At one of Ecuador’s oldest flower farms, workers are planting hemp on land that was traditionally used for roses, making a bet that selling cannabinoid products wold help offset the decline in flower sales caused by the COVID-19 pandemic.

Declining sales spurred by COVID-19 dealt a heavy blow to Ecuador’s flower sector, one of the Andean nation’s traditional export industries, leaving farms cutting output or seeking to reinvent themselves.

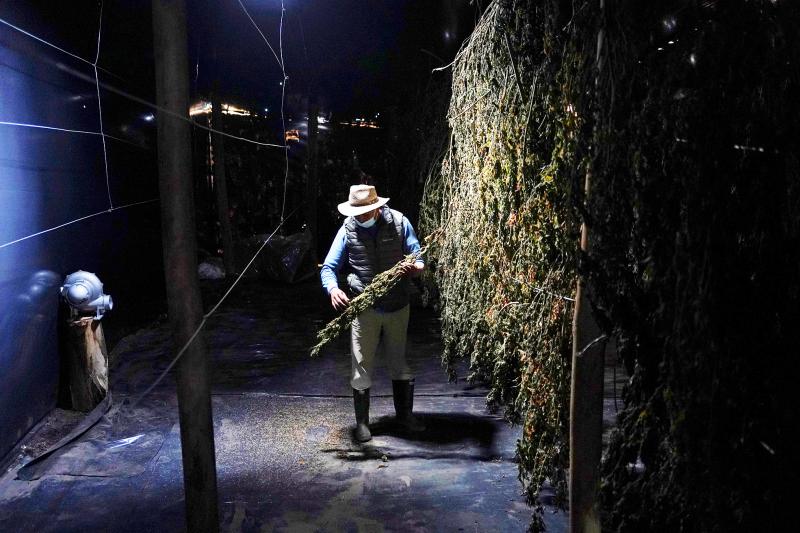

The Boutique Flowers farm in Tabacundo, an hour north of the capital, Quito, has built cannabis greenhouses to take advantage of recent legal reforms that allow for cultivation of the plant — even though marijuana remains illegal.

Photo: Reuters

Marijuana contains higher levels of tetrahydrocannabinol (THC) — the cannabinoid that causes a high — than hemp. Ecuadorean law requires that cannabis have less than 1 percent THC.

“The project was born from hard times,” said Klaus Graetzer, Boutique Flowers floriculture manager and president of hemp start-up CannAndes.

“In the pandemic, the flower industry was hit hard. We saw the chance to take advantage of this new regulation,” he said.

Photo: Reuters

His 30 hectare farm slashed rose production by 37.5 percent to 15 million stems last year due to a drop in orders from the US, Europe and Russia, its main markets.

Ecuador’s total flower exports fell 8 percent last year, flower producer and export association Expoflores says.

Cannabis plants are increasingly cultivated globally for the extraction of cannabidiol (CBD), which is being researched for various medical applications and has found increased use as a relaxant.

However, CannAndes sees the greatest potential in the niche business of hemp flowers, which is smoked as a palliative for conditions such as nausea or anxiety.

Hemp flowers do not have psychotropic effects, and can be produced with much of the flower industry’s traditional infrastructure. In contrast, CBD oils require industrial machinery to separate oil from plant material.

“The idea is to get to export smokable CBD flowers to Switzerland: That’s the biggest market for this flower,” CannAndes manager Felipe Norton said. “Given the experience we have with flowers, it’s a good opportunity.”

CannAndes plans to begin exporting the product in the next two years, and it is seeking licenses from Ecuadorean authorities to sell CBD products such as creams for body care as well as teas and edible oils for chocolates and sweets.

Ecuador’s flower industry leaders remain skeptical of hemp because the value of the associated products swing sharply with shifts in consumer fads and government regulatory decisions, Expoflores president Alejandro Martinez said.

Ecuador in late 2019 legalized the imports of hemp seeds, as well as the production, marketing and export of hemp. The Ecuadorian Ministry of Agriculture, Livestock, Aquaculture and Fisheries has approved 46 10-year licenses for various phases of hemp development.

“We have the climate and soil conditions to do the cultivation, but it will be the demand that will dictate the level of supply,” Ecuadorian Vice Minister of Productive Development Ney Barrionuevo said. “For now, it is incipient.”

On Tuesday, US President Donald Trump weighed in on a pressing national issue: The rebranding of a restaurant chain. Last week, Cracker Barrel, a Tennessee company whose nationwide locations lean heavily on a cozy, old-timey aesthetic — “rocking chairs on the porch, a warm fire in the hearth, peg games on the table” — announced it was updating its logo. Uncle Herschel, the man who once appeared next to the letters with a barrel, was gone. It sparked ire on the right, with Donald Trump Jr leading a charge against the rebranding: “WTF is wrong with Cracker Barrel?!” Later, Trump Sr weighed

SinoPac Financial Holdings Co (永豐金控) is weighing whether to add a life insurance business to its portfolio, but would tread cautiously after completing three acquisitions in quick succession, president Stanley Chu (朱士廷) said yesterday. “We are carefully considering whether life insurance should play a role in SinoPac’s business map,” Chu told reporters ahead of an earnings conference. “Our priority is to ensure the success of the deals we have already made, even though we are tracking some possible targets.” Local media have reported that Mercuries Life Insurance Co (三商美邦人壽), which is seeking buyers amid financial strains, has invited three financial

Artificial intelligence (AI) chip designer Cambricon Technologies Corp (寒武紀科技) plunged almost 9 percent after warning investors about a doubling in its share price over just a month, a record gain that helped fuel a US$1 trillion Chinese market rally. Cambricon triggered the selloff with a Thursday filing in which it dispelled talk about nonexistent products in the pipeline, reminded investors it labors under US sanctions, and stressed the difficulties of ascending the technology ladder. The Shanghai-listed company’s stock dived by the most since April in early yesterday trading, while the market stood largely unchanged. The litany of warnings underscores growing scrutiny of

OUTLOOK: Among the six sub-indices, only the stock market confidence sub-index rose due to strong equity performance and expectations of a US Federal Reserve rate cut Consumer confidence weakened further this month, sliding to its lowest level in two-and-a-half years as households grew increasingly uneasy about the economic outlook, job security and big-ticket spending, a survey by the National Central University showed yesterday. The consumer confidence index fell 1.07 points from last month to 63.31, the weakest number since May 2023, said the university’s Research Center for Taiwan Economic Development (RCTED), which conducts the monthly poll. “Although the Directorate-General of Budget, Accounting and Statistics recently increased Taiwan’s GDP growth forecast for this year to 4.45 percent, consumer sentiment tells a different story,” RCTED director Dachrahn Wu