Bitcoin yesterday hit a fresh record above US$47,000 after Tesla Inc’s announcement of a US$1.5 billion investment in the largest cryptocurrency.

The token rose as much as 6.3 percent to almost US$47,493 in Asian trading before paring some of the gains. It was at about US$46,455 as of 12:22pm in Hong Kong.

Tesla’s disclosure on Monday sent the price soaring.

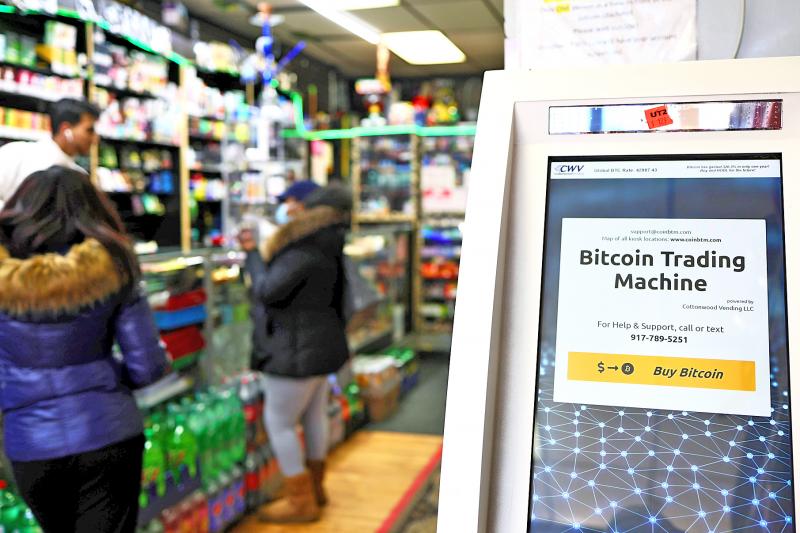

Photo: AFP

The company also said it would begin accepting the digital token as a form of payment for its electric vehicles.

The developments amounted to the biggest endorsement of the controversial cryptocurrency by a mainstream firm.

Elon Musk, Tesla’s chief executive officer and the world’s richest man, has for weeks been commenting about digital coins, buffeting their prices.

“One by one, corporations will add bitcoin to their balance sheets and it couldn’t get bigger than Tesla,” said Vijay Ayyar, head of Asia Pacific with cryptocurrency exchange Luno in Singapore. “Imagine if 100 companies start putting even 1 percent into bitcoin, what that is going to do to demand and supply.”

A rally was also evident in bitcoin futures, suggesting that shorts were throwing in the towel and signaling traders they would not fight the crypto advance.

The wider Bloomberg Galaxy Crypto Index jumped to a record. Japanese and South Korean cryptocurrency-exposed stocks rose, tracking US and European peers.

Bitcoin’s ascent to its latest summit came with big swings that continue to stoke controversy about its outlook. Predictions for its possible long-term price range from US$400,000 and more to zero. Risks for cryptocurrencies range from tightening rules to concerns about their use in terrorist and criminal financing.

Proponents cite backing from the likes of Musk and signs of interest from long-term investors as evidence of a durable bitcoin rally. They envisage a role for the token as a hedge for risks such as faster inflation, akin to gold. Skeptics see speculators at work and echoes of the 2017 boom that turned to bust.

“The crypto craze is entirely driven by short-term speculative momentum/mania,” Oanda Asia Pacific Pte senior market analyst Jeffrey Halley wrote in e-mailed comments. “For all the noise I keep hearing about how high bitcoin may go, the noise around how it will be used in everyday life is deafeningly silent.”

In the wake of Tesla’s investment, Michael Novogratz, founder of crypto investment firm Galaxy Digital, said bitcoin might reach US$100,000 by the end of this year.

Michael Saylor, chief executive officer of MicroStrategy Inc, declared bitcoin the “scarcest asset” in the world.

Bitcoin is designed to have a fixed supply of 21 million coins, underpinned by a digital ledger distributed across computer networks. It has more than quadrupled over the past year.

Commentators have cited demand from day traders, wealthy buyers, hedge funds, companies and even interest from usually staid investors like insurers.

Among the rows of vibrators, rubber torsos and leather harnesses at a Chinese sex toys exhibition in Shanghai this weekend, the beginnings of an artificial intelligence (AI)-driven shift in the industry quietly pulsed. China manufactures about 70 percent of the world’s sex toys, most of it the “hardware” on display at the fair — whether that be technicolor tentacled dildos or hyper-realistic personalized silicone dolls. Yet smart toys have been rising in popularity for some time. Many major European and US brands already offer tech-enhanced products that can enable long-distance love, monitor well-being and even bring people one step closer to

Malaysia’s leader yesterday announced plans to build a massive semiconductor design park, aiming to boost the Southeast Asian nation’s role in the global chip industry. A prominent player in the semiconductor industry for decades, Malaysia accounts for an estimated 13 percent of global back-end manufacturing, according to German tech giant Bosch. Now it wants to go beyond production and emerge as a chip design powerhouse too, Malaysian Prime Minister Anwar Ibrahim said. “I am pleased to announce the largest IC (integrated circuit) Design Park in Southeast Asia, that will house world-class anchor tenants and collaborate with global companies such as Arm [Holdings PLC],”

TRANSFORMATION: Taiwan is now home to the largest Google hardware research and development center outside of the US, thanks to the nation’s economic policies President Tsai Ing-wen (蔡英文) yesterday attended an event marking the opening of Google’s second hardware research and development (R&D) office in Taiwan, which was held at New Taipei City’s Banciao District (板橋). This signals Taiwan’s transformation into the world’s largest Google hardware research and development center outside of the US, validating the nation’s economic policy in the past eight years, she said. The “five plus two” innovative industries policy, “six core strategic industries” initiative and infrastructure projects have grown the national industry and established resilient supply chains that withstood the COVID-19 pandemic, Tsai said. Taiwan has improved investment conditions of the domestic economy

Sales in the retail, and food and beverage sectors last month continued to rise, increasing 0.7 percent and 13.6 percent respectively from a year earlier, setting record highs for the month of March, the Ministry of Economic Affairs said yesterday. Sales in the wholesale sector also grew last month by 4.6 annually, mainly due to the business opportunities for emerging applications related to artificial intelligence (AI) and high-performance computing technologies, the ministry said in a report. The ministry forecast that retail, and food and beverage sales this month would retain their growth momentum as the former would benefit from Tomb Sweeping Day