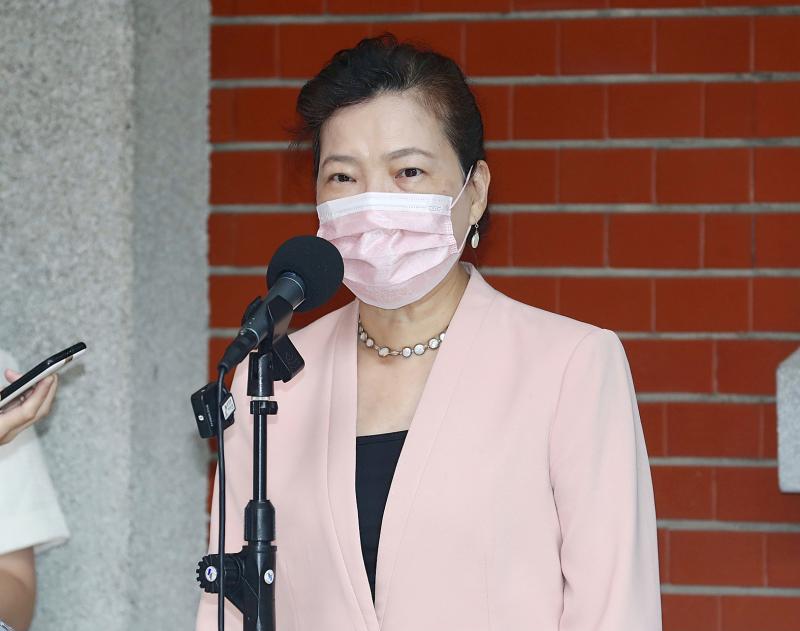

The government “encourages” talks with the EU about inking a trade agreement, Minister of Economic Affairs Wang Mei-hua (王美花) said yesterday.

“A trade deal would allow us to fight for better, closer and more flexible trade relations with the EU, and produce trusted supply chain partners,” Wang told the online EU Investment Forum in her keynote speech. “It would be a reward and an encouragement for investors.”

Despite the COVID-19 pandemic’s continuing effects in Taiwan and Europe, developments in Taiwan-EU trade in the past year are examples of successful Taiwan-EU cooperation, she said.

Photo: CNA

“Siemens Gamesa Renewable Energy SA’s nacelle assembly plant in Taichung was successfully launched [last month], making it the first in the APEC region,” Wang said. “Hon Hai Precision Industry Co (鴻海精密) signed a memorandum of understanding with automaker Stellantis NV [in May] to create the next generation of smart car components.”

Sectors in Taiwan and the EU that might cooperate include the Internet of Things, high-end medical devices, biotech and smart energy, she said.

“We have been holding bilateral trade talks on various topics and our goal is to take Taiwanese-European cooperation between companies to the next level,” she said.

Photo: Huang Pei-chun, Taipei Times

EU Directorate-General for Trade Director-General Sabine Weyand described Taiwan as a “key strategic partner.”

Although Taiwan and the EU are far apart geographically, they share a vision of “an open and interconnected world,” Weyand said.

A recent shortage in auto chips has reminded the world of the importance of supply chains and chips, she said.

Hopefully, Taiwan’s manufacturing prowess and Europe’s advanced chip technology can produce great results together, she said.

Digital transformation, renewable energy, energy storage and network security are other areas for potential cooperation between the two sides, she said.

With 450 million people, the EU is the biggest single market in the world, she said, adding that it guarantees free passage of people, capital and goods in the eurozone.

EUROPEAN PROGRAMS

The European Green Deal and the Digital Europe transition are opportunities for Taiwanese businesses to invest in Europe, she said.

The European Green Deal and Digital Europe represent estimated expenditure of NT$25 trillion (US$889.58 billion).

European officials have said that they provide great opportunities for Taiwanese firms to invest in Europe.

The InvestEU program from this year to 2027 is to provide 26 billion euros (US$30.17 billion) in loan guarantees, the officials said.

The US dollar was trading at NT$29.7 at 10am today on the Taipei Foreign Exchange, as the New Taiwan dollar gained NT$1.364 from the previous close last week. The NT dollar continued to rise today, after surging 3.07 percent on Friday. After opening at NT$30.91, the NT dollar gained more than NT$1 in just 15 minutes, briefly passing the NT$30 mark. Before the US Department of the Treasury's semi-annual currency report came out, expectations that the NT dollar would keep rising were already building. The NT dollar on Friday closed at NT$31.064, up by NT$0.953 — a 3.07 percent single-day gain. Today,

‘SHORT TERM’: The local currency would likely remain strong in the near term, driven by anticipated US trade pressure, capital inflows and expectations of a US Fed rate cut The US dollar is expected to fall below NT$30 in the near term, as traders anticipate increased pressure from Washington for Taiwan to allow the New Taiwan dollar to appreciate, Cathay United Bank (國泰世華銀行) chief economist Lin Chi-chao (林啟超) said. Following a sharp drop in the greenback against the NT dollar on Friday, Lin told the Central News Agency that the local currency is likely to remain strong in the short term, driven in part by market psychology surrounding anticipated US policy pressure. On Friday, the US dollar fell NT$0.953, or 3.07 percent, closing at NT$31.064 — its lowest level since Jan.

The New Taiwan dollar and Taiwanese stocks surged on signs that trade tensions between the world’s top two economies might start easing and as US tech earnings boosted the outlook of the nation’s semiconductor exports. The NT dollar strengthened as much as 3.8 percent versus the US dollar to 30.815, the biggest intraday gain since January 2011, closing at NT$31.064. The benchmark TAIEX jumped 2.73 percent to outperform the region’s equity gauges. Outlook for global trade improved after China said it is assessing possible trade talks with the US, providing a boost for the nation’s currency and shares. As the NT dollar

The Financial Supervisory Commission (FSC) yesterday met with some of the nation’s largest insurance companies as a skyrocketing New Taiwan dollar piles pressure on their hundreds of billions of dollars in US bond investments. The commission has asked some life insurance firms, among the biggest Asian holders of US debt, to discuss how the rapidly strengthening NT dollar has impacted their operations, people familiar with the matter said. The meeting took place as the NT dollar jumped as much as 5 percent yesterday, its biggest intraday gain in more than three decades. The local currency surged as exporters rushed to