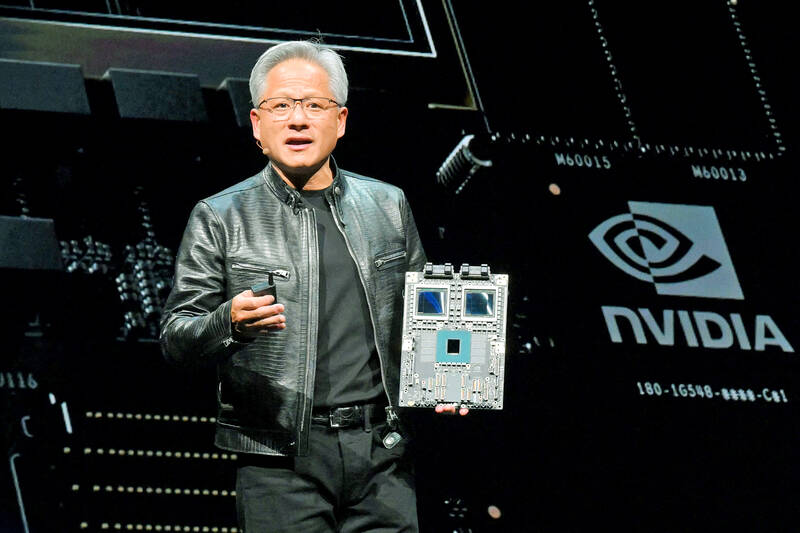

Nvidia Corp CEO Jensen Huang (黃仁勳), whose products have become the hottest commodity in the technology world, on Wednesday said that the scramble for a limited amount of supply has frustrated some customers and raised tensions.

“The demand on it is so great, and everyone wants to be first and everyone wants to be most,” he told the audience at a Goldman Sachs Group Inc technology conference in San Francisco. “We probably have more emotional customers today. Deservedly so. It’s tense. We’re trying to do the best we can.”

Huang’s company is experiencing strong demand for its latest generation of chips, called Blackwell, he told the audience.

Photo: Sam Yeh, AFP

The Santa Clara, California-based business outsources the physical production of its hardware, and Nvidia’s suppliers are making progress in catching up, he said.

Nvidia’s chips are used by data center operators to develop and run artificial intelligence (AI) models. The feverish appetite for such services has sent its sales — and stock price — soaring. The shares have more than doubled this year, following a 239 percent run-up last year.

The stock gained 8.1 percent to US$116.91 in New York on Wednesday, marking its biggest single-day rise in six weeks.

Nvidia counts on a small number of customers — data center operators such as Microsoft Corp and Meta Platforms Inc — for much of its revenue.

Huang was asked whether the massive AI spending is providing customers with a return on investment. That has been a concern during the tech industry’s AI frenzy.

However, he said companies have no choice other than to embrace “accelerated computing.” Nvidia’s technology speeds up conventional workloads — data processing — as well as handling AI tasks that older technology cannot manage, he said.

Nvidia leans heavily on Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) for production of its most important chips and does so because that company is the best in its field by a large margin, Huang said.

However, geopolitical tension has raised risks. China sees Taiwan, where TSMC is based, as a rogue province, stoking concerns that it might try to annex it. That could potentially cut off Nvidia from the key supplier.

Huang said he develops much of the company’s technology in-house and that should allow Nvidia to switch orders to alternative suppliers. Still, such a change would likely result in a reduction in quality of his chips, he said.

TSMC’s “agility and their capability to respond to our needs is just incredible,” he said. “And so we use them because they’re great, but if necessary, of course, we can always bring up others.”

TSMC shares yesterday rose 4.79 percent to close at NT$940 in Taipei trading. The stock has gained 51.94 percent since the beginning of this year.

South Korea’s equity benchmark yesterday crossed a new milestone just a month after surpassing the once-unthinkable 5,000 mark as surging global memory demand powers the country’s biggest chipmakers. The KOSPI advanced as much as 2.6 percent to a record 6,123, with Samsung Electronics Co and SK Hynix Inc each gaining more than 2 percent. With the benchmark now up 45 percent this year, South Korea’s stock market capitalization has also moved past France’s, following last month’s overtaking of Germany’s. Long overlooked by foreign funds, despite being undervalued, South Korean stocks have now emerged as clear winners in the global market. The so-called “artificial intelligence

‘SEISMIC SHIFT’: The researcher forecast there would be about 1.1 billion mobile shipments this year, down from 1.26 billion the prior year and erasing years of gains The global smartphone market is expected to contract 12.9 percent this year due to the unprecedented memorychip shortage, marking “a crisis like no other,” researcher International Data Corp (IDC) said. The new forecast, a dramatic revision down from earlier estimates, gives the latest accounting of the ongoing memory crunch that is affecting every corner of the electronics industry. The demand for advanced memory to power artificial intelligence (AI) tasks has drained global supply until well into next year and jeopardizes the business model of many smartphone makers. IDC forecast about 1.1 billion mobile shipments this year, down from 1.26 billion the prior

NEW IDENTITY: Known for its software, India has expanded into hardware, with its semiconductor industry growing from US$38bn in 2023 to US$45bn to US$50bn India on Saturday inaugurated its first semiconductor assembly and test facility, a milestone in the government’s push to reduce dependence on foreign chipmakers and stake a claim in a sector dominated by China. Indian Prime Minister Narendra Modi opened US firm Micron Technology Inc’s semiconductor assembly, test and packaging unit in his home state of Gujarat, hailing the “dawn of a new era” for India’s technology ambitions. “When young Indians look back in the future, they will see this decade as the turning point in our tech future,” Modi told the event, which was broadcast on his YouTube channel. The plant would convert

People stand in a Pokemon store in Tokyo on Thursday. One of the world highest-grossing franchises is celebrated its 30th anniversary yesterday.