Robinhood Markets Inc reshaped how small-time traders buy and sell stocks. Now it is trying to entice them to invest in companies going public — including its own shares.

The company that popularized free trading made its case to investors of all kinds in a live-streamed presentation on Saturday.

Although this type of event, called a roadshow, is typically limited to hedge funds and other institutions ahead of an initial public offering, Robinhood took the unusual step of making its presentation available for anyone to watch.

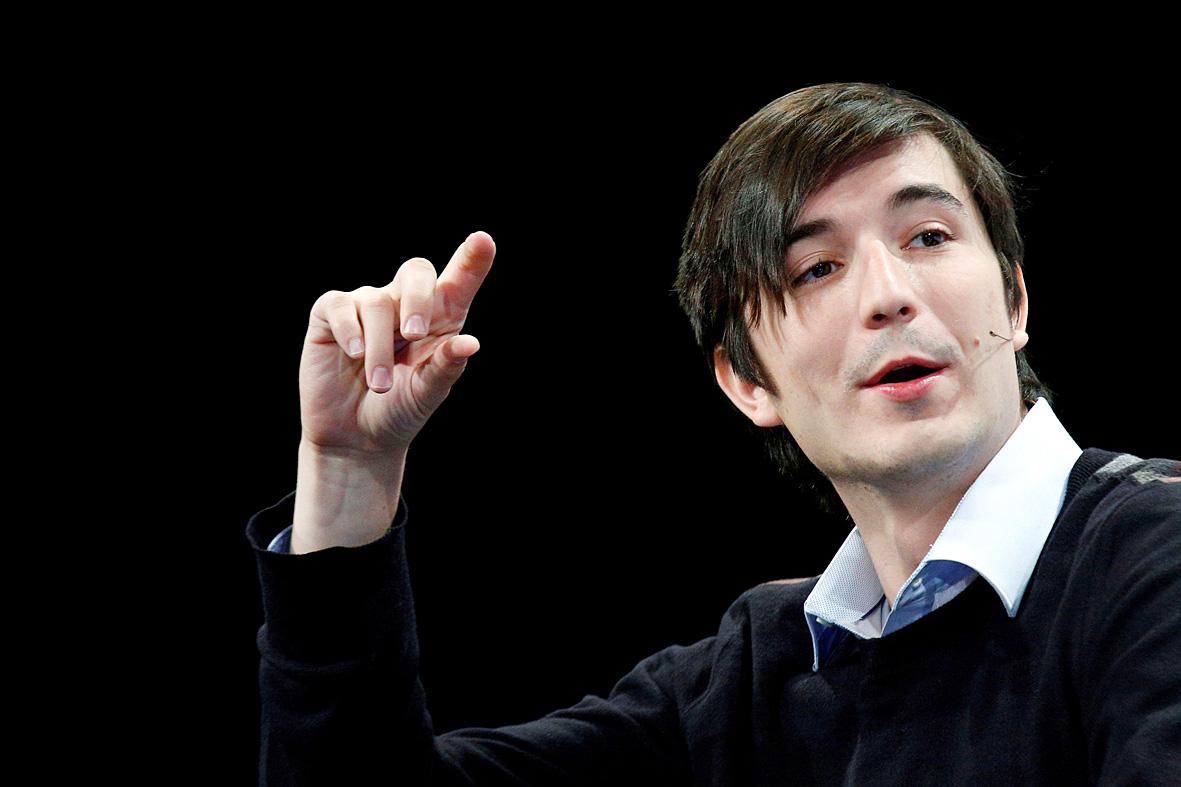

Photo: Reuters

It is the latest way in which Robinhood is defying conventions as it advances toward a public debut unlike any other. The company is reserving as much as 35 percent of its shares for traders from its own app, who would ordinarily need to wait until they start trading on an exchange to buy them — potentially at a higher price than the current target range of US$38 to US$42.

The company is expected to start trading on the NASDAQ stock market on Thursday, according to people with knowledge of the matter.

“We anticipate this will be one of the largest retail allocations ever,” Robinhood CEO Vlad Tenev said, seated together on a white sofa with the company’s leadership team as they responded to customer questions on its business model and how it plans to grow.

“This is a very special moment and we’re humbled,” Tenev said

Tenev added that Robinhood was open to the idea of offering retirement accounts like IRAs and Roth IRAs.

“We want to make first-time investors into long-term investors,” he said.

Robinhood chief financial officer Jason Warnick addressed payment for order flow — a practice in which brokerages send customer orders to trading firms like Citadel Securities to be carried out, and receive payments in return.

Robinhood earns the majority of its revenue from such payments, which are controversial, as it leads to questions about conflicts of interest.

“If a ban or other limitations on it were to be imposed, we believe Robinhood and the industry would adapt,” Warnick said.

Robinhood’s debut will put its message of “democratizing finance” to the test.

If shares soar, it would enrich its traders and generate goodwill after repeated run-ins with regulators. Anything short of that could be another headache for a firm that convinced young investors to jump into stock trading.

As it stands, the California-based brokerage is striving for a valuation as high as US$35 billion. The company is seeking to raise about US$2 billion and will trade under the ticker HOOD.

Merida Industry Co (美利達) has seen signs of recovery in the US and European markets this year, as customers are gradually depleting their inventories, the bicycle maker told shareholders yesterday. Given robust growth in new orders at its Taiwanese factory, coupled with its subsidiaries’ improving performance, Merida said it remains confident about the bicycle market’s prospects and expects steady growth in its core business this year. CAUTION ON CHINA However, the company must handle the Chinese market with great caution, as sales of road bikes there have declined significantly, affecting its revenue and profitability, Merida said in a statement, adding that it would

i Gasoline and diesel prices at fuel stations are this week to rise NT$0.1 per liter, as tensions in the Middle East pushed crude oil prices higher last week, CPC Corp, Taiwan (台灣中油) and Formosa Petrochemical Corp (台塑石化) said yesterday. International crude oil prices last week rose for the third consecutive week due to an escalating conflict between Israel and Iran, as the market is concerned that the situation in the Middle East might affect crude oil supply, CPC and Formosa said in separate statements. Front-month Brent crude oil futures — the international oil benchmark — rose 3.75 percent to settle at US$77.01

RISING: Strong exports, and life insurance companies’ efforts to manage currency risks indicates the NT dollar would eventually pass the 29 level, an expert said The New Taiwan dollar yesterday rallied to its strongest in three years amid inflows to the nation’s stock market and broad-based weakness in the US dollar. Exporter sales of the US currency and a repatriation of funds from local asset managers also played a role, said two traders, who asked not to be identified as they were not authorized to speak publicly. State-owned banks were seen buying the greenback yesterday, but only at a moderate scale, the traders said. The local currency gained 0.77 percent, outperforming almost all of its Asian peers, to close at NT$29.165 per US dollar in Taipei trading yesterday. The

RECORD LOW: Global firms’ increased inventories, tariff disputes not yet impacting Taiwan and new graduates not yet entering the market contributed to the decrease Taiwan’s unemployment rate last month dropped to 3.3 percent, the lowest for the month in 25 years, as strong exports and resilient domestic demand boosted hiring across various sectors, the Directorate-General of Budget, Accounting and Statistics (DGBAS) said yesterday. After seasonal adjustments, the jobless rate eased to 3.34 percent, the best performance in 24 years, suggesting a stable labor market, although a mild increase is expected with the graduation season from this month through August, the statistics agency said. “Potential shocks from tariff disputes between the US and China have yet to affect Taiwan’s job market,” Census Department Deputy Director Tan Wen-ling