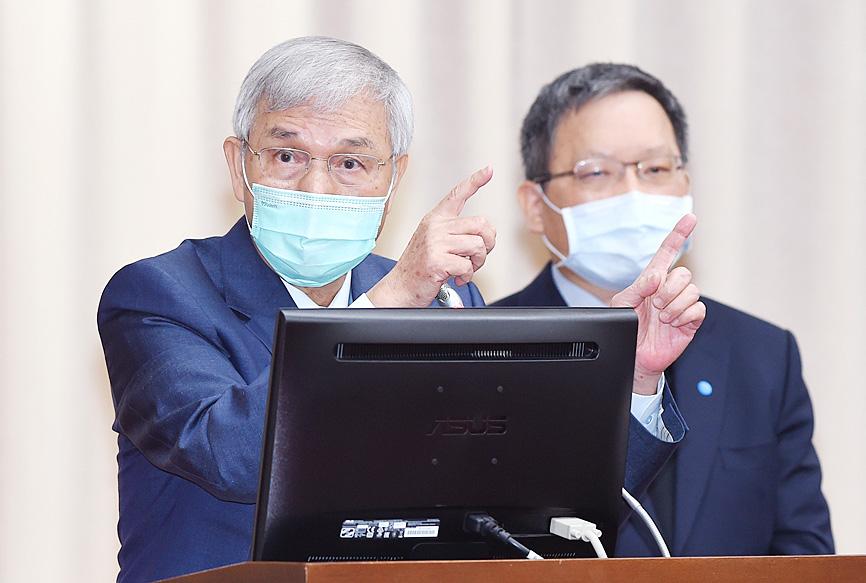

The central bank would not consider raising the interest rate unless inflationary pressures become uncontrollable, although it would consider further tightening credit to cool the property market, Governor Yang Chin-long (楊金龍) told a meeting of the legislature’s Finance Committee yesterday.

Yang said that consumer prices, interest rate decisions by major economies and the local responses to COVID-19 would guide the central bank’s policymaking.

The chance of rate hikes by the US Federal Reserve in the first half of next year stands at 50 percent after consumer prices in the US climbed by more than 5 percent for five straight months, Yang said.

Photo: Liao Cheng-hui, Taipei Times

The Fed has stood by its view that consumer price index (CPI) readings would slow in the second half of next year, although pressure is building for tightening measures, said Yang, who has taken cues from the Fed and described inflation at home and abroad as transitory.

Taiwan’s consumer prices grew 1.82 percent in the first 10 months and would not exceed the 2 percent alert level for the remainder of the year, Yang said, citing data from the Directorate-General of Budget, Accounting and Statistics.

Most research bodies expect the inflationary gauge in Taiwan to ease below 1.5 percent next year, while GDP growth would hover around 3 percent, affirming stable consumer prices, Yang said.

The forecasts show that neither inflation nor stagflation is a problem for Taiwan, although CPI values would remain relatively high in the first quarter of next year due partly to the low base effect, he said.

Consumer prices picked up this year after stalling last year, which affected some people, Yang said.

The pace of CPI gains is less noticeable if judging from two-year averages or over longer terms, the governor said.

However, Yang said the central bank would closely monitor existing credit controls to see if they are strong enough to induce a soft landing for the local housing market.

The governor said he saw both economic fundamentals and speculation underpinning current housing price rises.

The government has stiffened loan-to-value ratios for purchases of multiple homes, land financing, second-home mortgages in popular locations and income taxes from short-term property transactions, he said.

Those measures should help stem property inflation, the governor said, adding that the central bank would proactively review its policies and introduce stricter measures whenever necessary.

South Korea’s equity benchmark yesterday crossed a new milestone just a month after surpassing the once-unthinkable 5,000 mark as surging global memory demand powers the country’s biggest chipmakers. The KOSPI advanced as much as 2.6 percent to a record 6,123, with Samsung Electronics Co and SK Hynix Inc each gaining more than 2 percent. With the benchmark now up 45 percent this year, South Korea’s stock market capitalization has also moved past France’s, following last month’s overtaking of Germany’s. Long overlooked by foreign funds, despite being undervalued, South Korean stocks have now emerged as clear winners in the global market. The so-called “artificial intelligence

‘SEISMIC SHIFT’: The researcher forecast there would be about 1.1 billion mobile shipments this year, down from 1.26 billion the prior year and erasing years of gains The global smartphone market is expected to contract 12.9 percent this year due to the unprecedented memorychip shortage, marking “a crisis like no other,” researcher International Data Corp (IDC) said. The new forecast, a dramatic revision down from earlier estimates, gives the latest accounting of the ongoing memory crunch that is affecting every corner of the electronics industry. The demand for advanced memory to power artificial intelligence (AI) tasks has drained global supply until well into next year and jeopardizes the business model of many smartphone makers. IDC forecast about 1.1 billion mobile shipments this year, down from 1.26 billion the prior

People stand in a Pokemon store in Tokyo on Thursday. One of the world highest-grossing franchises is celebrated its 30th anniversary yesterday.

Chinese artificial intelligence (AI) start-up DeepSeek’s (深度求索) latest AI model, set to be released as soon as next week, was trained on Nvidia Corp’s most advanced AI chip, the Blackwell, a senior official of US President Donald Trump’s administration said on Monday, in what could represent a violation of US export controls. The US believes DeepSeek will remove the technical indicators that might reveal its use of American AI chips, the official said, adding that the Blackwells are likely clustered at its data center in Inner Mongolia, an autonomous region of China. The person declined to say how the US government received