Line Bank Taiwan Ltd (連線商業銀行), the nation’s second Web-only bank, launched on Thursday, but promptly drew a rebuke from the regulator after its system crashed.

The virtual bank launched its banking service, integrated into the messaging app Line offered by its affiliate Line Taiwan Ltd (台灣連線), at about 5pm on Thursday, but users said they could not access the service.

People who clicked on its Web page were greeted by either a blank page or a “server is busy” message.

Photo: Kao Shih-ching, Taipei Times

That was contrary to the bank’s claims that people would be able to open an account within six minutes and its promise of a smooth system as it had conducted numerous stress tests.

The bank issued a statement on Thursday evening attributing the crash to a system overload caused by too many people using the service.

It said that it was trying to fix the problem as quickly as possible and suggested that users try again the following day.

In another statement issued at 11pm on Thursday, it said that it had solved the problem and people should have been able to use the service from 10pm.

The situation drew the ire of the Financial Supervisory Commission, with Banking Bureau Director-General Sherri Chuang (莊琇媛) telling reporters on Thursday that the commission had explicitly demanded that the bank conduct stress tests to prevent a system failure.

“Banks’ core operating system, which includes opening an account, should not break down for longer than two hours, as that would significantly affect customers’ rights,” Chuang said.

The commission would conduct an investigation and demand that the bank submit an improvement plan, she said.

At a news conference in Taipei earlier on Thursday, Line Bank announced several services, with an eye to attracting 500,000 new customers by the end of June.

The services include an installment savings program, which allows clients to build up their savings gradually by making fixed monthly deposits into their accounts, Line Bank general manager Morris Huang (黃以孟) said.

“Many conventional banks have dropped this service, but we decided to offer it, as it would allow clients to customize their savings plans,” he said.

Customers could choose deposit terms ranging from four months to two years, with the minimum deposit set at NT$10,000 (US$356) and the maximum at NT$3 million, Huang said.

The nearer customers are to reaching their savings goal, the higher the interest the bank would offer as an incentive, he said.

For example, if a customer aims to save NT$10,000 in four months, the bank would gradually raise its interest rate from 0.25 percent to 0.5 percent and further to 0.75 percent, he said.

Interest rates could go as high as 1.62 percent for customers who choose a 24-month savings plan, he said.

The bank plans to offer debit cards, but not credit cards for the time being, he said.

Calling the bank’s debit card “the best debit card in Taiwan,” Huang said it would reward cardholders with Line points immediately after they make payments using the card.

The card could be used as an iPass card and be linked to Line Pay Money, an electronic payment service offered by the virtual bank’s affiliate LINE Biz+.

SEMICONDUCTOR SERVICES: A company executive said that Taiwanese firms must think about how to participate in global supply chains and lift their competitiveness Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) yesterday said it expects to launch its first multifunctional service center in Pingtung County in the middle of 2027, in a bid to foster a resilient high-tech facility construction ecosystem. TSMC broached the idea of creating a center two or three years ago when it started building new manufacturing capacity in the US and Japan, the company said. The center, dubbed an “ecosystem park,” would assist local manufacturing facility construction partners to upgrade their capabilities and secure more deals from other global chipmakers such as Intel Corp, Micron Technology Inc and Infineon Technologies AG, TSMC said. It

EXPORT GROWTH: The AI boom has shortened chip cycles to just one year, putting pressure on chipmakers to accelerate development and expand packaging capacity Developing a localized supply chain for advanced packaging equipment is critical for keeping pace with customers’ increasingly shrinking time-to-market cycles for new artificial intelligence (AI) chips, Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) said yesterday. Spurred on by the AI revolution, customers are accelerating product upgrades to nearly every year, compared with the two to three-year development cadence in the past, TSMC vice president of advanced packaging technology and service Jun He (何軍) said at a 3D IC Global Summit organized by SEMI in Taipei. These shortened cycles put heavy pressure on chipmakers, as the entire process — from chip design to mass

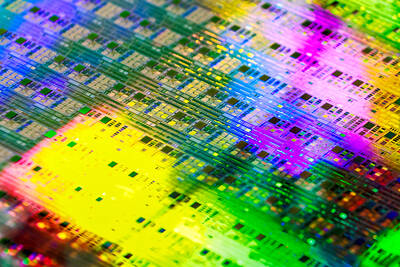

People walk past advertising for a Syensqo chip at the Semicon Taiwan exhibition in Taipei yesterday.

NO BREAKTHROUGH? More substantial ‘deliverables,’ such as tariff reductions, would likely be saved for a meeting between Trump and Xi later this year, a trade expert said China launched two probes targeting the US semiconductor sector on Saturday ahead of talks between the two nations in Spain this week on trade, national security and the ownership of social media platform TikTok. China’s Ministry of Commerce announced an anti-dumping investigation into certain analog integrated circuits (ICs) imported from the US. The investigation is to target some commodity interface ICs and gate driver ICs, which are commonly made by US companies such as Texas Instruments Inc and ON Semiconductor Corp. The ministry also announced an anti-discrimination probe into US measures against China’s chip sector. US measures such as export curbs and tariffs