The number of COVID-19 infections in Malaysia is threatening to aggravate shortages of semiconductors and other components that have hammered automakers for months.

The Southeast Asian nation has not historically had the kind of importance to technology supply chains that Taiwan, South Korea or Japan do, but Malaysia has emerged as a major center for chip testing and packaging, with Infineon Technologies AG, NXP Semiconductors NV and STMicroelectronics NV among the key suppliers operating plants there.

Now COVID-19 infections are soaring in the nation, jeopardizing plans to lift lockdowns and restore full production capacity.

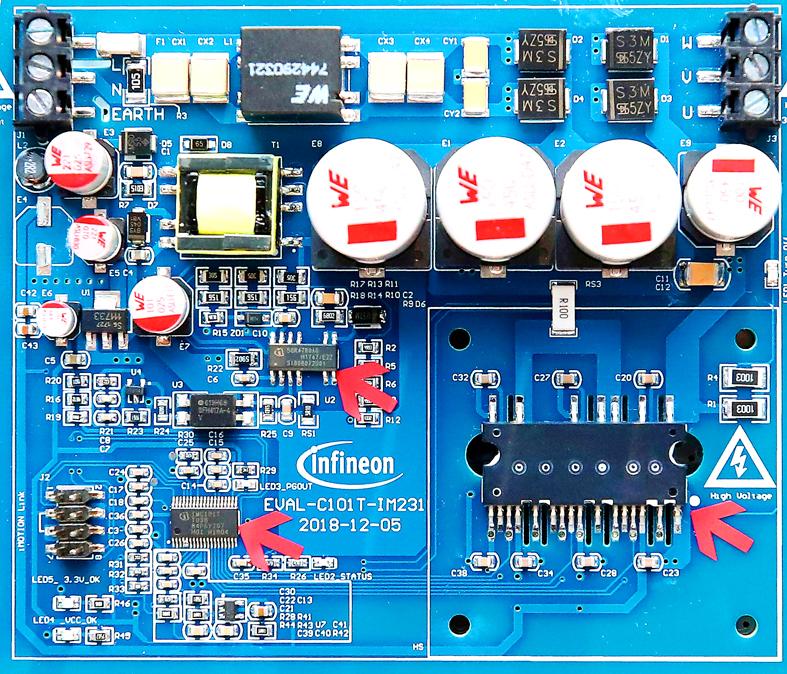

Photo: Reuters

Ford Motor Co last week said that it would temporarily suspend production of its popular F-150 pickup truck at one US plant because of “a semiconductor-related part shortage as a result of the COVID-19 pandemic in Malaysia.”

The Malaysian government is racing to address the outbreak and has granted exemptions to certain manufacturers in an effort to keep the economy on track. Companies were allowed to keep operating with 60 percent of their workforces during June lockdowns and they are able to move back to 100 percent when more than 80 percent of their workers are fully vaccinated.

On Monday, the number of daily reported infections dropped to 17,672, but the situation on the ground remains volatile. Factories have to shut down completely for as long as two weeks for sanitation if more than three workers contract COVID-19 under unofficial guidelines and the Delta variant of SARS-CoV-2 is proving particularly infectious and difficult to stop.

“This could be very disruptive for Infineon and other companies that have plants of a few thousand workers,” Kuala Lumpur-based Kenanga Investment Bank Bhd semiconductor analyst Samuel Tan said.

Local firms are reporting such closures through exchange filings. STMicro and Infineon, both key auto suppliers, have had to close facilities.

The situation could aggravate semiconductor shortages already at crisis levels.

Chip lead times, the gap between ordering a semiconductor and taking delivery, increased by more than eight days to 20.2 weeks last month from June, research by the Susquehanna Financial Group showed.

That gap was already the longest wait time since the firm began tracking the data in 2017.

Automakers have lost sales after a series of unexpected blows in the past year, including a cold snap in Texas that hobbled factories and a fire in Japan at a critical auto chip plant.

Toyota Motor Corp last week said that it would suspend production at 14 plants because suppliers, particularly in Southeast Asia, have been hit by COVID-19 infections and lockdowns. It has partners clustered in Thailand, Vietnam and Malaysia.

Thailand and Vietnam are also seeing sharp increases in reported infections.

Malaysia’s position as a prime base for testing and packaging chips is critical because those are the last steps of semiconductor production. Electronics and electrical products account for 39 percent of the nation’s exports, according to Malaysian Ministry of International Trade and Industry data.

“Malaysia is a key player in the global semiconductor trade,” Malaysia Semiconductor Industry Association president Wong Siew Hai said. “Thus, any disruption anywhere along the supply chain will have knock-on effects elsewhere in the ecosystem.”

Merida Industry Co (美利達) has seen signs of recovery in the US and European markets this year, as customers are gradually depleting their inventories, the bicycle maker told shareholders yesterday. Given robust growth in new orders at its Taiwanese factory, coupled with its subsidiaries’ improving performance, Merida said it remains confident about the bicycle market’s prospects and expects steady growth in its core business this year. CAUTION ON CHINA However, the company must handle the Chinese market with great caution, as sales of road bikes there have declined significantly, affecting its revenue and profitability, Merida said in a statement, adding that it would

Greek tourism student Katerina quit within a month of starting work at a five-star hotel in Halkidiki, one of the country’s top destinations, because she said conditions were so dire. Beyond the bad pay, the 22-year-old said that her working and living conditions were “miserable and unacceptable.” Millions holiday in Greece every year, but its vital tourism industry is finding it harder and harder to recruit Greeks to look after them. “I was asked to work in any department of the hotel where there was a need, from service to cleaning,” said Katerina, a tourism and marketing student, who would

i Gasoline and diesel prices at fuel stations are this week to rise NT$0.1 per liter, as tensions in the Middle East pushed crude oil prices higher last week, CPC Corp, Taiwan (台灣中油) and Formosa Petrochemical Corp (台塑石化) said yesterday. International crude oil prices last week rose for the third consecutive week due to an escalating conflict between Israel and Iran, as the market is concerned that the situation in the Middle East might affect crude oil supply, CPC and Formosa said in separate statements. Front-month Brent crude oil futures — the international oil benchmark — rose 3.75 percent to settle at US$77.01

RISING: Strong exports, and life insurance companies’ efforts to manage currency risks indicates the NT dollar would eventually pass the 29 level, an expert said The New Taiwan dollar yesterday rallied to its strongest in three years amid inflows to the nation’s stock market and broad-based weakness in the US dollar. Exporter sales of the US currency and a repatriation of funds from local asset managers also played a role, said two traders, who asked not to be identified as they were not authorized to speak publicly. State-owned banks were seen buying the greenback yesterday, but only at a moderate scale, the traders said. The local currency gained 0.77 percent, outperforming almost all of its Asian peers, to close at NT$29.165 per US dollar in Taipei trading yesterday. The