GlobalFoundries Inc asked a judge to rule that it does not owe US$2.5 billion to International Business Machines Corp (IBM) over a 2014 deal in which the semiconductor maker agreed to take an unprofitable chip-manufacturing unit off IBM’s hands.

In a complaint filed on Monday in New York Supreme Court, GlobalFoundries is seeking a declaratory judgment that it did not breach the agreement and said IBM is threatening to sue.

The suit comes as GlobalFoundries works with banks on an initial public offering (IPO) that could value the chipmaker at about US$30 billion.

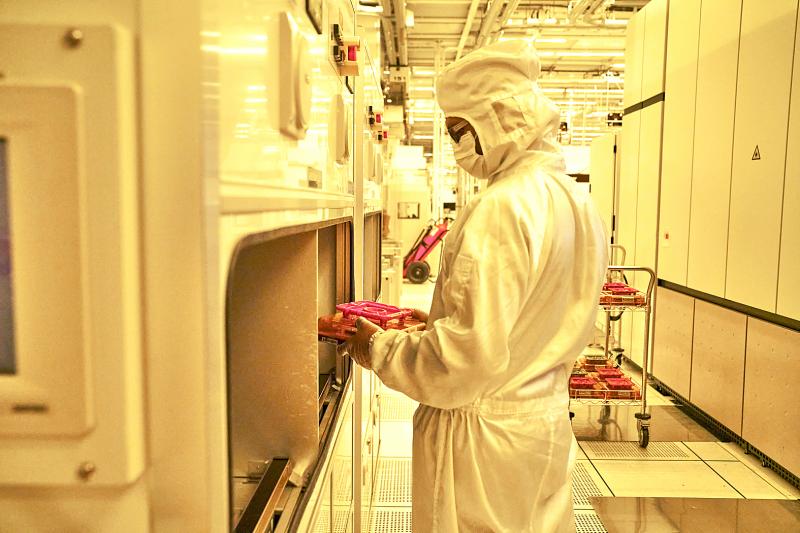

Photo: Bloomberg

“This action arises out of what seems to be a misguided and ill-conceived effort by IBM’s law department to try to extract an outlandish payment,” GlobalFoundries said its in complaint.

IBM agreed in 2014 to pay GlobalFoundries US$1.5 billion for GlobalFoundries to acquire the unit. As part of the deal, GlobalFoundries became IBM’s exclusive provider of certain power processors for the next 10 years, in exchange for access to IBM’s intellectual property. GlobalFoundries acquired manufacturing facilities in East Fishkill, New York, and Essex Junction, Vermont.

In its lawsuit, GlobalFoundries said IBM’s request for damages is “highly suspect,” as it follows news of the potential IPO.

GlobalFoundries also said that IBM “has yet to provide any substantive explanation” to its claims over the alleged breach.

GlobalFoundries said in its lawsuit that it invested billions of dollars to develop cutting-edge chipmaking technology, but that it decided not to pursue IBM’s “failing strategy” and notified IBM in 2018.

According to the filing, development of the chip technology was more challenging and expensive than initially anticipated, causing delays in the project’s targeted milestones.

GlobalFoundries said it spent more money to catch up, but still fell behind competitors including Samsung Electronics Co and Taiwan Semiconductor Manufacturing Co (台積電).

It also said IBM was “well aware” of delays and the switch to Samsung was beneficial for the company, as it was cheaper and faster than GlobalFoundries would have been able to deliver.

IBM did not complain about GlobalFoundries’ actions until news of its potential IPO broke, and it now seeks “a quick payday,” GlobalFoundries said.

A call and e-mail to IBM was not immediately returned.

South Korea’s equity benchmark yesterday crossed a new milestone just a month after surpassing the once-unthinkable 5,000 mark as surging global memory demand powers the country’s biggest chipmakers. The KOSPI advanced as much as 2.6 percent to a record 6,123, with Samsung Electronics Co and SK Hynix Inc each gaining more than 2 percent. With the benchmark now up 45 percent this year, South Korea’s stock market capitalization has also moved past France’s, following last month’s overtaking of Germany’s. Long overlooked by foreign funds, despite being undervalued, South Korean stocks have now emerged as clear winners in the global market. The so-called “artificial intelligence

NEW IDENTITY: Known for its software, India has expanded into hardware, with its semiconductor industry growing from US$38bn in 2023 to US$45bn to US$50bn India on Saturday inaugurated its first semiconductor assembly and test facility, a milestone in the government’s push to reduce dependence on foreign chipmakers and stake a claim in a sector dominated by China. Indian Prime Minister Narendra Modi opened US firm Micron Technology Inc’s semiconductor assembly, test and packaging unit in his home state of Gujarat, hailing the “dawn of a new era” for India’s technology ambitions. “When young Indians look back in the future, they will see this decade as the turning point in our tech future,” Modi told the event, which was broadcast on his YouTube channel. The plant would convert

‘SEISMIC SHIFT’: The researcher forecast there would be about 1.1 billion mobile shipments this year, down from 1.26 billion the prior year and erasing years of gains The global smartphone market is expected to contract 12.9 percent this year due to the unprecedented memorychip shortage, marking “a crisis like no other,” researcher International Data Corp (IDC) said. The new forecast, a dramatic revision down from earlier estimates, gives the latest accounting of the ongoing memory crunch that is affecting every corner of the electronics industry. The demand for advanced memory to power artificial intelligence (AI) tasks has drained global supply until well into next year and jeopardizes the business model of many smartphone makers. IDC forecast about 1.1 billion mobile shipments this year, down from 1.26 billion the prior

People stand in a Pokemon store in Tokyo on Thursday. One of the world highest-grossing franchises is celebrated its 30th anniversary yesterday.