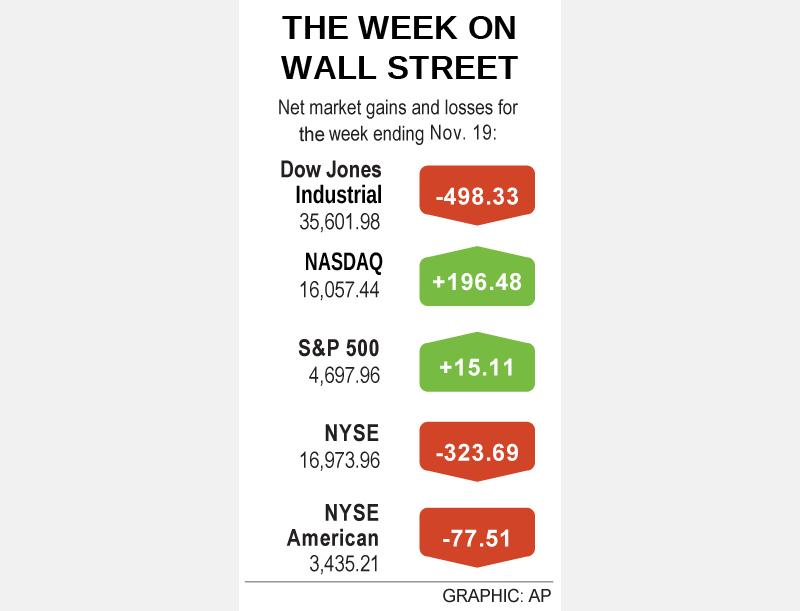

The NASDAQ and S&P 500 scored a winning week, up 1.24 percent and 0.32 percent respectively, after last week’s declines snapped a five-week run of higher finishes.

The Dow Jones Industrial Average’s second-successive weekly loss — this one of 1.38 percent — wiped out the last of its gains for this month, extending the index’s drop from a record high on Monday last week to 2.3 percent.

Friday’s fall was caused by banking, energy and airline stocks slumping on fears that European countries, battling a resurgence of COVID-19 cases, could follow Austria in moving toward a full lockdown.

Banking stocks fell 1.6 percent, tracking a drop in US Treasury yields as investors snapped up safe-haven bonds. The S&P energy index dropped 3.9 percent, the worst performing sector, as crude prices fell on demand implications.

Carriers, including Delta Air Lines Inc, United Airlines Inc and American Airlines Inc, and cruiseliners Norwegian Cruise Line and Carnival Corp all dropped 0.6 percent to 2.8 percent.

Photo: Reuters

“It’s a normal time to take risk off, and in this case, there’s just so much liquidity that the market doesn’t go down — just people take risk off by going into safe havens,” said Jay Hatfield, chief executive officer of Infrastructure Capital Management in New York.

Falling yields and safe-haven demand supported major technology stocks, which in turn lifted the NASDAQ.

FAANG stocks — Facebook Inc, Apple Inc, Amazon.com Inc, Netflix Inc and Google parent Alphabet Inc — which have largely persevered through economic shocks since last year, traded broadly higher. Netflix Inc gained along with other stay-at-home stocks.

Chipmaker Nvidia Corp rose 4.1 percent to its third straight closing high, and the Philadelphia semiconductor index, up 0.3 percent, hit its third record closing high in four.

The Dow Jones Industrial Average fell 268.97 points, or 0.75 percent, to 35,601.98, the S&P 500 lost 6.58 points, or 0.14 percent, at 4,697.96 and the NASDAQ Composite added 63.73 points, or 0.4 percent, to 16,057.44.

The S&P 500 gyrated on Friday before slipping into negative territory, after a week in which retailers pushed it to a record finish the previous day.

The S&P consumer discretionary sector rose 0.3 percent to a closing peak for a second day in a row, after breaking its lifetime intraday high on Friday. This follows strong retail earnings this week and positive signs for holiday shopping.

“Out of the Q3 earnings, one of the trends we have seen is the resounding strength of the US consumer,” Easterly Investment Partners portfolio manager Jessica Bemer said. “We’ve heard it all through this week from retailers talking about the consumer coming back into the store, enjoying the shopping experience and getting ready for the holidays. It makes sense, but it was really validated during earnings season.”

Volume on US exchanges was 10.68 billion shares, compared with the 11.12 billion average for the full session over the past 20 trading days.

The S&P 500 posted 45 new 52-week highs and nine new lows, while the NASDAQ Composite recorded 100 new highs and 309 new lows.

Among the rows of vibrators, rubber torsos and leather harnesses at a Chinese sex toys exhibition in Shanghai this weekend, the beginnings of an artificial intelligence (AI)-driven shift in the industry quietly pulsed. China manufactures about 70 percent of the world’s sex toys, most of it the “hardware” on display at the fair — whether that be technicolor tentacled dildos or hyper-realistic personalized silicone dolls. Yet smart toys have been rising in popularity for some time. Many major European and US brands already offer tech-enhanced products that can enable long-distance love, monitor well-being and even bring people one step closer to

Malaysia’s leader yesterday announced plans to build a massive semiconductor design park, aiming to boost the Southeast Asian nation’s role in the global chip industry. A prominent player in the semiconductor industry for decades, Malaysia accounts for an estimated 13 percent of global back-end manufacturing, according to German tech giant Bosch. Now it wants to go beyond production and emerge as a chip design powerhouse too, Malaysian Prime Minister Anwar Ibrahim said. “I am pleased to announce the largest IC (integrated circuit) Design Park in Southeast Asia, that will house world-class anchor tenants and collaborate with global companies such as Arm [Holdings PLC],”

Sales in the retail, and food and beverage sectors last month continued to rise, increasing 0.7 percent and 13.6 percent respectively from a year earlier, setting record highs for the month of March, the Ministry of Economic Affairs said yesterday. Sales in the wholesale sector also grew last month by 4.6 annually, mainly due to the business opportunities for emerging applications related to artificial intelligence (AI) and high-performance computing technologies, the ministry said in a report. The ministry forecast that retail, and food and beverage sales this month would retain their growth momentum as the former would benefit from Tomb Sweeping Day

Thousands of parents in Singapore are furious after a Cordlife Group Ltd (康盛人生集團), a major operator of cord blood banks in Asia, irreparably damaged their children’s samples through improper handling, with some now pursuing legal action. The ongoing case, one of the worst to hit the largely untested industry, has renewed concerns over companies marketing themselves to anxious parents with mostly unproven assurances. This has implications across the region, given Cordlife’s operations in Hong Kong, Macau, Indonesia, the Philippines and India. The parents paid for years to have their infants’ cord blood stored, with the understanding that the stem cells they contained