Machinery exports expanded for a 13th straight month last month, but the industry is facing unpredictable challenges relating to China’s power rationing and a stronger New Taiwan dollar, the Taiwan Association of Machinery Industry (TAMI, 台灣機械公會) said yesterday.

Exports grew 28.1 percent to US$2.69 billion from a year earlier, but were 9.3 percent lower than the previous month, TAMI statistics showed.

For the first nine months of the year, outbound shipments increased 29.2 percent to US$24.21 billion in US dollar terms, but expanded at a more moderate 21.5 percent to NT$679.92 billion in NT dollar terms as the local currency appreciated against the greenback, TAMI said in a report.

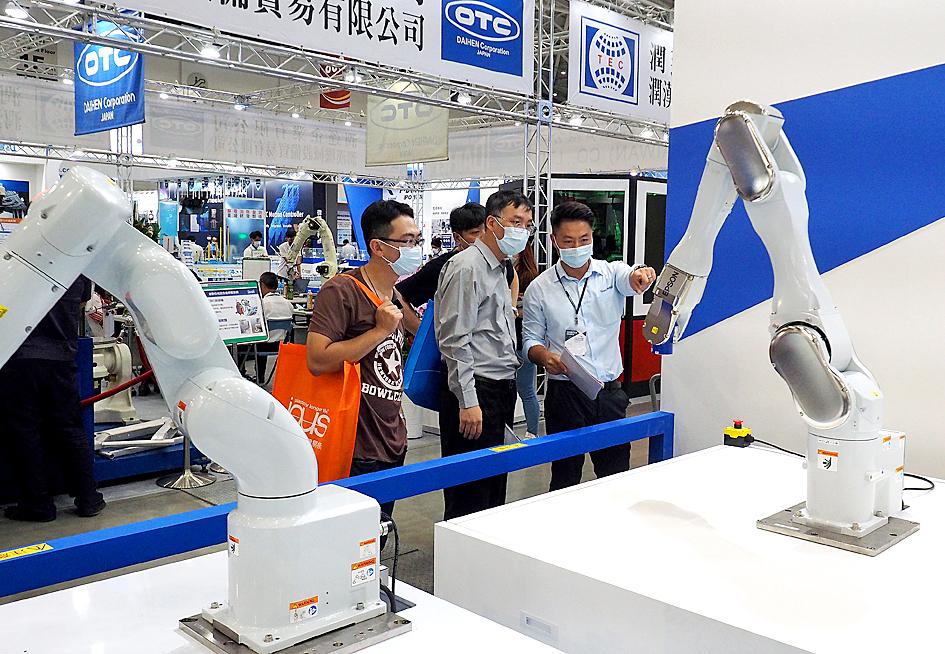

Photo: David Chang, EPA-EFE

Beijing’s tight emission standards have caused a power crunch in China and led to rising prices for certain raw materials and some key components, with the effects inevitably rippling down the supply chain, the association said.

“Steel mills, which are huge energy consumers, frequently have to stop production, causing the price of steel to linger at a high point,” it said. “The power outages have also hit electronic component factories, affecting the supply of critical parts such as switches, motors and controllers.”

Delivery schedules therefore have to be stretched to accommodate the shortages, and it is not clear how severe the effect would be going forward, the association said.

“The unpredictability will continue to affect the ability of Taiwanese companies to stock and ship products on schedule,” it added.

In addition, Taiwanese manufacturers face the challenge of an appreciating NT dollar, the association said.

“The US dollar recently strengthened against Asian currencies, but compared with the Korean won and the Japanese yen, the NT dollar has not fallen that much in value,” it said.

Year to date, the NT dollar has gained 1.61 percent, compared with the yuan’s 1.32 percent gain. The won has fallen by 10.36 percent, while yen has dropped by 8.70 percent so far this year, it said.

Such a “forex disadvantage” has now reached 10 to 12 percent for Taiwanese companies and is “widening rapidly,” it said.

“We would like to ask the government to be more active in stabilizing our currency and helping exporters be competitive against neighboring nations,” it said.

Taiwan Semiconductor Manufacturing Co (TSMC, 台積電), the world’s biggest contract chipmaker, booked its first-ever profit from its Arizona subsidiary in the first half of this year, four years after operations began, a company financial statement showed. Wholly owned by TSMC, the Arizona unit contributed NT$4.52 billion (US$150.1 million) in net profit, compared with a loss of NT$4.34 billion a year earlier, the statement showed. The company attributed the turnaround to strong market demand and high factory utilization. The Arizona unit counts Apple Inc, Nvidia Corp and Advanced Micro Devices Inc among its major customers. The firm’s first fab in Arizona began high-volume production

VOTE OF CONFIDENCE: The Japanese company is adding Intel to an investment portfolio that includes artificial intelligence linchpins Nvidia Corp and TSMC Softbank Group Corp agreed to buy US$2 billion of Intel Corp stock, a surprise deal to shore up a struggling US name while boosting its own chip ambitions. The Japanese company, which is adding Intel to an investment portfolio that includes artificial intelligence (AI) linchpins Nvidia Corp and Taiwan Semiconductor Manufacturing Co (TSMC, 台積電), is to pay US$23 a share — a small discount to Intel’s last close. Shares of the US chipmaker, which would issue new stock to Softbank, surged more than 5 percent in after-hours trading. Softbank’s stock fell as much as 5.4 percent on Tuesday in Tokyo, its

COLLABORATION: Softbank would supply manufacturing gear to the factory, and a joint venture would make AI data center equipment, Young Liu said Hon Hai Precision Industry Co (鴻海精密) would operate a US factory owned by Softbank Group Corp, setting up what is in the running to be the first manufacturing site in the Japanese company’s US$500 billion Stargate venture with OpenAI and Oracle Corp. Softbank is acquiring Hon Hai’s electric-vehicle plant in Ohio, but the Taiwanese company would continue to run the complex after turning it into an artificial intelligence (AI) server production plant, Hon Hai chairman Young Liu (劉揚偉) said yesterday. Softbank would supply manufacturing gear to the factory, and a joint venture between the two companies would make AI data

The prices of gasoline and diesel at domestic fuel stations are to rise NT$0.1 and NT$0.4 per liter this week respectively, after international crude oil prices rose last week, CPC Corp, Taiwan (台灣中油) and Formosa Petrochemical Corp (台塑石化) announced yesterday. Effective today, gasoline prices at CPC and Formosa stations are to rise to NT$27.3, NT$28.8 and NT$30.8 per liter for 92, 95 and 98-octane unleaded gasoline respectively, the companies said in separate statements. The price of premium diesel is to rise to NT$26.2 per liter at CPC stations and NT$26 at Formosa pumps, they said. The announcements came after international crude oil prices