The leasing market for Taipei’s upscale offices was resilient last quarter, as the monthly average rent gained 0.7 percentage points to NT$2,847 (US$101.13) per ping (3.3m2), although the vacancy rate climbed slightly to 2.4 percent, the local branch of Jones Lang LaSalle Inc (JLL) said yesterday.

The minor increase in vacancy resulted from landlords squeezing extra spaces to meet market needs amid a lack of fresh supply in central locations, JLL senior market director Brian Liu (劉建宇) told an online news conference.

The vacancy rate remained ultralow at 2.4 percent last quarter — albeit slightly up from 1.9 percent in the second quarter — which is why landlords increased rents upon renewing contracts, Liu said.

Photo: Hsu Yi-ping, Taipei Times

“Landlords had the upper hand in negotiations,” he said.

JLL Taiwan, which controls 60 percent of the local market, said that the average monthly rent for Grade-A offices could rise to a record NT$3,000 per ping next year, supported by stable demand from technology, financial and Internet businesses.

Supply, on the other hand, would stay tight, it said.

The supply crunch has prompted JLL Taiwan to focus its attention on the pre-leasing market these days, a trend that is likely to persist until massive supply enters the market in 2025, JLL managing director Tony Chao (趙正義) said, adding that a vacancy rate of 5 to 8 percent is considered the norm.

Relocation and upgrade needs would add further momentum to the market, as 49 percent of top-grade offices in Taipei turn 20 years or older, Chao said.

The process of digitalization and the COVID-19 pandemic are reshaping the concept of ideal and efficient office spaces and layouts, he said.

The average office rent in the city’s prime Xinyi District (信義) picked up 0.4 percentage points quarterly to NT$3,435 per ping, diverging increasingly from rates in other popular locations, the broker said.

Rental rates for landmark buildings way exceeded the benchmark, Chao said, referring to newly completed and upcoming office spaces.

Vacancy rates in Nangang District (南港) dwindled to 0.8 percent, while rents held steady at NT$1,400 to NT$2,500 per ping, JLL Taiwan said.

Vacancy figures stood little changed in western Neihu District (內湖) at 4.82 percent, with rental fees averaging NT$1,300 to NT$2,000 per ping, its quarterly report said.

Honhui Ruiguang Plaza (宏匯瑞光), a mixed-use complex on Neihu’s bustling Ruiguang Road, is approaching full occupancy, JLL Taiwan said.

The economy at home and abroad is emerging from the pains of the COVID-19 pandemic, which is favorable to the market, despite lingering uncertainty, it said.

Nvidia Corp chief executive officer Jensen Huang (黃仁勳) on Monday introduced the company’s latest supercomputer platform, featuring six new chips made by Taiwan Semiconductor Manufacturing Co (TSMC, 台積電), saying that it is now “in full production.” “If Vera Rubin is going to be in time for this year, it must be in production by now, and so, today I can tell you that Vera Rubin is in full production,” Huang said during his keynote speech at CES in Las Vegas. The rollout of six concurrent chips for Vera Rubin — the company’s next-generation artificial intelligence (AI) computing platform — marks a strategic

REVENUE PERFORMANCE: Cloud and network products, and electronic components saw strong increases, while smart consumer electronics and computing products fell Hon Hai Precision Industry Co (鴻海精密) yesterday posted 26.51 percent quarterly growth in revenue for last quarter to NT$2.6 trillion (US$82.44 billion), the strongest on record for the period and above expectations, but the company forecast a slight revenue dip this quarter due to seasonal factors. On an annual basis, revenue last quarter grew 22.07 percent, the company said. Analysts on average estimated about NT$2.4 trillion increase. Hon Hai, which assembles servers for Nvidia Corp and iPhones for Apple Inc, is expanding its capacity in the US, adding artificial intelligence (AI) server production in Wisconsin and Texas, where it operates established campuses. This

Garment maker Makalot Industrial Co (聚陽) yesterday reported lower-than-expected fourth-quarter revenue of NT$7.93 billion (US$251.44 million), down 9.48 percent from NT$8.76 billion a year earlier. On a quarterly basis, revenue fell 10.83 percent from NT$8.89 billion, company data showed. The figure was also lower than market expectations of NT$8.05 billion, according to data compiled by Yuanta Securities Investment and Consulting Co (元大投顧), which had projected NT$8.22 billion. Makalot’s revenue this quarter would likely increase by a mid-teens percentage as the industry is entering its high season, Yuanta said. Overall, Makalot’s revenue last year totaled NT$34.43 billion, down 3.08 percent from its record NT$35.52

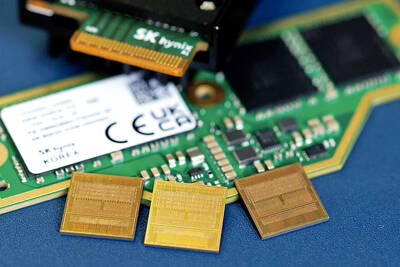

OPPORTUNITY: Supply of conventional DRAM chips tightened after the world’s major memory makers focused on manufacturing chips utilized in AI servers DRAM chipmaker Nanya Technology Corp (南亞科技) yesterday reported a spike in revenue for last month, as severe supply constraints prompted chip price hikes, almost doubling the company’s annual revenue last year from the previous year. Revenue soared 444.87 percent last month to NT$12.02 billion (US$381.4 million), from NT$2.21 billion a year earlier. That brought fourth-quarter revenue to NT$30.17 billion, from NT$6.58 billion for the same period in 2024. On a quarterly basis, revenue jumped 60.65 percent from NT$18.78 billion. Last year, revenue soared 95.09 percent to NT$66.59 billion from NT$32.13 billion in 2024, the company said. Supply of conventional DRAM