European stocks on Friday snapped four weeks of gains, as the prospect of tighter lockdowns, slow vaccine shipments to the continent and resurgent COVID-19 cases in China dampened hopes of a speedy economic recovery.

The pan-European STOXX 600 index closed down 1.01 percent at 407.85 in its worst session since Dec. 21, with losses accelerating after Wall Street stocks tumbled following big bank earnings.

The STOXX 600 logged a 0.81 percent weekly decline, its first since the middle of last month.

Adding to worries, some EU nations are receiving fewer than expected doses of COVID-19 vaccines as US pharmaceutical firm Pfizer slowed shipments of the vaccine developed with German partner BioNTech. BioNTech shares dropped 2.2 percent.

German Chancellor Angela Merkel called for “very fast action” to counter the spread of COVID-19 as the country saw a record number of virus-related deaths, while France said that it would bolster its border controls from tomorrow.

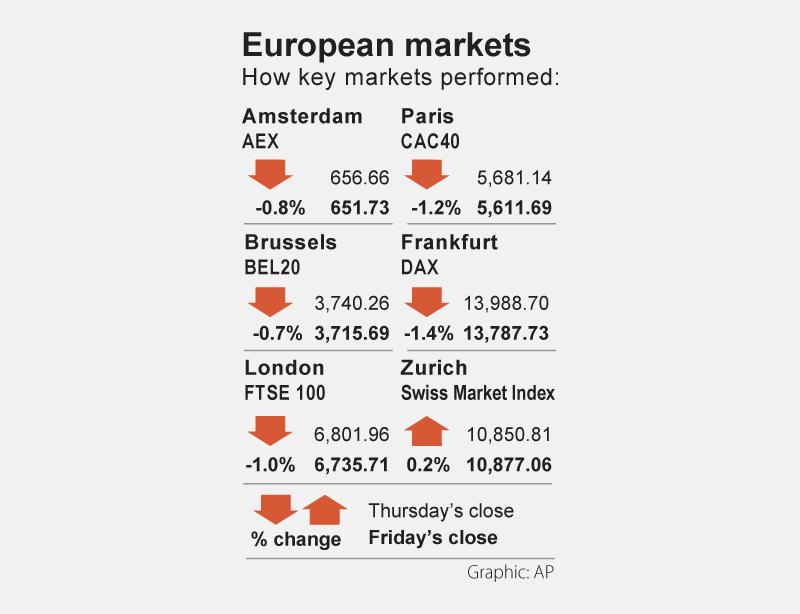

The German DAX dropped 1.44 percent to 13,787.73, a weekly decline of 1.86 percent, and France’s CAC 40 fell 1.22 percent to 5,611.69, losing 1.67 percent on the week

In London, the FTSE 100 dropped 0.97 percent to 6,735.71, despite data showing that the UK’s economy recorded a smaller-than-expected contraction in November.

The FTSE 100 declined 2 percent from a week earlier.

The mining, and oil and gas sectors slumped 3.1 percent and 2.6 percent, respectively, after Chinese authorities put more than 28 million people under new lockdowns, raising concerns about demand from the major consumer of commodities.

Hopes of a large US fiscal stimulus sent the STOXX 600 to a 11-month peak earlier this week, but markets retreated after US president-elect Joe Biden outlined a US$1.9 trillion proposal that raised worries of a tax hike.

“Market positioning had been quite aggressive, so I suppose it is a pause for breath,” said Roger Jones, head of equities at London & Capital. “The rollout and the speed of vaccination is becoming increasingly important and the market is willing to look through a period of extended lockdown if it’s a relatively short period.”

German business software group SAP closed down 0.7 percent, reversing early gains after it released preliminary annual results that came at the high end of guidance.

Siemens Energy AG fell 6.3 percent after General Electric Co accused a subsidiary of the power distribution company of using stolen trade secrets to rig bids for lucrative contracts.

French grocer Carrefour fell almost 3 percent after the French government all but killed off a possible US$20 billion takeover by Canada’s Alimentation Couche Tard.

Additional reporting by staff writer.

Among the rows of vibrators, rubber torsos and leather harnesses at a Chinese sex toys exhibition in Shanghai this weekend, the beginnings of an artificial intelligence (AI)-driven shift in the industry quietly pulsed. China manufactures about 70 percent of the world’s sex toys, most of it the “hardware” on display at the fair — whether that be technicolor tentacled dildos or hyper-realistic personalized silicone dolls. Yet smart toys have been rising in popularity for some time. Many major European and US brands already offer tech-enhanced products that can enable long-distance love, monitor well-being and even bring people one step closer to

TRANSFORMATION: Taiwan is now home to the largest Google hardware research and development center outside of the US, thanks to the nation’s economic policies President Tsai Ing-wen (蔡英文) yesterday attended an event marking the opening of Google’s second hardware research and development (R&D) office in Taiwan, which was held at New Taipei City’s Banciao District (板橋). This signals Taiwan’s transformation into the world’s largest Google hardware research and development center outside of the US, validating the nation’s economic policy in the past eight years, she said. The “five plus two” innovative industries policy, “six core strategic industries” initiative and infrastructure projects have grown the national industry and established resilient supply chains that withstood the COVID-19 pandemic, Tsai said. Taiwan has improved investment conditions of the domestic economy

Malaysia’s leader yesterday announced plans to build a massive semiconductor design park, aiming to boost the Southeast Asian nation’s role in the global chip industry. A prominent player in the semiconductor industry for decades, Malaysia accounts for an estimated 13 percent of global back-end manufacturing, according to German tech giant Bosch. Now it wants to go beyond production and emerge as a chip design powerhouse too, Malaysian Prime Minister Anwar Ibrahim said. “I am pleased to announce the largest IC (integrated circuit) Design Park in Southeast Asia, that will house world-class anchor tenants and collaborate with global companies such as Arm [Holdings PLC],”

MAJOR BENEFICIARY: The company benefits from TSMC’s advanced packaging scarcity, given robust demand for Nvidia AI chips, analysts said ASE Technology Holding Co (ASE, 日月光投控), the world’s biggest chip packaging and testing service provider, yesterday said it is raising its equipment capital expenditure budget by 10 percent this year to expand leading-edge and advanced packing and testing capacity amid strong artificial intelligence (AI) and high-performance computing chip demand. This is on top of the 40 to 50 percent annual increase in its capital spending budget to more than the US$1.7 billion to announced in February. About half of the equipment capital expenditure would be spent on leading-edge and advanced packaging and testing technology, the company said. ASE is considered by analysts