Taiwan moved up three spots from last year to place eighth, its best performance since 2013, in the latest annual world competitiveness rankings, released yesterday by the International Institute for Management Development (IMD).

Innovation, digitalization, welfare benefits and social cohesion are critical to economic performance, with Switzerland, Sweden, Denmark, the Netherlands and Singapore making up the top five on the list this year, the Switzerland-based institute said, after grading 64 countries and regions based on economic performance, infrastructure, and government and business efficiency.

“Leading performers are characterized by varying degrees of investment in innovation, diversified economic activities and supportive public policy,” IMD World Competitiveness Center director Arturo Bris said in a statement.

Photo courtesy of National Development Council

Strength in these areas prior to the COVID-19 pandemic allowed these economies to cope with the economic implications of the virus crisis more effectively, Bris said.

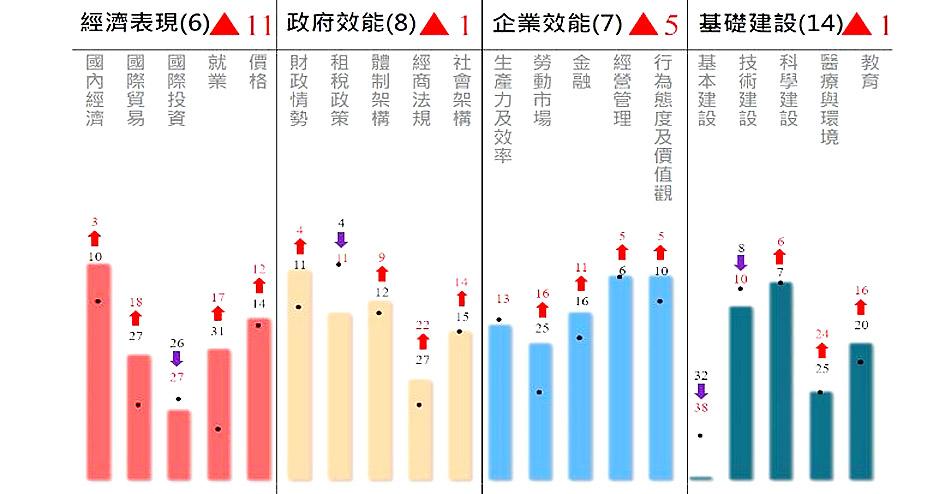

Taiwan improved in all four areas, with its economic performance making the biggest leap from 17th to sixth place, the report showed.

It is one of the few economies that registered concrete GDP growth last year and continues to thrive this year.

Taiwan’s business efficiency also improved significantly, moving from 12th to seventh place, IMD said, adding that the nation moved up one place in government efficiency and infrastructure to eighth and 14th place respectively.

Taiwan faces various challenges, including the promotion of technology innovation and enhancing its international cooperation, as well as improving domestic and foreign investment, to seize opportunities created by a global recovery in the post-pandemic era, IMD said.

Taiwan needs to cultivate, retain and recruit digital talent, the institute said, adding that it also needs to foster social cohesion and social inclusion.

In addition, Taiwan has to reinforce energy saving and carbon reduction to ensure environmental sustainability, in line with a major global trend, it said.

South Korea’s equity benchmark yesterday crossed a new milestone just a month after surpassing the once-unthinkable 5,000 mark as surging global memory demand powers the country’s biggest chipmakers. The KOSPI advanced as much as 2.6 percent to a record 6,123, with Samsung Electronics Co and SK Hynix Inc each gaining more than 2 percent. With the benchmark now up 45 percent this year, South Korea’s stock market capitalization has also moved past France’s, following last month’s overtaking of Germany’s. Long overlooked by foreign funds, despite being undervalued, South Korean stocks have now emerged as clear winners in the global market. The so-called “artificial intelligence

Chinese artificial intelligence (AI) start-up DeepSeek’s (深度求索) latest AI model, set to be released as soon as next week, was trained on Nvidia Corp’s most advanced AI chip, the Blackwell, a senior official of US President Donald Trump’s administration said on Monday, in what could represent a violation of US export controls. The US believes DeepSeek will remove the technical indicators that might reveal its use of American AI chips, the official said, adding that the Blackwells are likely clustered at its data center in Inner Mongolia, an autonomous region of China. The person declined to say how the US government received

‘SEISMIC SHIFT’: The researcher forecast there would be about 1.1 billion mobile shipments this year, down from 1.26 billion the prior year and erasing years of gains The global smartphone market is expected to contract 12.9 percent this year due to the unprecedented memorychip shortage, marking “a crisis like no other,” researcher International Data Corp (IDC) said. The new forecast, a dramatic revision down from earlier estimates, gives the latest accounting of the ongoing memory crunch that is affecting every corner of the electronics industry. The demand for advanced memory to power artificial intelligence (AI) tasks has drained global supply until well into next year and jeopardizes the business model of many smartphone makers. IDC forecast about 1.1 billion mobile shipments this year, down from 1.26 billion the prior

FORTUNES REVERSED: The new 15 percent levies left countries with a 10 percent tariff worse off and stripped away the advantage of those with a 15 percent rate In a swift reversal of fortunes, countries that had been hardest hit by US President Donald Trump’s tariffs have emerged as the biggest winners from the US Supreme Court’s decision to strike down his emergency levies. China, India and Brazil are among those now seeing lower tariff rates for shipments to the US after the court ruled Trump’s use of the International Emergency Economic Powers Act to impose duties was illegal. While Trump subsequently announced plans for a 15 percent global rate, Bloomberg Economics said that would mean an average effective tariff rate of about 12 percent — the lowest since