Tim Berners-Lee’s source code for the World Wide Web on Wednesday sold for US$5.4 million in the form of non-fungible token (NFT).

Sotheby’s in New York organized the week-long sale of the program that paved the way for the Internet as it functions today, more than 30 years after its creation.

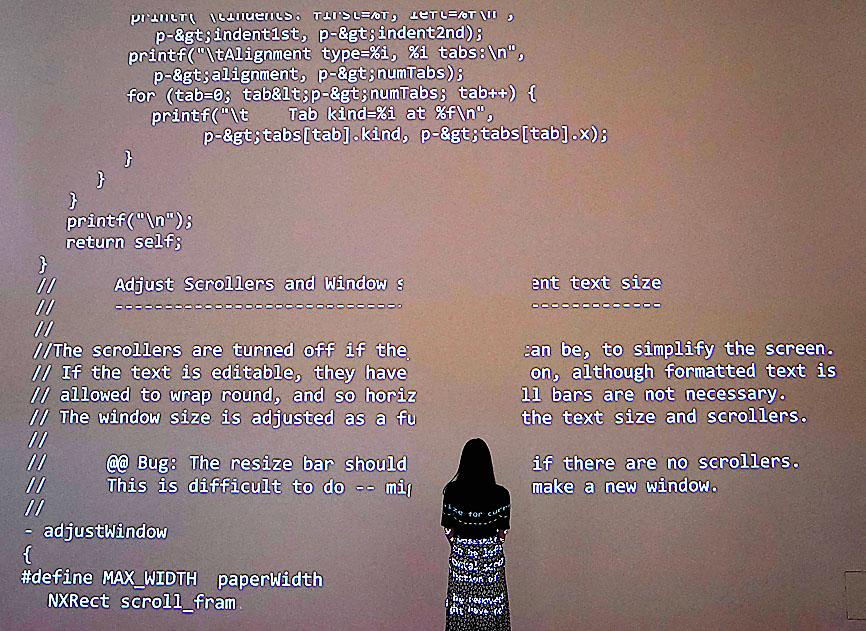

The lot included an animated version of Berners-Lee’s nearly 10,000 lines of code and a letter from the British-born computer scientist himself.

Photo: Timothy A. Clary, AFP

“Ten years ago, we wouldn’t have been able to do this,” Sotheby’s vice president Cassandra Hatton said, referring to the recent boom in NFTs.

This work is unique because of its importance for the creation of the World Wide Web, Hatton said.

“That changed every aspect of your life,” Hatton said. “We don’t even fully comprehend the impact that it has on our lives, and the impact that we will continue to have on our lives.”

Berners-Lee, a physicist-turned-computer scientist, in 1989 envisioned a system of information sharing that would allow scientists to access data from anywhere in the world.

At the time, he was an employee of the CERN Data Center — originally the European Council for Nuclear Research, now the European Organization for Nuclear Research — in Geneva, Switzerland.

He named the new network the World Wide Web.

In 1990 and 1991, he wrote the program that created the first Internet browser, laying the practical foundations for the current Web.

In the process, he also invented the uniform resource locator (Internet address), the hypertext transfer protocol, which allows users to find a site, and hypertext markup language, the standard coding language for creating Web sites.

Determined to make the Web an open space, Berners-Lee did not patent his program, but left it freely available to everyone, which contributed to its spread.

A little more than three decades after its invention, Berners-Lee put the original program files up for sale as a collector’s item.

At the end of the auction, he would receive part of the sale profit, but he intends to donate all of his proceeds to charity.

An NFT is a digital object such as a drawing, animation, piece of music, photo or video with a certificate of authenticity created by blockchain technology, which underlies cryptocurrency. It cannot be forged or otherwise manipulated.

NFTs generate several hundred million dollars in transactions every month.

NFT exchanges take place in cryptocurrencies such as bitcoin on specialist sites, but traditional auction houses are seeking to capitalize on the phenomenon.

The US dollar was trading at NT$29.7 at 10am today on the Taipei Foreign Exchange, as the New Taiwan dollar gained NT$1.364 from the previous close last week. The NT dollar continued to rise today, after surging 3.07 percent on Friday. After opening at NT$30.91, the NT dollar gained more than NT$1 in just 15 minutes, briefly passing the NT$30 mark. Before the US Department of the Treasury's semi-annual currency report came out, expectations that the NT dollar would keep rising were already building. The NT dollar on Friday closed at NT$31.064, up by NT$0.953 — a 3.07 percent single-day gain. Today,

‘SHORT TERM’: The local currency would likely remain strong in the near term, driven by anticipated US trade pressure, capital inflows and expectations of a US Fed rate cut The US dollar is expected to fall below NT$30 in the near term, as traders anticipate increased pressure from Washington for Taiwan to allow the New Taiwan dollar to appreciate, Cathay United Bank (國泰世華銀行) chief economist Lin Chi-chao (林啟超) said. Following a sharp drop in the greenback against the NT dollar on Friday, Lin told the Central News Agency that the local currency is likely to remain strong in the short term, driven in part by market psychology surrounding anticipated US policy pressure. On Friday, the US dollar fell NT$0.953, or 3.07 percent, closing at NT$31.064 — its lowest level since Jan.

The New Taiwan dollar and Taiwanese stocks surged on signs that trade tensions between the world’s top two economies might start easing and as US tech earnings boosted the outlook of the nation’s semiconductor exports. The NT dollar strengthened as much as 3.8 percent versus the US dollar to 30.815, the biggest intraday gain since January 2011, closing at NT$31.064. The benchmark TAIEX jumped 2.73 percent to outperform the region’s equity gauges. Outlook for global trade improved after China said it is assessing possible trade talks with the US, providing a boost for the nation’s currency and shares. As the NT dollar

The Financial Supervisory Commission (FSC) yesterday met with some of the nation’s largest insurance companies as a skyrocketing New Taiwan dollar piles pressure on their hundreds of billions of dollars in US bond investments. The commission has asked some life insurance firms, among the biggest Asian holders of US debt, to discuss how the rapidly strengthening NT dollar has impacted their operations, people familiar with the matter said. The meeting took place as the NT dollar jumped as much as 5 percent yesterday, its biggest intraday gain in more than three decades. The local currency surged as exporters rushed to