Wall Street ended sharply lower on Friday as investors weighed signs of higher inflation, while Apple Inc tumbled following an unfavorable court ruling related to its app store.

US producer prices rose solidly last month, leading to the biggest annual gain in nearly 11 years and indicating that high inflation was likely to persist as the COVID-19 pandemic pressures supply chains, data showed.

Sentiment also took a hit from Cleveland Federal Reserve Bank President Loretta Mester’s comments that she would still like the central bank to begin tapering asset purchases this year, despite last month’s weak jobs report.

Photo: Reuters

The S&P 500 has risen about 19 percent this year, buoyed by support from dovish central bank policies and reopening optimism.

However, Wall Street has moved sideways in the past few sessions as investors digest indications of increased inflation and concerns about effect of the Delta variant of SARS-CoV-2 on economic recovery.

Investors are also uncertain about when the US Federal Reserve might begin reducing massive measures enacted last year to shield the economy from the pandemic.

“The market is taking a breather,” AXS Investments chief executive officer Greg Bassuk said. “Investors are looking for some outsized news or information that is beyond the band of expectations, something much more outsized, positively or negatively, that will give investors better visibility into how things are going to look for the balance of the year.”

Apple dropped 3.3 percent after a judge struck down a core part of its App Store rules, benefiting app makers. Its drop contributed more than any other stocks to the NASDAQ and S&P 500’s declines.

Shares of app makers rallied, with Spotify Technology SA up 0.7 percent, and Activision Blizzard Inc and Electronic Arts Inc gaining about 2 percent.

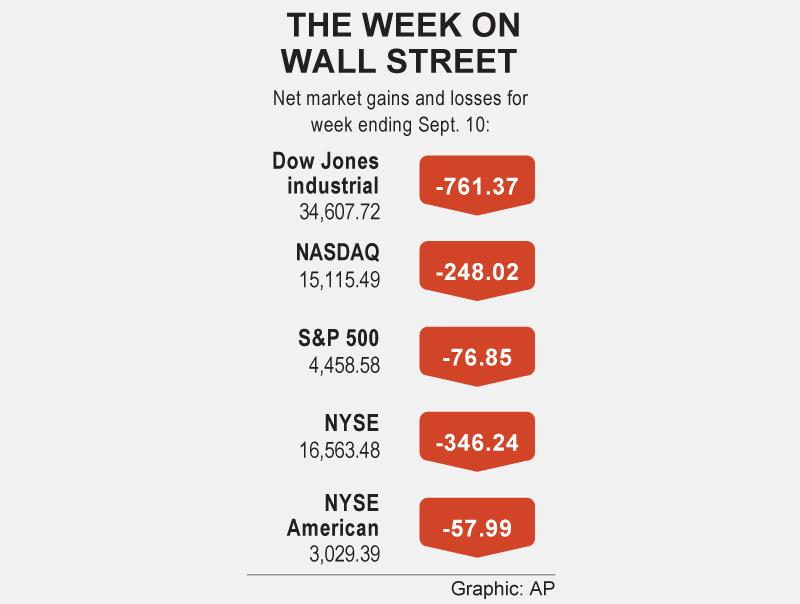

Losses in the three main indices accelerated toward the end of the session. The Dow Jones Industrial Average fell 0.78 percent to close at 34,607.72 points, while the S&P 500 lost 0.77 percent to 4,458.58. The NASDAQ Composite dropped 0.87 percent to 15,115.49.

For the week, the S&P 500 lost 1.69 percent, the Dow declined 2.15 percent and the NASDAQ shed 1.61 percent.

Friday was the first time since February that the S&P 500 had dropped for five days in a row.

The three main US indices received some early support from news of a telephone conversation between US President Joe Biden and Chinese President Xi Jinping (習近平), which could bring a thaw in ties between the world’s two most important trading partners.

All of the 11 S&P 500 sector indices fell, with real estate and utilities each down more than 1 percent and leading the declines.

Volume on US exchanges was 10.0 billion shares, compared with the 9.2 billion average for the full session over the past 20 trading days.

Declining issues outnumbered advancing ones on the NYSE by a 1.84-to-1 ratio, while on the NASDAQ, a 1.88-to-1 ratio favored decliners.

The S&P 500 posted 15 new 52-week highs and three new lows; the NASDAQ Composite recorded 55 new highs and 47 new lows.

In Italy’s storied gold-making hubs, jewelers are reworking their designs to trim gold content as they race to blunt the effect of record prices and appeal to shoppers watching their budgets. Gold prices hit a record high on Thursday, surging near US$5,600 an ounce, more than double a year ago as geopolitical concerns and jitters over trade pushed investors toward the safe-haven asset. The rally is putting undue pressure on small artisans as they face mounting demands from customers, including international brands, to produce cheaper items, from signature pieces to wedding rings, according to interviews with four independent jewelers in Italy’s main

Japanese Prime Minister Sanae Takaichi has talked up the benefits of a weaker yen in a campaign speech, adopting a tone at odds with her finance ministry, which has refused to rule out any options to counter excessive foreign exchange volatility. Takaichi later softened her stance, saying she did not have a preference for the yen’s direction. “People say the weak yen is bad right now, but for export industries, it’s a major opportunity,” Takaichi said on Saturday at a rally for Liberal Democratic Party candidate Daishiro Yamagiwa in Kanagawa Prefecture ahead of a snap election on Sunday. “Whether it’s selling food or

CONCERNS: Tech companies investing in AI businesses that purchase their products have raised questions among investors that they are artificially propping up demand Nvidia Corp chief executive officer Jensen Huang (黃仁勳) on Saturday said that the company would be participating in OpenAI’s latest funding round, describing it as potentially “the largest investment we’ve ever made.” “We will invest a great deal of money,” Huang told reporters while visiting Taipei. “I believe in OpenAI. The work that they do is incredible. They’re one of the most consequential companies of our time.” Huang did not say exactly how much Nvidia might contribute, but described the investment as “huge.” “Let Sam announce how much he’s going to raise — it’s for him to decide,” Huang said, referring to OpenAI

The global server market is expected to grow 12.8 percent annually this year, with artificial intelligence (AI) servers projected to account for 16.5 percent, driven by continued investment in AI infrastructure by major cloud service providers (CSPs), market researcher TrendForce Corp (集邦科技) said yesterday. Global AI server shipments this year are expected to increase 28 percent year-on-year to more than 2.7 million units, driven by sustained demand from CSPs and government sovereign cloud projects, TrendForce analyst Frank Kung (龔明德) told the Taipei Times. Demand for GPU-based AI servers, including Nvidia Corp’s GB and Vera Rubin rack systems, is expected to remain high,