Wall Street stocks advanced on Friday in a holiday-shortened week as retailers started the year-end shopping season amid record COVID-19 hospitalizations in the US.

The NASDAQ Composite closed at a record high as investors favored tech-related, market-leading stocks that have fared well during the COVID-19 pandemic, while economically sensitive cyclical stocks weighed.

All three indices rose for the week, in which the S&P 500 reached a new closing high and the blue-chip Dow Jones Industrial Average ended above 30,000 for the first time ever.

“It’s an abbreviated session and volume is light, so the only conclusion is that the rally is not faltering for now,” said Peter Cardillo, chief market economist at Spartan Capital Securities LLC in New York.

“It does bode well for next month,” Cardillo added. “Will we see a Santa rally? Most likely. Will it be as robust as November? That’s a big question mark.”

Retailers opened their doors to Black Friday shoppers, with social distancing practices and other measures put in place to mitigate infection risks, while offering steep discounts.

“Black Friday has been somewhat tarnished — traffic is down due to the pandemic — but the good news is e-commerce sales have reached a new record,” Cardillo said. “That’s encouraging.”

In the latest development on the road toward developing a vaccine against COVID-19, the UK gave drugmaker AstraZeneca PLC the green light after experts raised questions about the vaccine’s trial data.

As US hospitalizations for coronavirus set a grim record of more than 89,000, the race for a medical solution to the pandemic has led to promising vaccines from Pfizer Inc, Moderna Inc and others, fueling optimism for light at the end of the tunnel.

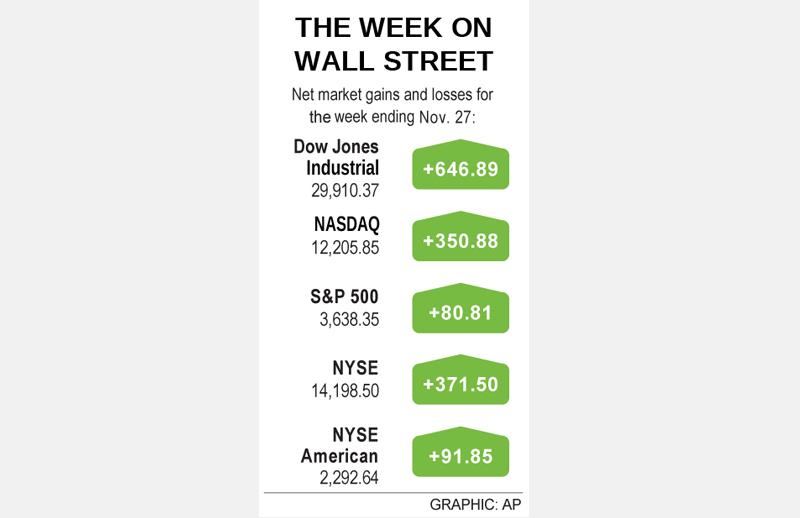

The Dow Jones Industrial Average on Friday rose 37.9 points, or 0.13 percent, to 29,910.37, the S&P 500 gained 8.7 points, or 0.24 percent, at 3,638.35, and the NASDAQ Composite added 111.44 points, or 0.92 percent, at 12,205.85.

For the week, the Dow rose 2.2 percent, the S&P 500 added 2.3 percent and the NASDAQ gained 3 percent.

On Friday, of the 11 major sectors in the S&P 500, healthcare companies enjoyed the largest percentage gains, while energy shares had the biggest percentage loss.

Chipmaker stocks, which have been resilient throughout the global health crisis, once again outperformed the broader market, with the Philadelphia SE Semiconductor index rising 1.2 percent.

Shares of Walt Disney Co dipped 1.3 percent after the company said it would lay off about 32,000 workers, up from the 28,000 announced previously. Jobs are to be cut mainly at Disney’s theme parks.

Tesla Inc built on its recent rally, its shares advancing 2 percent even as US regulators opened an investigation into front suspension issues in about 115,000 Tesla vehicles.

US-listed shares of iQiyi Inc (愛奇藝) fell 1.7 percent after Reuters reported that Alibaba Group Holding Ltd (阿里巴巴) and Tencent Holdings Ltd (騰訊) had put on hold talks to buy a controlling stake in the video streaming service.

Advancing issues outnumbered decliners on the New York Stock Exchange by a 1.36-to-1 ratio; on NASDAQ, a 1.73-to-1 ratio favored advancers.

The S&P 500 posted 23 new 52-week highs and no new lows; the NASDAQ Composite recorded 154 new highs and nine new lows.

Volume on US exchanges was 6.82 billion shares, compared with the 11.03 billion average over the past 20 trading days.

Additional reporting by staff writer

DIVIDED VIEWS: Although the Fed agreed on holding rates steady, some officials see no rate cuts for this year, while 10 policymakers foresee two or more cuts There are a lot of unknowns about the outlook for the economy and interest rates, but US Federal Reserve Chair Jerome Powell signaled at least one thing seems certain: Higher prices are coming. Fed policymakers voted unanimously to hold interest rates steady at a range of 4.25 percent to 4.50 percent for a fourth straight meeting on Wednesday, as they await clarity on whether tariffs would leave a one-time or more lasting mark on inflation. Powell said it is still unclear how much of the bill would fall on the shoulders of consumers, but he expects to learn more about tariffs

NOT JUSTIFIED: The bank’s governor said there would only be a rate cut if inflation falls below 1.5% and economic conditions deteriorate, which have not been detected The central bank yesterday kept its key interest rates unchanged for a fifth consecutive quarter, aligning with market expectations, while slightly lowering its inflation outlook amid signs of cooling price pressures. The move came after the US Federal Reserve held rates steady overnight, despite pressure from US President Donald Trump to cut borrowing costs. Central bank board members unanimously voted to maintain the discount rate at 2 percent, the secured loan rate at 2.375 percent and the overnight lending rate at 4.25 percent. “We consider the policy decision appropriate, although it suggests tightening leaning after factoring in slackening inflation and stable GDP growth,”

Meta Platforms Inc offered US$100 million bonuses to OpenAI employees in an unsuccessful bid to poach the ChatGPT maker’s talent and strengthen its own generative artificial intelligence (AI) teams, OpenAI CEO Sam Altman has said. Facebook’s parent company — a competitor of OpenAI — also offered “giant” annual salaries exceeding US$100 million to OpenAI staffers, Altman said in an interview on the Uncapped with Jack Altman podcast released on Tuesday. “It is crazy,” Sam Altman told his brother Jack in the interview. “I’m really happy that at least so far none of our best people have decided to take them

PLANS: MSI is also planning to upgrade its service center in the Netherlands Micro-Star International Co (MSI, 微星) yesterday said it plans to set up a server assembly line at its Poland service center this year at the earliest. The computer and peripherals manufacturer expects that the new server assembly line would shorten transportation times in shipments to European countries, a company spokesperson told the Taipei Times by telephone. MSI manufactures motherboards, graphics cards, notebook computers, servers, optical storage devices and communication devices. The company operates plants in Taiwan and China, and runs a global network of service centers. The company is also considering upgrading its service center in the Netherlands into a