The central bank yesterday denied acting to unfairly boost Taiwan’s exports, as it attributed the nation’s widening trade surpluses with the US to the fallout from US-China trade tensions.

Central bank Governor Yang Chin-long (楊金龍) made the statement after the bank left its policy rediscount rate unchanged at the record low 1.125 percent saying that Taiwan cannot buck the global trend of monetary easing, given its small and open economy.

“Taiwan’s interest comes first when the central bank carries out its duty,” Yang told a news conference in Taipei, one day after the US Department of the Treasury placed Taiwan on its watch list for currency manipulation.

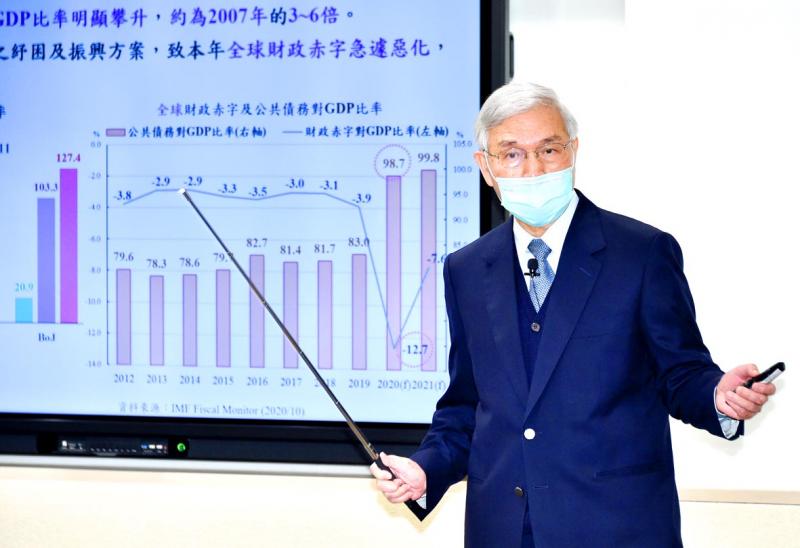

Photo: Tu Chien-jung, Taipei Times

Taiwan could be labeled a currency manipulator in April if its current account surpluses escalate and the central bank’s intervention exceeds 2 percent of the GDP.

However, Yang said it was difficult, if not impossible, to define currency manipulation, and the US watch list is designed to prevent attempts by trade partners to engage in unfair competition through weakening their currency.

The bank would explain how it moderates the foreign exchange market during a briefing to the legislature in the spring, he said.

“We will make known details of the operation and the amount involved,” Yang said.

The US had exaggerated the sum in its report, based on external projections, while the central bank’s figures would be based on facts, he said.

Taiwan has seen massive fund inflows because of US-China trade tensions and global monetary easing, forcing the central bank to step in to slow their effects, Yang said.

Taiwanese firms have moved manufacturing facilities home from China to circumvent punitive tariffs on Chinese goods and the decoupling of US-China trade ties has allowed them to benefit from order transfers, he said.

That helped explain Taiwan’s strong exports and sharpening current account surpluses, he said.

Ongoing global quantitative easing, three to six times the size during the global financial crisis, has driven excessive funds worldwide — including Taiwan — pushing up the New Taiwan dollar and asset prices noticeably, Yang said.

The central bank has no choice but to intervene in times of massive fund inflows, as on Nov. 30 when MSCI weighting adjustments took place, the governor said.

The central bank would try to understand the US’ reasoning for its actions, but it has to give top priority to Taiwan’s currency and financial market stability, Yang said, adding that the US quantitative policy has eased the central bank’s headache.

The bank raised its forecast for Taiwan’s GDP growth for this year from 1.6 percent to 2.58 percent and expects the expansion to reach 3.68 percent next year, due to better-than-expected exports.

Private consumption would replace exports as the main growth driver next year, it said.

Yang dismissed interest rate hikes as imprudent measures to rein in housing prices, saying that tightening loan-to-value ratios is a better policy tool because it would not affect the economy.

South Korea’s equity benchmark yesterday crossed a new milestone just a month after surpassing the once-unthinkable 5,000 mark as surging global memory demand powers the country’s biggest chipmakers. The KOSPI advanced as much as 2.6 percent to a record 6,123, with Samsung Electronics Co and SK Hynix Inc each gaining more than 2 percent. With the benchmark now up 45 percent this year, South Korea’s stock market capitalization has also moved past France’s, following last month’s overtaking of Germany’s. Long overlooked by foreign funds, despite being undervalued, South Korean stocks have now emerged as clear winners in the global market. The so-called “artificial intelligence

NEW IDENTITY: Known for its software, India has expanded into hardware, with its semiconductor industry growing from US$38bn in 2023 to US$45bn to US$50bn India on Saturday inaugurated its first semiconductor assembly and test facility, a milestone in the government’s push to reduce dependence on foreign chipmakers and stake a claim in a sector dominated by China. Indian Prime Minister Narendra Modi opened US firm Micron Technology Inc’s semiconductor assembly, test and packaging unit in his home state of Gujarat, hailing the “dawn of a new era” for India’s technology ambitions. “When young Indians look back in the future, they will see this decade as the turning point in our tech future,” Modi told the event, which was broadcast on his YouTube channel. The plant would convert

‘SEISMIC SHIFT’: The researcher forecast there would be about 1.1 billion mobile shipments this year, down from 1.26 billion the prior year and erasing years of gains The global smartphone market is expected to contract 12.9 percent this year due to the unprecedented memorychip shortage, marking “a crisis like no other,” researcher International Data Corp (IDC) said. The new forecast, a dramatic revision down from earlier estimates, gives the latest accounting of the ongoing memory crunch that is affecting every corner of the electronics industry. The demand for advanced memory to power artificial intelligence (AI) tasks has drained global supply until well into next year and jeopardizes the business model of many smartphone makers. IDC forecast about 1.1 billion mobile shipments this year, down from 1.26 billion the prior

People stand in a Pokemon store in Tokyo on Thursday. One of the world highest-grossing franchises is celebrated its 30th anniversary yesterday.