Garment and fabric supplier Eclat Textile Co (儒鴻) on Monday reported better-than-expected revenue of NT$3.7 billion (US$129.9 million) for last month, up 48.4 percent month-on-month and 35.6 percent year-on-year, as the work-from-home trend and people exercising more amid the COVID-19 pandemic spurred sales of casual clothing and leisure wear.

Driven by restocking demand, revenue increased for a fourth straight month last month and hit a new high, analysts said.

That brought Eclat’s quarterly revenue to NT$9.33 billion, up 26.5 percent quarterly and 20.5 percent annually, beating Jih Sun Securities Investment Consulting Co’s (日盛投顧) estimate of NT$8.19 billion.

Photo: Bloomberg

Although the pandemic initially led to a 13.07 percent annual drop in revenue in the first half of last year, recovering demand, rush orders and new clients lifted sales in the second half, allowing full-year revenue to edge up 0.18 percent to a record NT$28.18 billion.

Analysts said that given container shortages, Eclat’s booking of NT$300 million in sales was delayed from November to last month, while recognition of another NT$400 million in sales would also be delayed from last month to this month.

Given the positive outlook for the company’s orders in the first half of this year, coupled with two major clients revising up their sales estimates for this quarter and improved US apparel retail sales in the past few months, Jih Sun on Monday said it was maintaining its “buy” rating on Eclat shares, with a target price of NT$480.

Yuanta Securities Investment Consulting Co (元大投顧) also retained its “buy” rating on Eclat shares, but raised its target price to NT$535 from NT$480.

“We expect double-digit sales growth for Eclat in 2021 and 2022, with growth returning to the upcycle levels seen in 2013-2015,” Yuanta said in a note on Monday.

“This is mainly due to brand and channel clients accelerating supplier concentration amid the [COVID-19] pandemic, with Eclat seeing continued order growth from Nike Inc and Lululemon Athletica Inc, as well as transferred orders from Target Corp, given its healthy financial structure and large, flexible capacity,” the note said.

Sales to Nike and Lululemon are expected to account for 15 to 16 percent and 8 to 10 percent of its overall sales this year, while Target and Under Armour Inc would make up more than 5 percent each, Yuanta said, adding that the top four clients’ contribution would rise to 40 percent this year from 30 percent last year.

As 90 to 100 percent of Eclat’s sales and 70 to 80 percent of its operating costs are denominated in US dollars, the appreciation of the New Taiwan dollar would affect Eclat’s gross margin, but this is expected to be offset by the company’s improved product mix, expanding economies of scale and average selling price adjustments, Yuanta said.

Eclat shares yesterday rose 2.29 percent to close at NT$425 in Taipei trading.

Taiwan’s exports soared 56 percent year-on-year to an all-time high of US$64.05 billion last month, propelled by surging global demand for artificial intelligence (AI), high-performance computing and cloud service infrastructure, the Ministry of Finance said yesterday. Department of Statistics Director-General Beatrice Tsai (蔡美娜) called the figure an unexpected upside surprise, citing a wave of technology orders from overseas customers alongside the usual year-end shopping season for technology products. Growth is likely to remain strong this month, she said, projecting a 40 percent to 45 percent expansion on an annual basis. The outperformance could prompt the Directorate-General of Budget, Accounting and

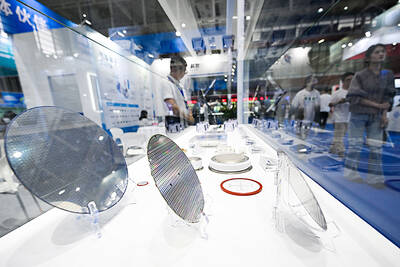

Two Chinese chipmakers are attracting strong retail investor demand, buoyed by industry peer Moore Threads Technology Co’s (摩爾線程) stellar debut. The retail portion of MetaX Integrated Circuits (Shanghai) Co’s (上海沐曦) upcoming initial public offering (IPO) was 2,986 times oversubscribed on Friday, according to a filing. Meanwhile, Beijing Onmicro Electronics Co (北京昂瑞微), which makes radio frequency chips, was 2,899 times oversubscribed on Friday, its filing showed. The bids coincided with Moore Threads’ trading debut, which surged 425 percent on Friday after raising 8 billion yuan (US$1.13 billion) on bets that the company could emerge as a viable local competitor to Nvidia

BARRIERS: Gudeng’s chairman said it was unlikely that the US could replicate Taiwan’s science parks in Arizona, given its strict immigration policies and cultural differences Gudeng Precision Industrial Co (家登), which supplies wafer pods to the world’s major semiconductor firms, yesterday said it is in no rush to set up production in the US due to high costs. The company supplies its customers through a warehouse in Arizona jointly operated by TSS Holdings Ltd (德鑫控股), a joint holding of Gudeng and 17 Taiwanese firms in the semiconductor supply chain, including specialty plastic compounds producer Nytex Composites Co (耐特) and automated material handling system supplier Symtek Automation Asia Co (迅得). While the company has long been exploring the feasibility of setting up production in the US to address

OPTION: Uber said it could provide higher pay for batch trips, if incentives for batching is not removed entirely, as the latter would force it to pass on the costs to consumers Uber Technologies Inc yesterday warned that proposed restrictions on batching orders and minimum wages could prompt a NT$20 delivery fee increase in Taiwan, as lower efficiency would drive up costs. Uber CEO Dara Khosrowshahi made the remarks yesterday during his visit to Taiwan. He is on a multileg trip to the region, which includes stops in South Korea and Japan. His visit coincided the release last month of the Ministry of Labor’s draft bill on the delivery sector, which aims to safeguard delivery workers’ rights and improve their welfare. The ministry set the minimum pay for local food delivery drivers at