CPC Corp, Taiwan (CPC, 台灣中油) and Formosa Petrochemical Corp (台塑石化) yesterday said that gasoline prices this week would rise by NT$0.8 per liter and diesel prices by NT$0.9, after hikes of NT$0.4 and NT$0.3 respectively last week.

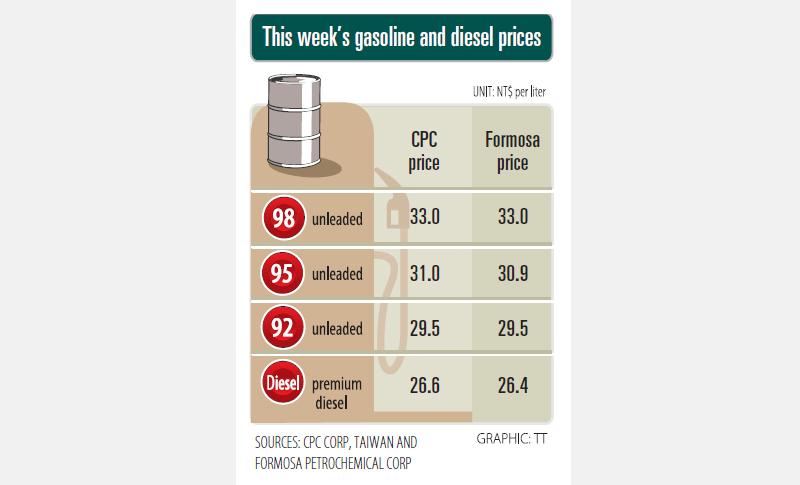

Effective today, prices at CPC stations are to rise to NT$29.5, NT$31 and NT$33 per liter for 92, 95 and 98-octane unleaded gasoline respectively, while the price of premium diesel is to rise to NT$26.6 per liter, CPC said.

CPC’s price of NT$31.0 for 95-octane unleaded gasoline marks the highest in nearly three years.

Prices at Formosa stations are to rise to NT$29.5, NT$30.9 and NT$33.0 per liter for 92, 95 and 98-octane unleaded gasoline respectively, while premium diesel is to rise to NT$26.4 per liter.

State-run CPC said that based on its floating oil price formula, the cost of crude oil last week increased 3.04 percent from a week earlier, as global oil prices rose due to a surge in energy demand.

“Countries are rushing to buy coal and natural gas, leading prices of related energy sources to soar in the short term, while rapidly driving demand for crude oil,” CPC said in a statement.

“In addition, OPEC and its allies are maintaining a moderate production increase for next month rather than producing extra output, which also drove oil prices to rise.”

Based on the formula, gasoline and diesel prices should rise by NT$2.0 and NT$3.2 per liter respectively, but CPC said it would absorb the cost of the increase in compliance with government policy.

Separately, Formosa said that demand for heating fuels increased as the northern hemisphere approaches winter, and that power shortages in China and India pushed up prices of natural gas and coal, which all led crude oil prices to further rise last week.

Among the rows of vibrators, rubber torsos and leather harnesses at a Chinese sex toys exhibition in Shanghai this weekend, the beginnings of an artificial intelligence (AI)-driven shift in the industry quietly pulsed. China manufactures about 70 percent of the world’s sex toys, most of it the “hardware” on display at the fair — whether that be technicolor tentacled dildos or hyper-realistic personalized silicone dolls. Yet smart toys have been rising in popularity for some time. Many major European and US brands already offer tech-enhanced products that can enable long-distance love, monitor well-being and even bring people one step closer to

TRANSFORMATION: Taiwan is now home to the largest Google hardware research and development center outside of the US, thanks to the nation’s economic policies President Tsai Ing-wen (蔡英文) yesterday attended an event marking the opening of Google’s second hardware research and development (R&D) office in Taiwan, which was held at New Taipei City’s Banciao District (板橋). This signals Taiwan’s transformation into the world’s largest Google hardware research and development center outside of the US, validating the nation’s economic policy in the past eight years, she said. The “five plus two” innovative industries policy, “six core strategic industries” initiative and infrastructure projects have grown the national industry and established resilient supply chains that withstood the COVID-19 pandemic, Tsai said. Taiwan has improved investment conditions of the domestic economy

Malaysia’s leader yesterday announced plans to build a massive semiconductor design park, aiming to boost the Southeast Asian nation’s role in the global chip industry. A prominent player in the semiconductor industry for decades, Malaysia accounts for an estimated 13 percent of global back-end manufacturing, according to German tech giant Bosch. Now it wants to go beyond production and emerge as a chip design powerhouse too, Malaysian Prime Minister Anwar Ibrahim said. “I am pleased to announce the largest IC (integrated circuit) Design Park in Southeast Asia, that will house world-class anchor tenants and collaborate with global companies such as Arm [Holdings PLC],”

MAJOR BENEFICIARY: The company benefits from TSMC’s advanced packaging scarcity, given robust demand for Nvidia AI chips, analysts said ASE Technology Holding Co (ASE, 日月光投控), the world’s biggest chip packaging and testing service provider, yesterday said it is raising its equipment capital expenditure budget by 10 percent this year to expand leading-edge and advanced packing and testing capacity amid strong artificial intelligence (AI) and high-performance computing chip demand. This is on top of the 40 to 50 percent annual increase in its capital spending budget to more than the US$1.7 billion to announced in February. About half of the equipment capital expenditure would be spent on leading-edge and advanced packaging and testing technology, the company said. ASE is considered by analysts