The EU is considering building an advanced semiconductor factory in Europe in an attempt to avoid relying on the US and Asia for technology at the heart of some of its major industries.

The EU is exploring how to produce semiconductors with features smaller than 10 nanometers, and eventually down to 2-nanometer chips, according to people familiar with the project. The aim is to curtail dependence on countries such as Taiwan for chips to power 5G wireless systems, connected cars, high-performance computing and more.

Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) and Samsung Electronics Co of South Korea, the two leaders making the most innovative processors in the sector, could be involved in the EU project, but nothing has been decided, a French Finance Ministry official said in a press briefing on Thursday, following the report from Bloomberg.

Photo: Sam Yeh / AFP

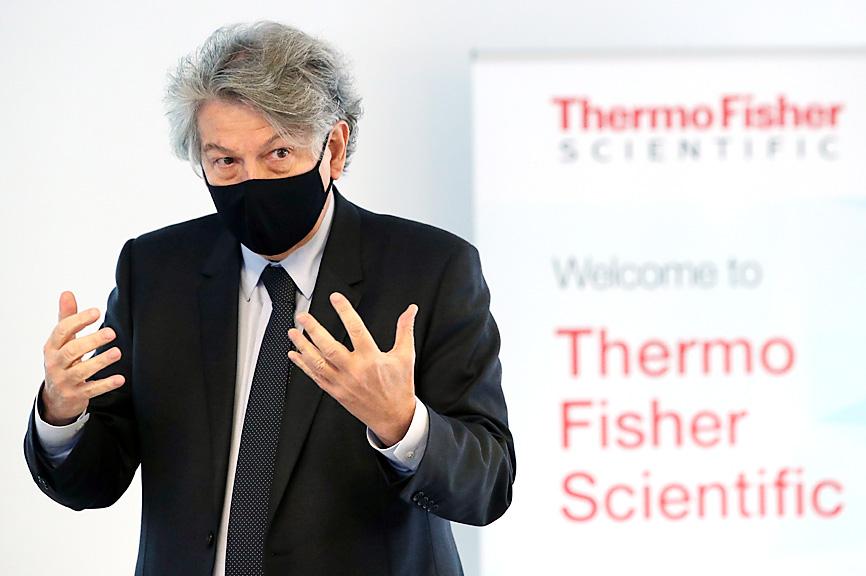

European attempts to ramp up production — led in part by European Industry Commissioner Thierry Breton — could involve redeveloping an existing foundry or building a new one, the people said, adding that no final decision has been taken and the time frame of the project is still to be determined.

“When it comes to fab location selection, we need to consider many factors including customers’ need. TSMC does not rule out any possibility, but there is no concrete plan at this time,” TSMC spokeswoman Nina Kao (高孟華) said in an e-mail when asked about cooperating with Europe.

Once a hub of semiconductor factories, Europe has dramatically cut back on manufacturing over the past 20 years, with automotive-chip designers including NXP Semiconductors NV and Infineon Technologies AG preferring to outsource a major chunk of production to giants like TSMC, and other foundries. When carmakers wanted to increase orders at the end of last year, they struggled to secure capacity, after demand had already been allocated to other industries such as smartphones.

Photo: Reuters

The EU outlined a goal last year to produce at least one-fifth of the world’s chips and microprocessors by value, without giving details on how this would be achieved.

“Without an autonomous European capacity on microelectronics, there will be no European digital sovereignty,” Breton said in a speech, adding that Europe currently accounts for less than 10 percent of global production of processors and other microelectronics.

To reach those goals, the European Commission said it would launch a European alliance on microelectronics, which will likely include Europe’s major chipmakers and possibly also carmakers and telecom companies.

Technical work is ongoing to map out a plan for the alliance, but initial discussions about the fabrication plans have already taken place, according to people familiar with the matter. The alliance is due to be formally unveiled at the end of the first quarter of the year.

Europe’s plans to reinvest in leading-edge chip fabrication may be too little, too late as China, Japan and the US all try to increase or regain their self-sufficiency in semiconductors.

But all are slipping further behind industry leaders Samsung and especially TSMC, which announced capital spending of as much as US$28 billion for this year, and the Asian companies, whose current leading-edge chips are 5nm, have plans to go down to the even more advanced 3nm, while GlobalFoundries Inc is Europe’s main foundry, which typically produces 28nm processors at its Dresden factory for mainstream applications.

The industry has also spent decades crafting a well-oiled global supply chain that would be difficult to change overnight, according to Peter Wennink, chief executive officer of ASML Holding NV of the Netherlands, which has an effective monopoly on the machines needed to fabricate the best chips. Regions will have to rebuild a local ecosystem, which in turn would likely raise costs.

“If you think that you can actually replicate that within a very short term, it’s simply not possible,” Wennink said at ASML’s full-year earnings press conference last month. “If governments are determined to do this, it will take years to break this up, and not months.”

One of the biggest hurdles for the EU’s semiconductor plans could come down to financing. At a conference last week, French Finance Minister Bruno LeMaire said Europe’s industrial projects, including on semiconductors, are all very investment intensive.

“One of the weak points is the access to risk capital in Europe and the implementation of the capital market in Europe,” he said.

Breton said last year the chip alliance would be armed with an initial combined public and private investment of as much as 30 billion euros, only slightly higher than TSMC’s annual capital expenditure this year.

Around 19 member states have already backed the commission’s plans and have agreed to establish an investment instrument co-financed by the countries and participating companies.

South Korea’s equity benchmark yesterday crossed a new milestone just a month after surpassing the once-unthinkable 5,000 mark as surging global memory demand powers the country’s biggest chipmakers. The KOSPI advanced as much as 2.6 percent to a record 6,123, with Samsung Electronics Co and SK Hynix Inc each gaining more than 2 percent. With the benchmark now up 45 percent this year, South Korea’s stock market capitalization has also moved past France’s, following last month’s overtaking of Germany’s. Long overlooked by foreign funds, despite being undervalued, South Korean stocks have now emerged as clear winners in the global market. The so-called “artificial intelligence

Chinese artificial intelligence (AI) start-up DeepSeek’s (深度求索) latest AI model, set to be released as soon as next week, was trained on Nvidia Corp’s most advanced AI chip, the Blackwell, a senior official of US President Donald Trump’s administration said on Monday, in what could represent a violation of US export controls. The US believes DeepSeek will remove the technical indicators that might reveal its use of American AI chips, the official said, adding that the Blackwells are likely clustered at its data center in Inner Mongolia, an autonomous region of China. The person declined to say how the US government received

‘SEISMIC SHIFT’: The researcher forecast there would be about 1.1 billion mobile shipments this year, down from 1.26 billion the prior year and erasing years of gains The global smartphone market is expected to contract 12.9 percent this year due to the unprecedented memorychip shortage, marking “a crisis like no other,” researcher International Data Corp (IDC) said. The new forecast, a dramatic revision down from earlier estimates, gives the latest accounting of the ongoing memory crunch that is affecting every corner of the electronics industry. The demand for advanced memory to power artificial intelligence (AI) tasks has drained global supply until well into next year and jeopardizes the business model of many smartphone makers. IDC forecast about 1.1 billion mobile shipments this year, down from 1.26 billion the prior

FORTUNES REVERSED: The new 15 percent levies left countries with a 10 percent tariff worse off and stripped away the advantage of those with a 15 percent rate In a swift reversal of fortunes, countries that had been hardest hit by US President Donald Trump’s tariffs have emerged as the biggest winners from the US Supreme Court’s decision to strike down his emergency levies. China, India and Brazil are among those now seeing lower tariff rates for shipments to the US after the court ruled Trump’s use of the International Emergency Economic Powers Act to impose duties was illegal. While Trump subsequently announced plans for a 15 percent global rate, Bloomberg Economics said that would mean an average effective tariff rate of about 12 percent — the lowest since