Taiwan Pelican Express Co’s (台灣宅配通) board of directors has approved a proposal to distribute a cash dividend of NT$1.8 per share, the highest in the company’s history, as its net profit rose 29 percent annually last year thanks to booming e-commerce sales.

The home delivery service provider had offered cash dividends ranging from NT$0.45 to NT$1.2 per share from 2012 to last year, company data showed.

The proposal suggested a payout ratio of 82 percent, based on Taiwan Pelican’s earnings per share of NT$2.19 last year — up from NT$1.69 in 2019 — and a dividend yield of 5.57 percent given its share price of NT$32.3 yesterday.

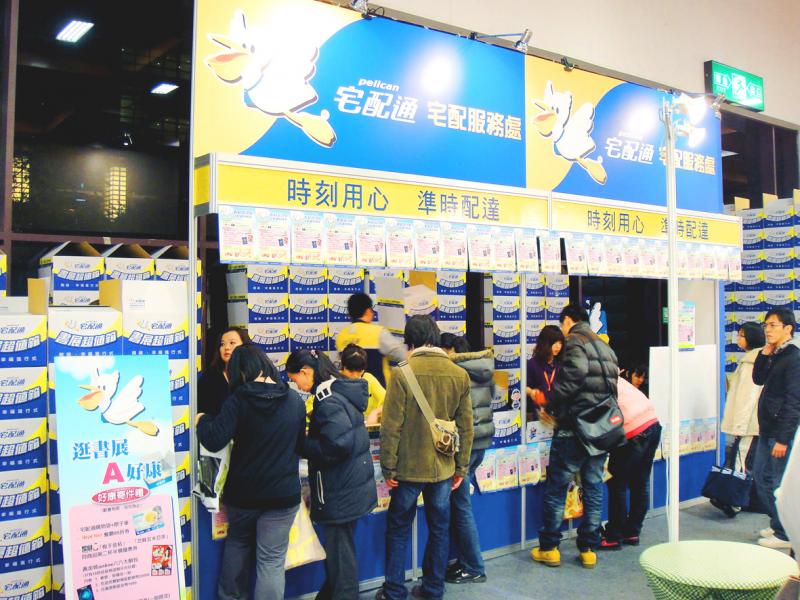

Photo: CNA

The total planned dividend payout would be NT$171.84 million (US$6.07 million), it said in a filing with the Taiwan Stock Exchange on Friday.

Launched in 2000, Taiwan Pelican offers customer-to-customer, business-to-customer and customer-to-business delivery services.

Last year, the company’s net profit grew 29 percent year-on-year to NT$209 million.

It reported revenue of NT$3.98 billion, which increased 7.3 percent annually due to rising demand for parcel shipments as more people were shopping online amid the COVID-19 outbreak, Taiwan Pelican said.

Gross margin improved to 17.2 percent, from 16.62 percent a year earlier, company data showed.

Taiwan Pelican, which has 16 logistics and warehousing centers and owns 1,100 delivery trucks, said that it would expand its same-day delivery service to attract new customers and raise its efficiency by installing smart conveyor systems in two centers so that packages could be automatically categorized and distributed.

Meanwhile, Dimerco Express Group (中菲行), which offers global freight-forwarding and logistics services, saw its net profit jump 170 percent year-on-year to NT$841 million for the first three quarters of last year, with earnings per share of NT$6.68, up from NT$2.46 a year earlier, company data showed.

The increase could be attributed to an increase in freight rates of air cargo and sea freight, as well as Dimerco’s supply chain management, which helped its clients deliver their goods despite COVID-19-related disruptions, the firm’s spokesperson Jack Ruan (阮耀樟) said by telephone yesterday.

Based on airlines’ and shipping companies’ pricing information, the company expects freight rates to remain at a comparatively high level for the first half of this year, Ruan said.

Among the rows of vibrators, rubber torsos and leather harnesses at a Chinese sex toys exhibition in Shanghai this weekend, the beginnings of an artificial intelligence (AI)-driven shift in the industry quietly pulsed. China manufactures about 70 percent of the world’s sex toys, most of it the “hardware” on display at the fair — whether that be technicolor tentacled dildos or hyper-realistic personalized silicone dolls. Yet smart toys have been rising in popularity for some time. Many major European and US brands already offer tech-enhanced products that can enable long-distance love, monitor well-being and even bring people one step closer to

TRANSFORMATION: Taiwan is now home to the largest Google hardware research and development center outside of the US, thanks to the nation’s economic policies President Tsai Ing-wen (蔡英文) yesterday attended an event marking the opening of Google’s second hardware research and development (R&D) office in Taiwan, which was held at New Taipei City’s Banciao District (板橋). This signals Taiwan’s transformation into the world’s largest Google hardware research and development center outside of the US, validating the nation’s economic policy in the past eight years, she said. The “five plus two” innovative industries policy, “six core strategic industries” initiative and infrastructure projects have grown the national industry and established resilient supply chains that withstood the COVID-19 pandemic, Tsai said. Taiwan has improved investment conditions of the domestic economy

Malaysia’s leader yesterday announced plans to build a massive semiconductor design park, aiming to boost the Southeast Asian nation’s role in the global chip industry. A prominent player in the semiconductor industry for decades, Malaysia accounts for an estimated 13 percent of global back-end manufacturing, according to German tech giant Bosch. Now it wants to go beyond production and emerge as a chip design powerhouse too, Malaysian Prime Minister Anwar Ibrahim said. “I am pleased to announce the largest IC (integrated circuit) Design Park in Southeast Asia, that will house world-class anchor tenants and collaborate with global companies such as Arm [Holdings PLC],”

MAJOR BENEFICIARY: The company benefits from TSMC’s advanced packaging scarcity, given robust demand for Nvidia AI chips, analysts said ASE Technology Holding Co (ASE, 日月光投控), the world’s biggest chip packaging and testing service provider, yesterday said it is raising its equipment capital expenditure budget by 10 percent this year to expand leading-edge and advanced packing and testing capacity amid strong artificial intelligence (AI) and high-performance computing chip demand. This is on top of the 40 to 50 percent annual increase in its capital spending budget to more than the US$1.7 billion to announced in February. About half of the equipment capital expenditure would be spent on leading-edge and advanced packaging and testing technology, the company said. ASE is considered by analysts